HOME > Japan SPOTLIGHT > Article

Toward a Service-Oriented Country - from the Perspective of the Globalization of the Economy

By Masayuki Morikawa

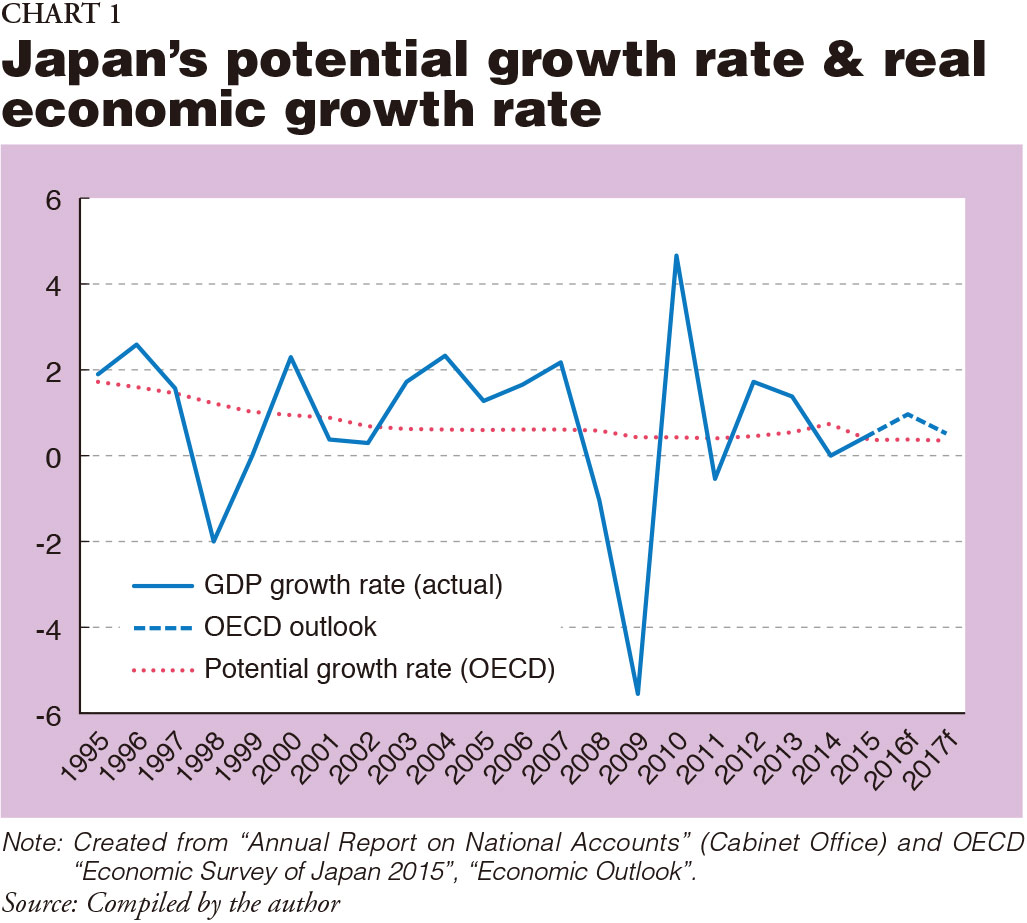

Japan's unemployment rate is hovering below 3.5%, the lowest level since 1997, while the ratio of job offers to job seekers remains around 1.3, the highest level in a quarter of a century since 1991. According to the Bank of Japan's "Tankan", a short-term economic survey of enterprises in Japan, Japanese companies of all sizes and businesses are short on labor forces, and the non-manufacturing sector in particular has been suffering from a chronic shortage of workers for more than four years. But since the consumption tax rate hike of April 2014, a low economic growth rate has continued in tandem with stagnating consumption spending. Real economic growth has been below 1% since the October-December 2013 period, when the ratio of job offers to job seekers exceeded 1. This may have been the result of the drastic negative growth rate following the consumption tax hike, but this period also includes the months preceding the tax hike, during which demand was pushed upward by last-minute purchasing. The current potential growth rate of Japan is estimated to be less than 0.5%, and the actual growth rate is close to this potential growth rate (Chart 1).

In other words, the Japanese economy is near the ceiling of its supply capacity; the economy is not bad but the economic growth rate is weak. Therefore, unless the potential growth rate is increased, it will be impossible to raise the economic growth rate. The policies required to tackle this issue are not economic measures, but rather long-term structural policies. Consequently, it is only natural to place increasing the productivity of the service industries at the center of growth policies, as they account for 70% of the Japanese economy. The government put together a "Competitiveness Promotion Program for the Service Industries" last year, and has announced a numerical target of achieving a 2% labor productivity rate for the service industries. A commendation - the Japan Service Award - has also been established by Prime Minister Shinzo Abe, and the first award was given in June this year. The 2016 Japan Revitalization Strategy which was announced this year also places revitalization and increasing productivity in the service industries as a policy pillar, and a new target of creating 10,000 high-growth service businesses has also been put forward.

I discussed in detail where the potential lies in raising productivity in the service industries and what policies are needed in my publication (in Japanese) Toward a Service-Oriented Country (Nikkei Publishing Inc., 2016). This article will provide a summary of the key points from this publication by focusing on the service industries from the perspective of the globalization of the economy.

Is Productivity in Service Industries Low?

It is often argued that productivity in the Japanese service industries is low, but empirical evidence to support this is actually surprisingly weak. Service industries also include various categories of businesses, and while there are categories with high productivity, there are also those with low productivity. In addition, the dispersion of productivity of individual companies within the same narrowly-defined industry is huge, and there are companies with both high productivity and low productivity.

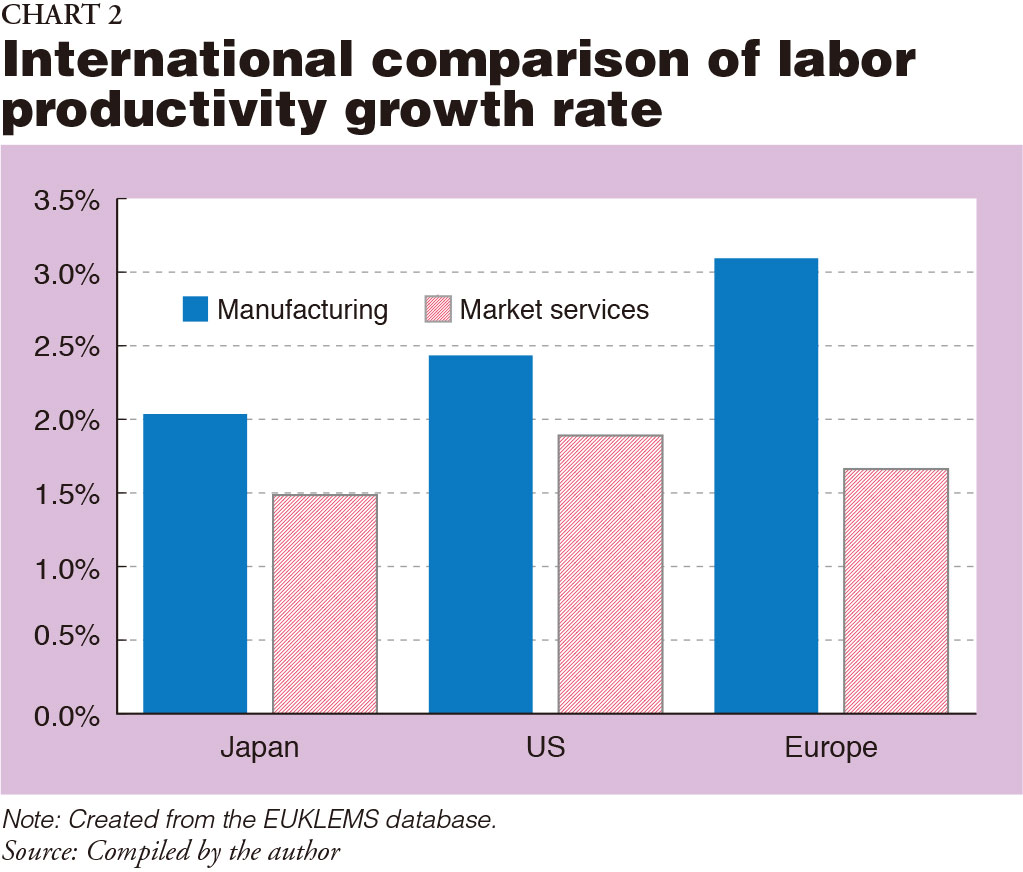

In comparing the long-term productivity growth rate of service industries and manufacturing industries, the rate of growth in productivity in service industries is slower than that in manufacturing industries. Such is the case not only in Japan but also in other advanced economies. In looking at the labor productivity growth rate for the market services sector (1990-2008, annual rate) in the EUKLEMS database, Japan was at 1.5% while the United States was 1.9%, and Europe (average of the United Kingdom, Germany and France) was at 1.7%. On the other hand, the labor productivity growth rate for manufacturing industries for the same period for Japan was at 2.0%, the US at 2.4%, and Europe at 3.1% - a higher percentage than in service industries across all countries (Chart 2). However, the difference in the productivity growth rate for service industries is small across countries, and it is difficult to argue that the low productivity growth rate was the main reason behind Japan's two "lost decades".

It can also be pointed out that the productivity "level" for Japanese service industries compares poorly to that of the US. But not all of the productivity in Japanese service industries is lower than that of the US, and it varies by business categories. First, in order to enable international comparisons in the level of productivity, it is necessary to convert the prices of services into a common currency, using the ratio of the prices in national currencies of the same service in different countries, i.e. purchasing power parity (PPP) exchange rates. However, unlike agricultural products or industrial products, it is often difficult to find the same service in multiple countries. It is almost impossible to find the same quality sushi restaurant or a traditional Japanese restaurant and compare the prices. For railways and taxis which exist in all countries, we can compare, for example, the cost per unit distance traveled, but the quality of services such as frequency and punctuality is not the same across countries. A survey conducted by the Japan Productivity Center found that the quality of many types of services in Japan is considered to be 5% to 10% higher than that in the US, indicating the degree to which the productivity of such types of services in Japan is underestimated.

Innovation & Reallocation

It is not easy to get an accurate answer to the simple question of whether the productivity of service industries is high or low. Of course an accurate comparison of productivities is an important research topic, but in terms of actual policymaking, starting from identifying where there is room for improving productivity is a realistic approach. I believe that there is ample room to raise the productivity of service industries, but this is not based on the notion that the productivity of Japanese service industries is low.

An increase in the productivity of an industry can be brought about by two mechanisms: 1) increased productivity of individual firms (within effect) and 2) the entries of highly efficient firms and the exits or shrinking of inefficient firms (reallocation effect). Within effect is growth in productivity of individual companies. This stems from various factors such as innovation, effective use of IT, multi-store operations that take advantage of economies of scale, and improvement in the quality of management. Along with improvement in the quality of human capital, innovation constitutes the biggest driving force of productivity growth. Service companies' investment in research and development for hard innovation is relatively small compared to manufacturing industries. But, according to my empirical study using survey data for 2011, the difference in productivity between companies that undertook innovation and those that did not was 6% for manufacturing industries and a far larger 13% for service industries. New technologies such as big data and artificial intelligence (AI) have the potential to dramatically improve productivity in service industries. Legal protection of trade secrets and support for investments in intangible assets are important for service innovation.

On the other hand, reallocation effect raises the entire productivity of the industry as a whole, with high-productivity companies entering the market and expanding, while low-productivity companies downsize or leave the market. Recent studies have shown that substantial productivity gaps exist even among companies in the same industry, and it is particularly the case in service industries. In other words, while there are many inefficient companies in service industries, there also exist many excellent ones, and thus the potential and importance of renewal is high. But in recent years the reallocation effect has contributed little to improve productivity, and there is much room for doing so. The easing of market entry rules such as the occupational licensing system which prevails in many service industries will promote market competition and have the effect of supporting the renewal mechanism.

Service Trade & Productivity

Japan has been acknowledged as a "manufacturing state" but the importance of service trade has grown over the years. Service industries face weak global competition pressures, but trade potential is relatively high in finance, transportation, communications, and business services. The rise in domestic consumption in Japan with the increase in foreign visitors has recently been attracting attention, but this is also included in service industries.

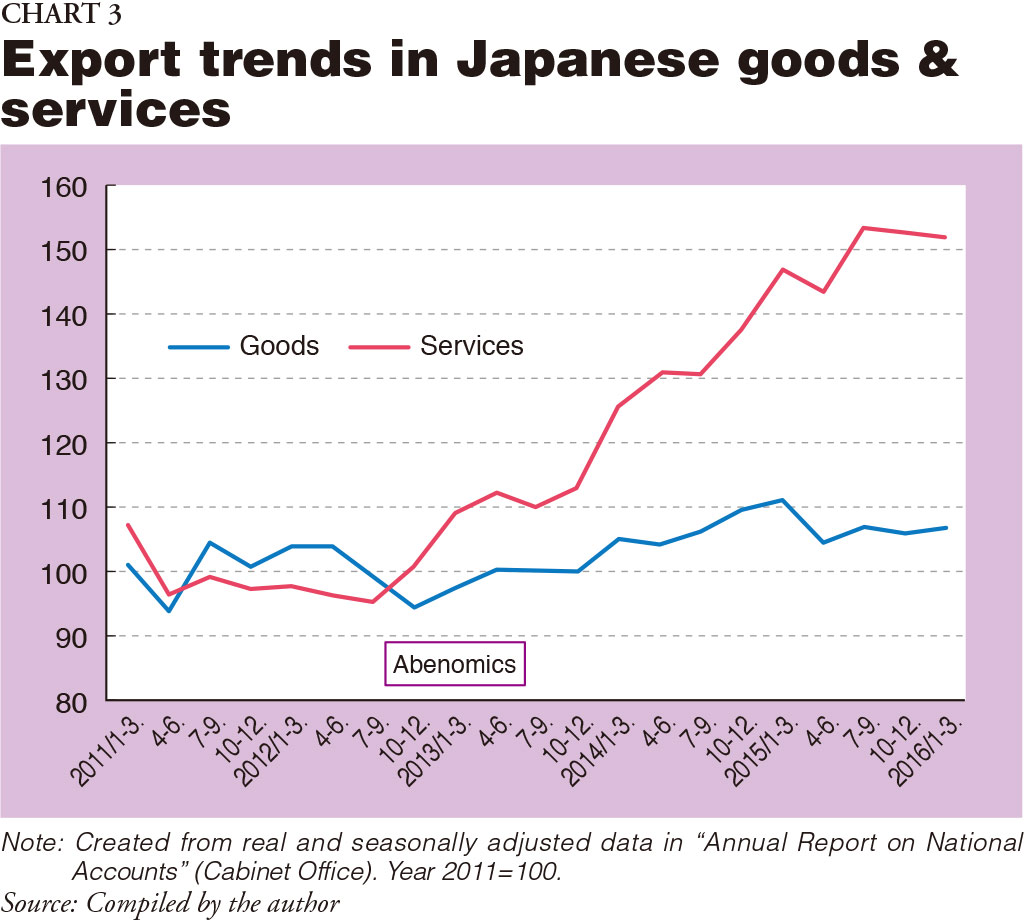

As the yen continued to depreciate with the monetary easing brought on by "Abenomics", growth in goods exports remained stagnant, but service exports steadily grew. Setting 2011 as the benchmark at 100, goods exports were only at 107, but service exports increased to 149 in 2015 (Chart 3).

In terms of exports of goods, Japan ranks fourth in the world, but is seventh for service exports, and the presence of services in trade is relatively weak. In looking at the value of service exports as a percentage of GDP, Japan's figure is low compared to that of European nations or the US. Conversely, however, this means that there is room for service trade expansion.

According to METI's "Basic Survey of Japanese Business Structure and Activities" for the years between 2009 and 2012, of the 30,000 companies surveyed roughly 21% were exporting goods, while roughly 6% were exporting services. However, in looking at the trends over the years, the percentage of companies that export goods has been flat, whereas the percentage of companies that export services has been increasing.

The expansion of service trade contributes to the improved productivity of service industries through two mechanisms. First is the learning-by-exporting effect whereby productivity increases by exporting. Second is the reallocation effect whereby the production share increases for companies with high productivity.

In fact, when looking at the characteristics of service export companies, productivity is higher than that of non-export companies. A similar relationship can be observed in goods exporting companies, but the difference in whether companies export or not is larger for service exports in terms of volume. In looking at total factor productivity (TFP), it is 20% higher in goods export companies than in non-exporting companies, and 28% higher in service export companies.

This number does not necessarily mean that there is a causal relationship between productivity and wage increases to service exports. Hurdles such as distance barriers and national differences in language and regulations are higher for service exports than for goods exports, and therefore only large companies with high productivity can export services. But expansion of service exports by companies with high productivity does, at least, improve the overall productivity of the industry itself through the reallocation effect.

Foreign Visitors & Utilization Rate of Accommodation Industry

In service industries that do not carry any inventory, productivity is determined by the extent to which capacity utilization can be improved by leveling demand. In addition, there is significant room to use IT as a means to improve capacity utilization. Indeed, many empirical studies have shown that effective use of IT has led, via increased capacity utilization, to remarkable productivity improvement in the logistics and passenger transportation industries.

This point is apparent in the accommodation industry. A rapid rise in inbound tourists to Japan has pushed up utilization rates in hotels and other accommodations (Photo). The total number of room occupancies by foreign nationals was 66,950,000 in 2015, making up 13% of gross occupancies. The capacity utilization rate of guest rooms at city hotels and business hotels has been around a high 80% level, and there have been increasing cases where lodging reservations have been difficult to place.

Unless there are guests in the rooms at hotels and inns, the facilities are completely unutilized and therefore the capacity utilization rates of the rooms strongly guide the productivity and profitability of the accommodation industry. Thus, lodging facilities have tried to improve capacity utilization by setting different rates depending on weekdays or weekends, and by seasons, but it is difficult to completely level out demand. For the accommodation industry, in addition to the volume effect of an increase in the number of guests, the merits of foreign tourism also include the different time patterns in demand for lodgings from Japanese guests.

If the lodging patterns of foreign visitors were the same as the Japanese, and if it was just an increase in the number of guests, facility and equipment investment would eventually be required, which in the mid to long term will offset the positive effect of the utilization rate. But while Japanese domestic tours tend to concentrate around three-day holidays which include national holidays, foreign visitors are not affected by these patterns. The seasonal patterns of foreign guests differ from the Japanese, whose peak travel time comes in August. Therefore, an increase in foreign visitors has had additional positive effects on the average utilization rate through the demand leveling effect.

Using data from the "Accommodation Survey" by the Japan Tourism Agency (JTA) for the years between 2010 and 2014, I estimate that even after controlling for the total number of guests, if the percentage of foreign room occupancies increased by 1%, the utilization rates of guest rooms will rise by 0.3% on average. If labor input amounts were perfectly adjusted to accommodate for changes in the number of guests, a 0.3% rise in the utilization rate of guest rooms will translate into a 0.1% rise in the measured TFP. Conversely, in cases where the number of employees and labor hours are fixed, a 0.3% increase in the utilization rate of guest rooms is accompanied by an increase in the utilization rate of workers, and therefore TFP rises by 0.3%. In reality, the number of housekeeping staff and their hours can be adjusted to a certain degree to accommodate the fluctuations in the number of guests, but labor input to maintenance and administrative sections are thought to remain largely unchanged, and therefore the actual number is thought to be in the middle of these two figures.

According to the JTA's "Consumption Trend Survey for Foreigners Visiting Japan" for the years between 2010 and 2015, roughly 30% of spending by foreigners visiting Japan is on accommodation expenses, and the rest on shopping (40%), dining and drinking (roughly 20%), and transportation (roughly 10%). This means that in addition to the accommodation industry, other industries such as the retail industry, food services, and passenger transport industry are also benefitting from an increase in foreign visitors. In today's Japan where the servitization economy has progressed, not only does an expansion of foreign tourists bring about demand creation effects in the form of increased service exports, it also indicates contributions in the form of improved productivity in service industries.

Deepening Global Value Chain

As globalization progresses, the importance of services is increasing, given international competition among manufacturing industries. Lower transportation costs and reductions in trade barriers such as tariffs have led to international fragmentation of production activities, and a Global Value Chain is deepening. As a result, many added values from various countries are included in one final product.

According to a case study on iPods and smartphones, whose final assembled products tend to be produced in China and exported, these products include materials and parts that were manufactured in industrialized nations, as well as many value-added services that went into the production process. On the other hand, the percentage of added value within China is small.

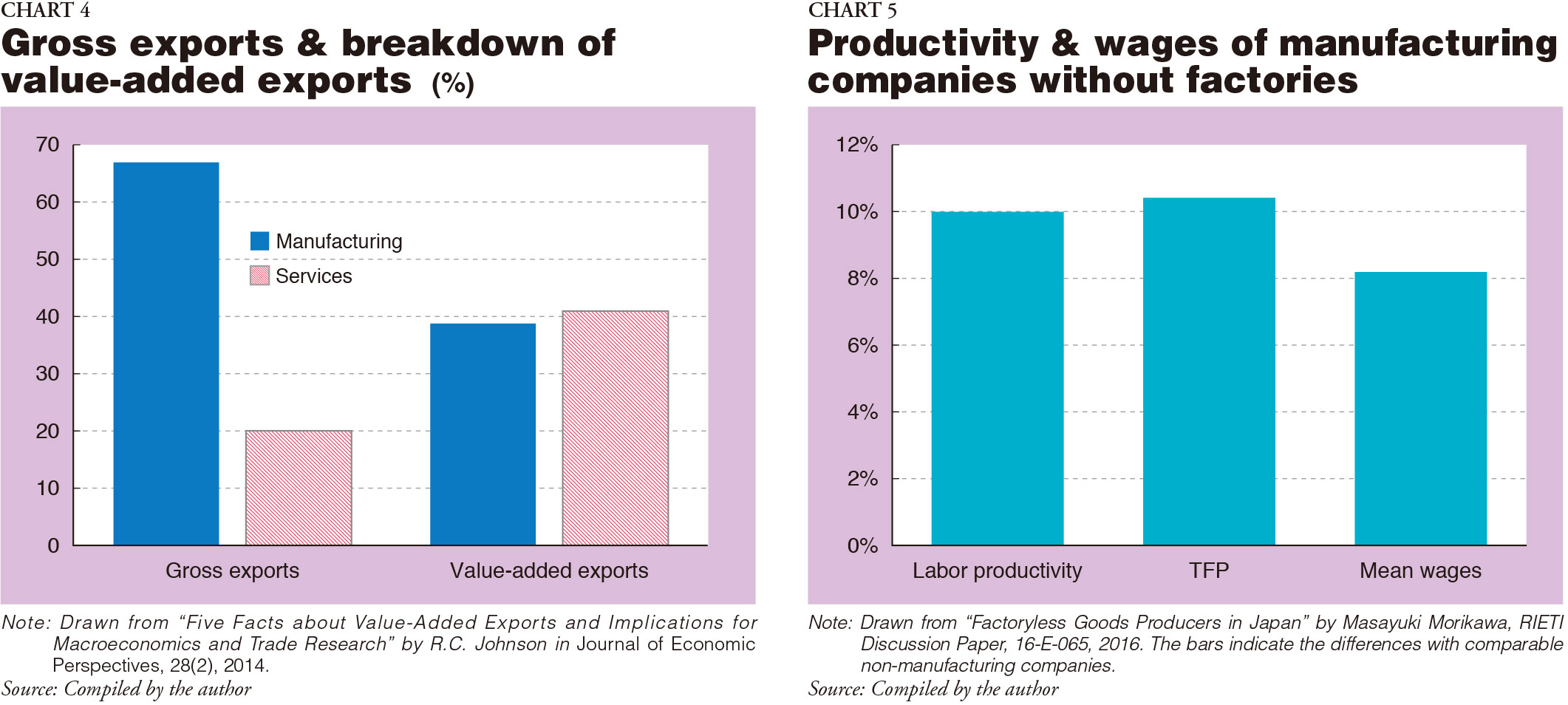

According to an empirical study of value-added trade using the World Input-Output Database, when looking at the world's exports of goods and services as gross exports observed in regular trade statistics or balances of payments, 67% are in manufacturing industries and just 20% in service exports. But industrial products that are exported include many added values from service industries in many countries. Thus, in looking at added value trade, the numbers switch, and added value for manufacturing industries and service industries are at 39% and 41% respectively (Chart 4).

In other words, international competitiveness of added value is not determined just by the domestic manufacturing companies, but is increasingly dependent on the intermediate input of services. National GDP is added value, and therefore for the benefit of the wealth of its people, the export value of added value is far more important than the gross export value which appears in the trade statistics. In the Global Value Chain, service industries with high skill intensities are taking on an important role in the comparative advantage of competitiveness for added value trade in industrialized countries. In fact, several empirical studies have shown that productivity and export competitiveness of downstream manufacturing industries is greatly influenced by the regulation and productivity of the upstream service industries which is used as input.

Servitization of Manufacturing Industries

From a corporate strategy perspective, there is a close link with the "smile curve" discussion. With increasingly intense competition with newly emerging countries, companies in manufacturing industries are less able to receive added value from the direct production process. On the other hand, added value is expanding for activities that are placed upstream in the operation chain, such as research & development and product design, as well as downstream activities such as marketing and after-service.

"Factoryless goods producers" (FGPs) are the extreme form of such manufacturing industries. According to US research, these are classified officially as wholesale industries, but unlike the traditional wholesale enterprises they are thought to be companies that design the products, coordinate production activities, and sell the products. Most outsource the production activities themselves to factories in low-wage countries. Apple of the US and Dyson of the UK are good examples of FGPs, and there are also many FGPs in pharmaceutical and apparel businesses.

In Japan, specialty store retailers like Fast Retailing (Uniqlo), Nitori, and Ryohin Keikaku have the same features. Domestic activities focus on services such as product planning and development, advertising, and sales. According to my analysis, at least several hundred FGPs exist in Japan, and the productivity of FGPs is 5% higher than other companies, after accounting for the difference in company size and industry. In addition, FGPs invest in numerous intangible assets, and have a high employment ratio of corporate headquarters staff, including research and planning divisions and international business divisions (Chart 5).

Servitization of manufacturing industries and service input in exports of industrialized goods are becoming increasingly important. It is imperative to build a high-quality service sector domestically to support the economic growth of Japan, a "Trade State", and improve the economic welfare of its people.

(2016/12/02)

Masayuki Morikawa

Masayuki Morikawa is vice president of the Research Institute of Economy, Trade and Industry (RIETI).

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27