HOME > Japan SPOTLIGHT > Article

The Risks to China's Economy

By Long Ke

The Chinese economy is at risk these days, not only because of the decline of GDP growth, but also due to the delay in building capacity for the construction of a market-oriented economy. The volatility of the stock exchange markets in China since the first half of 2015 not only shows the lack of potential of the companies listed there, but also the negative impacts of government intervention in the markets. Generally, markets require a free, fair and global environment at all times, but the Chinese government seems to want constant control of the markets. Thirty years ago a Chinese official described the economy which the government wanted to build as a bird in a cage, meaning the bird (the economy) will never be free. If the markets are controlled by the government's tight grasp, a true market-oriented economy cannot be realized and market mechanisms will never function properly.

The Chinese economy has reached a significant turning point: either the country will create a real market economy or it will go back to a socialist system. Neither of these two options is particularly easy for the Chinese government to choose. To create a real market-oriented economy, China would have to reform its state-owned enterprises, which would have a relatively large impact on the monopolistic political system. Going back to its old socialist system would mean losing efficiency and economic competitiveness. The Chinese government defines the current economic system and social system as a "Chinese socialist system", but in fact the Chinese people have experienced and enjoyed a free system (compared with the system under Mao) for the past 35 years. Nowadays, 200 million Chinese people go abroad for sightseeing and business every year. The Chinese government no longer has the option to close the door again. The conclusion I draw here is that China does not have the option of going back to a socialist system, but it will be challenging for the government to liberalize and deregulate the economy.

President Xi Jinping has emphasized several times how important the rule of law is for China to realize a market-oriented economic system. An effective market-oriented system requires transparency and good governance. The Chinese economy has achieved an annual real GDP growth rate of 9% for the past 35 years, but it is hard to say that the economic system is market-oriented. China acceded to the World Trade Organization (WTO) in 2001, but most developed countries refuse to acknowledge China as a market-oriented economy. Indeed, China's market economy is very uniquely Chinese. For example, 80% of the lending by state-owned commercial banks was to state-owned enterprises (SOEs). Most fiscal investment projects, like bridges, express railways, and power plants, are directly entrusted to SOEs. The management of SOEs is generally inefficient because they are protected by the government. Some of the loans made by state-owned commercial banks to SOEs are becoming non-performing loans. Furthermore, there are concerns about the quality of the assets of state-owned commercial banks. Over the past two decades, Chinese provincial and city governments have established a lot of investment companies; they have borrowed a huge amount of money from state-owned commercial banks and invested in the property market. This is one reason for the growing property bubble. Whether or not the local governments can repay their debts to the state-owned commercial banks will impact the future sustainability of the Chinese economy.

Why Is China's Economy Slowing?

The Chinese economy under the Hu Jingtao administration was driven by the building of infrastructure related to the Beijing Olympic Games and the Shanghai Expo, even as it postponed almost all reforms, including reform of SOEs and financial system reforms. The Xi Jinping administration, however, seems to have come to accept China's economic decline, which it defines as the "new normal". Premier Li Keqiang has emphasized the reduction of leverage by finance and the changing of the economic structure instead of economic stimulation. The administration's view on economic development is essentially correct; the problem here is how to change the economic structure.

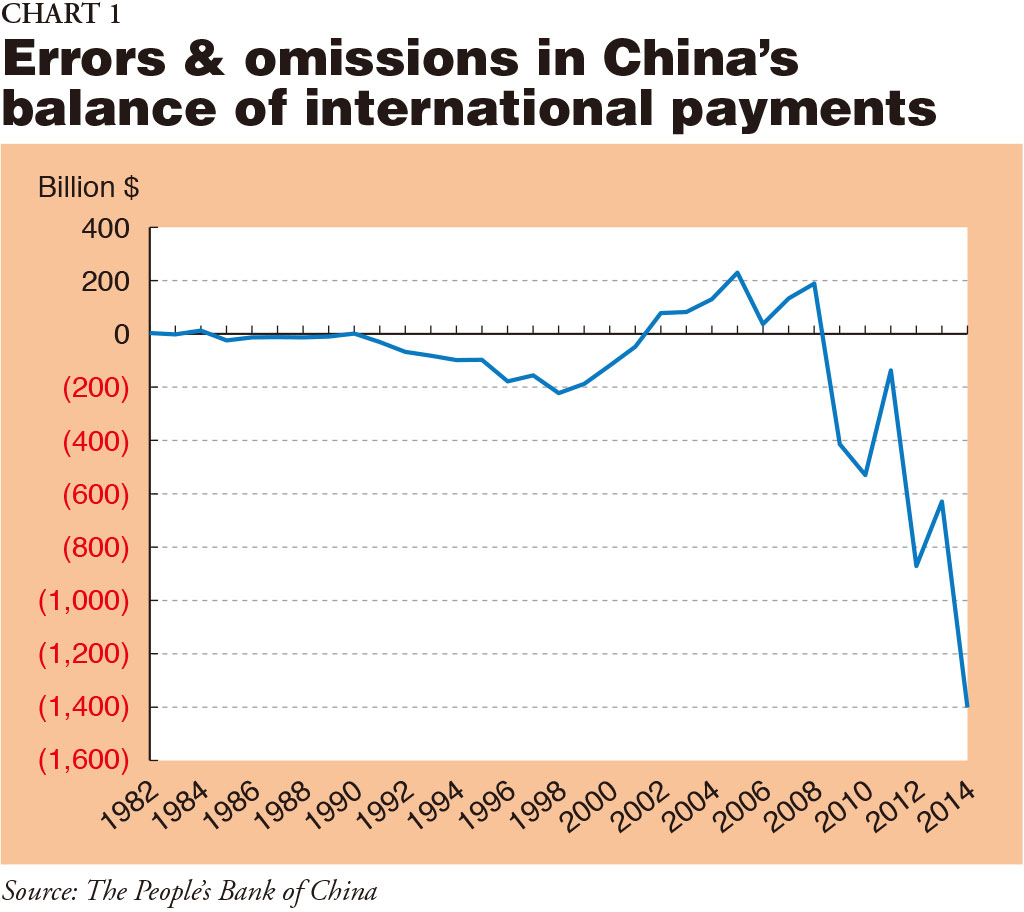

China's economic model of the past three decades was designed by Deng Xiaoping, the country's former leader. Under his model, the export and manufacturing industries drove economic development; there was so much cheap labor and the renminbi, the national currency, was pegged with the US dollar at an undervalued level for a long time. There is no doubt that this economic development model contributed to China's economy catching up with the rest of the world. But Chinese per capita GDP reached $9,000 in 2015, meaning that China cannot expect to maintain its economic growth by relying solely on the low-end export and manufacturing industries. China has lost its competitiveness in labor costs. Meanwhile, the renminbi has been revalued by over 40% against the dollar since 2005. Now the Chinese government wants to devalue the currency, but such devaluation could speed up capital flight. The errors and omissions of China's international balance of payments reached -$140 billion in 2014 (Chart 1). This is the first time that China has experienced such significant errors and omissions in the past three decades. Even government officials cannot fathom how it happened under such strict regulations concerning capital movement.

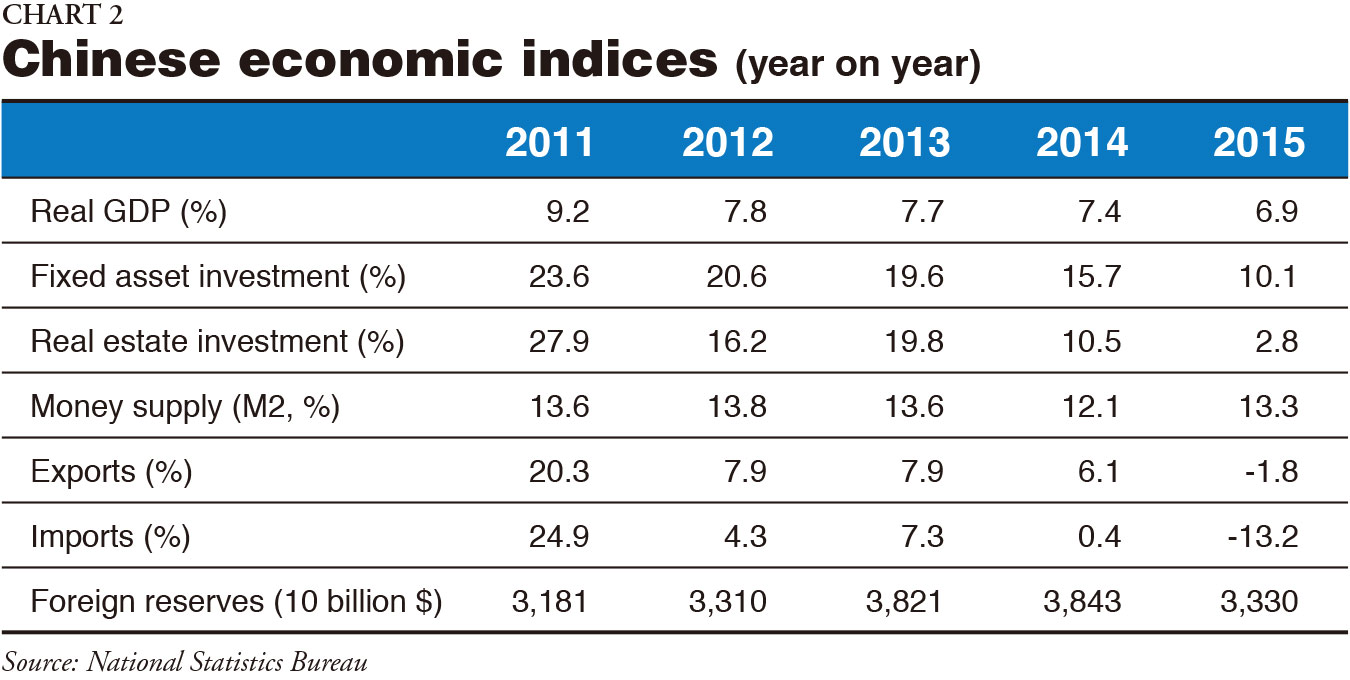

Another indicator of capital flight from China is the decline of the government's foreign reserves. At their peak in 2014, China's foreign reserves reached almost $4 trillion, but had declined to $3.23 trillion by the end of January 2016. I want to emphasize that the foreign reserves declined by $108 billion in December 2015, and by a further $99.5 billion in January 2016. This outflow means that investors, especially foreign investors, have started to shift their financial assets from China to other countries, including tax havens. From this we can conclude that the government needs to change the country's economic and political fundamentals as soon as possible, and unless the government carries out political reform post-haste, the economy is going to enter a serious recession.

In his report on the work of the government at the National People's Congress (NPC) 2016, Premier Li asserted that the target for economic development from 2016 to 2020 must be kept above 6.5% annually. If China can achieve a 6.5% GDP growth rate, it would be the highest growth rate among the big economies, namely the United States, the EU and Japan. The problem here is how to sustain such a high level of economic growth? The growth of fixed asset investment declined to 10.1% in 2015, compared with 23.6% in 2011. In the same period, the growth of investment in the property market declined to just 2.8% from 27.9%. The Chinese government announced its intention to strengthen consumption in order to increase economic development from 20 years ago, but we find that the growth of retail sales also declined to 10.6% in 2015 from 17.1% in 2011. That means that all of the main domestic economic engines have weakened rapidly over the past five years. Similarly, China's external trade declined to -7.0% in 2015 from 22.5%. Chinese external trade is unique among developing countries, since China was able to play the role of the world's manufacturing center thanks to its cheap labor costs compared to other developing countries. The structure of Chinese external trade is to import key components from developed countries like Japan and South Korea, assemble the products domestically, and export the products abroad, especially to developed countries.

China's low-end industries have lost their international competitiveness, however, because the cost of labor has increased rapidly over the past decades. Meanwhile, the foreign exchange rate of the renminbi was revalued by 40% against the dollar, making it difficult for China to sustain the growth of external trade. China needs to change the structure of its economy as soon as possible. Demand in China has weakened, causing a surfeit of equipment capacity. Li recommends closing the Jiangshi, or "zombie", companies, considered to be a successful strategy for reducing overcapacity. In fact, it will not be so easy. Most of the Jiangshi companies are SOEs, and unemployment is a serious concern. If the government were to close these companies, the workers could rise up to demonstrate against the administration and the Communist Party. This is one of the risks that China currently faces.

Good-bye to the Deng Era

There is no doubt that Deng Xiaoping's reforms of the Chinese economy, including liberalized control and increased building of a market economy, succeeded in helping China catch up with the rest of the world. Deng refused to reform the political system, however, till the very day he died. For this reason, we might say that the corruption in China's government is Deng's legacy, because the monopolistic political system concentrated authority within the central government and rejected any governance by the people. Chairman Xi seems to be struggling mightily against corruption, although some are of the view that his efforts will help him to strengthen his own personal authority. In any case, the problem is that the economy cannot recover on its own as long as it is strictly controlled by the government.

The conflict between the government and the people has not only damaged China's economic development, but its social stability too. The government still wants to achieve economic development in order to prove that the Communist Party and the current governmental structure work. But it is impossible to liberalize only economic control while maintaining political control. Maintaining the legacy of Deng means maintaining the leadership of the party. The new leaders, Xi and Li, understand that there is no possibility of reforming the political system, and so they have resorted to controlling the economy, regardless of their promises to improve deregulation.

If we take a look at the policy regarding SOEs, we see that the government has emphasized again and again the strengthening of those companies. What does the government mean by "strengthening the SOEs"? According to the State Council, the government wants to increase the competitiveness of SOEs through mergers and acquisitions. There are currently about 100 big state-owned enterprises, which the State Council wants to merge together into 40 huge state-owned company groups.

Thirty-five years ago Deng implemented liberalization, but now the new leaders want to reregulate companies and the economy. Some China watchers call the new system "state capitalism". It seems that China's new leaders want to establish several state-owned chaebols to accomplish China's goals. In the short-term view, strengthening control could be helpful for Chinese companies to invest abroad. The government could concentrate all of its management resources to help these state-owned chaebols. The Chinese economy and Chinese companies would have very strong international management in this case. But undertaking the establishment of state-owned chaebols could mean that private companies would face difficulties, as the government would concentrate its attention on helping these leviathans. Under the Hu administration, the trend of "guojin mintui" (the state advances, the private sectors retreats) made it clear that the private sector was not treated fairly. China needs to establish a fair, free and global economic system. Regulation by the government must be transparent, and corporate governance in the state-owned sector needs to be strengthened, not reduced in favor of a further monopoly.

What is the risk of putting more emphasis on the state-owned sector? The risk is that the lower efficiency of the SOEs will damage China's industrial structure and the economy. In China, the state-owned commercial banks essentially refuse to generate liquidity for private companies, unless the companies can guarantee the borrowing against assets. Conversely, the banks readily generate liquidity for SOEs because they can easily get support from the government, in particular local governments. The investments made by SOEs are usually inefficient, which leads to more non-performing loans. Local governments are active in establishing many companies and then helping them finance through state-owned commercial banks. But such SOEs are merely puppets controlled by the governments. The lack of corporate governance means most of these companies are not sustainable. But who is responsible for paying the costs?

Why has China's socialist system failed? The fault lies in the moral hazard of the government and SOEs propping each other up. As a result, nobody takes responsibility for the failure of economic operations. Thirty-five years ago, Deng and his administration started to liberalize the control of SOEs, but he never allowed their privatization. Theoretically, it is important to reform the ownership of these companies, which would lead to better corporate governance and, in turn, stronger competitiveness. It seems that Deng and most of the subsequent leaders in China worried that reforming the ownership of SOEs could damage the authority of the government and of the party. For the new leaders, the only other option they could come up with was to tighten their control over the economy. From the perspective of Western values, this is a national risk of China.

Reconsidering China's Risks

About 10 years ago, Chinese businessmen brought their overseas financial assets back to China, both legally and illegally. This so-called "hot money" was used by investors to speculate in China, and the economy has benefited from the influx of funds for the past 10 years. The resulting property market bubble caused a boom in investment into most of the heavy industries, like steel, aluminum, and cement. A ripple effect from the property market impacted all of the industries in the country. Not only economists, but officials and policy makers also predicted that the economy could maintain a growth rate of at least 8% annually over the coming decade. One of these believers is the former chief economist of the World Bank, Professor Justin Lin (Lin Yifu) of Beijing University. This optimistic view of the Chinese economy spurred investors to invest in asset markets.

China's economic bubble was a concern for economists and analysts, but Chinese officials and policy makers maintained their show of confidence in the country's economic development. Some officials told us that there was no economic bubble, and others admitted there was a bubble but promised that it would not burst. Such predictions show the rigid demands the government has of the economy. As many Chinese individuals invested in the property market, the price of an apartment in large Chinese cities like Beijing and Shanghai climbed as high as 25 times the average annual salary of workers five years ago. Even now, the price of an apartment is 20 times the average annual salary. George Soros pointed out at the World Economic Forum in Davos that the Chinese economic bubble has already burst.

The economic bubble was the engine driving China's economic development, and now that the bubble has burst, investors refuse to invest in the property market anymore. Companies suffering from overcapacity want to reduce their capacity, but local governments afraid of increased unemployment urge them not to. Even as Li asserted at the National People's Congress that there were no concerns over unemployment, thousands of the workers in Heilongjiang Province in northeast China and Shanxi Province in western China went to their local governments to protest their right to stable employment. According to a public statement by the central government, at least 1.8 million workers from steel factories and coal mines will lose their jobs.

To summarize, there are four elements of risk in China. First of all, the rapid decline of economic development could damage the stability of society. Until now, the government has stabilized society by successfully maintaining the country's economic development. Former leader Deng emphasized 30 years ago that economic development is the only truth for China. The Chinese people followed the Communist Party because they dreamed of being richer and happier. If the economy were to slow down sharply, the people would lose confidence in the government. Xi promised the people that the government would lead them and help them realize the Chinese dream. China and the Chinese people need to chase the wonderful dream of being richer and happier.

The second risk is the unemployment problem. Forty years ago, China implemented its one-child policy, and as a result its population will begin to decline from 2018. It is likely that China is going to face a population shortage rather than an unemployment problem. There are about 200 million farmers working in the coastal areas, and nowadays many low-tech industries like textiles and shoe manufacturing have been shifted to other Asian countries like Vietnam and Laos. It is estimated that there are about 30 million workers who have lost their jobs. Meanwhile, the government plans to close down steel factories and coal mines, which will result in 10 million more workers becoming jobless. The first stage of these closures will see 1.8 million workers laid off, but this is only the start of the impending changes to China's economic structure. The Chinese government needs to do more to build an effective social security system to guarantee social stability. It is impossible for the government to stabilize society using the police alone.

The third risk is income disparity. Generally speaking, in a socialist country like China income disparity should not be very large. The bible of socialism is Marxism, which defined society as an equal and just society — otherwise there would be no meaning to the revolution. But according to the Chinese Statistics Bureau, China's Gini coefficient reached 0.469 in 2015, meaning the country is far from an equal society. Equalizing income allocation will be key to stabilizing Chinese society.

The final and perhaps most important element of risk in China is the need for political system reform. It is clear that China needs to reform its monopolistic political system and to construct a more transparent one. This will doubtless take a long time, but the Communist Party at least needs to take the first step. The corruption of party leaders has shown us the necessity of strengthening the people's ability to monitor and govern. China now stands at a historic turning point. To make the jump to become an industrialized developed country, China must reform the existing political system; otherwise, it will fade into a developing middle-income nation.

(2016/06/03)

Long Ke

Long Ke is senior fellow, Economic Research Center, Fujitsu Research Institute.

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27