HOME > Japan SPOTLIGHT > Article

Another Look at the Growth & Inequality Nexus

By Orsetta Causa

Introduction

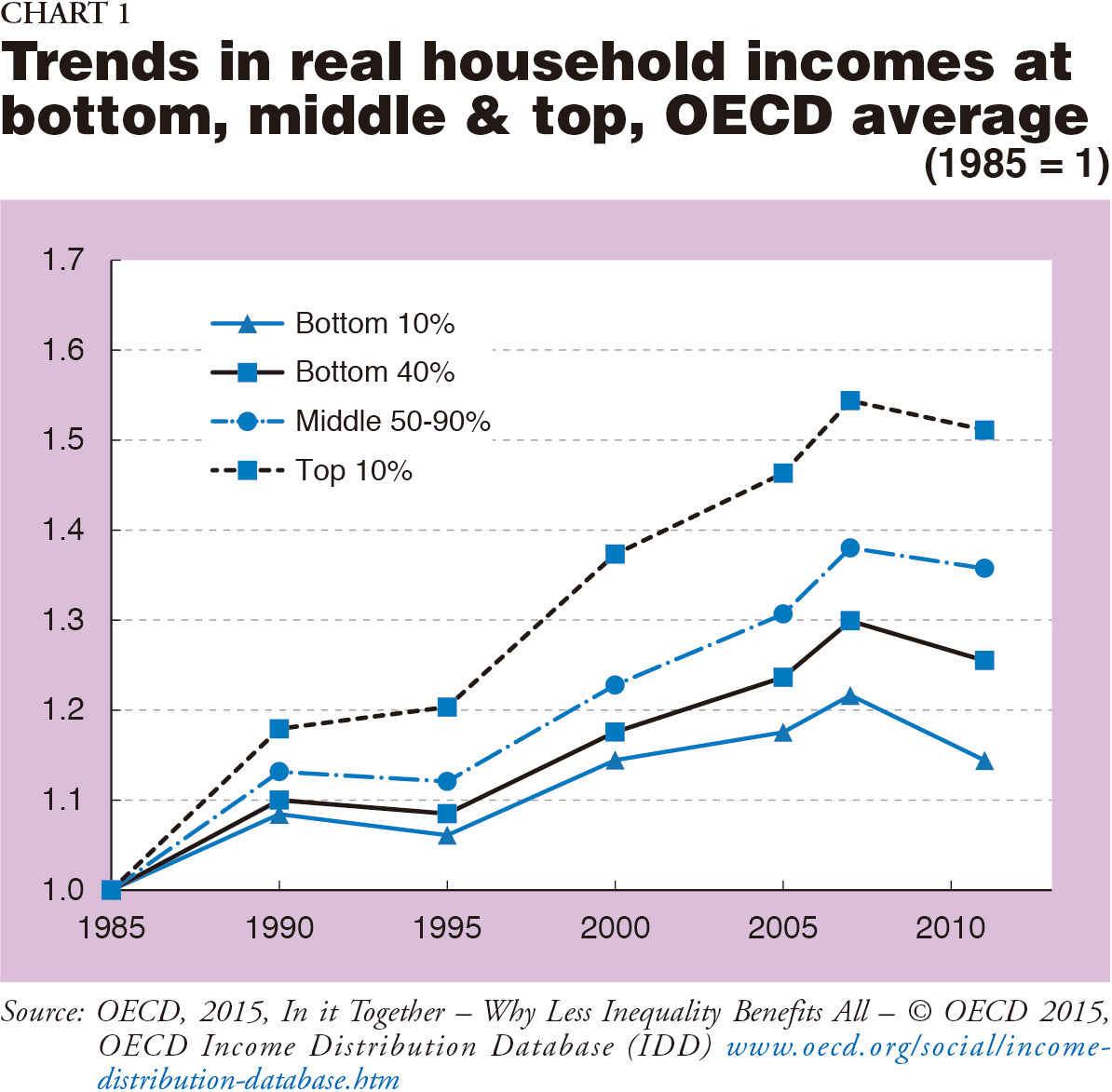

Concerns about rising inequality have been gaining prominence, not least as a result of the recent recession and its social implications. However, inequalities have been on the rise since well before the crisis. Indeed, many studies have been reporting steadily growing income inequalities in a majority of advanced countries during the past three decades (Chart 1). Differences in the pace of income growth across household groups were particularly pronounced. In Japan, the real incomes of those at the bottom of the income ladder actually fell compared with the mid-1980s (Divided We Stand: Why Inequality Keeps Rising, OECD, 2011). In many other countries and in particular in the United States, GDP growth has been associated with a relative stagnation of the median household incomes along with a surge in the share of income accruing to the "top one percent"(as Thomas Piketty notes in his Capital in the Twenty-First Century, 2013). An important question is whether some of the forces driving GDP growth may have also fuelled inequalities, and more broadly, the impact of growth on inequality.

Understanding the impact of economic growth on inequality has prompted a long-standing controversy among economists. One important strand of the literature has explored whether economic growth "lifts all boats", including incomes at the lower end of the distribution. This question has been mainly studied in the field of poverty. The conclusion from influential studies by David Dollar and Aart Kraay from the World Bank is contained in the titles of their articles "Growth Is Good for the Poor" (1991) and, along with Tatjana Kleineberg, "Growth Is Still Good for the Poor" (Policy Research Working Paper No. 6568, 2013). However, other macroeconomic studies have reached more nuanced results, and the impact of economic growth on inequality remains to a large extent an open question.

The Growth & Inequality Nexus

The failure to provide a convincing answer to the growth and inequality question may stem from the failure to specify the underlying issues. The mechanisms that link growth and inequality are likely to differ depending on the location of inequality, i.e. at the bottom, in the middle, or at the top of the income distribution ("Inequality and Growth in a Panel of Countries" by Robert J. Barro, Journal of Economic Growth, Vol. 5, No. 1, 2000). Hence, a single inequality measure such as the Gini coefficient may end up capturing relatively unimportant average effects. The mechanisms that link growth and inequality are likely to differ depending on the sources of growth, in particular whether growth in GDP per capita is driven by growth in labor productivity or growth in labor utilisation. The mechanisms that link growth and inequality are also likely to differ depending on whether one considers income inequality before or after government redistribution, that is, in inequality in market incomes, i.e. income derived before taxes and transfers, or inequality in disposable income, that is, income after taxes and transfers. Last but not least, rising income inequality amid rising GDP per capita does not, per se, imply any causal relationship from the former to the latter. A proper assessment of the distributional impact of growth needs to address the issue of reverse causality between growth in household income and inequality. In a nutshell, the growth and inequality question needs to be specified at a finer level and estimated with robust empirical techniques.

The OECD has produced new research to shed more light on the growth and inequality question ("The Distribution of the Growth Dividends" by Mikkel Hermansen, Orsetta Causa and Nicolas Ruiz, OECD Economics Department Working Paper, 2016, forthcoming). This is achieved by relying on a long-run approach to the growth and inequality nexus and by considering the location of income inequality, not one single summary measure of inequality. The idea is to identify the distribution of the growth dividends - in other words, if and to what extent income generated from GDP per capita (production value) accrues to households across different income groups, from the poor, to the middle class and the rich; taking into account not only the level of growth but also the nature of growth, that is, its underlying sources; as well as attempting to address issues of reverse causality between growth in GDP and in household incomes.

New Evidence for OECD Countries

The distribution of the growth dividends

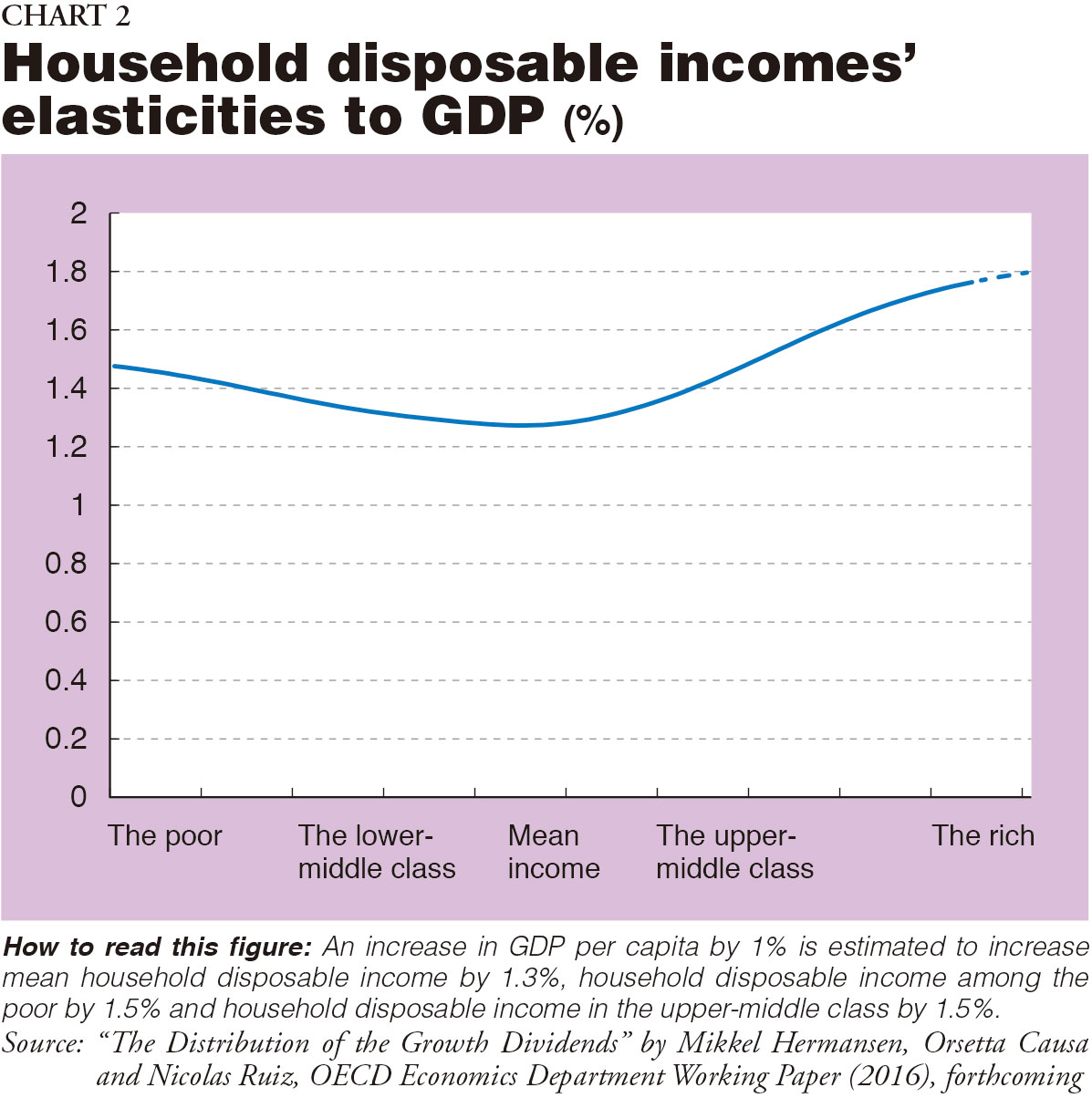

The results suggest that on average across countries and for the period from the mid-1980s to around 2012, GDP growth was fully transmitted to household disposable incomes: 1% growth in GDP per capita translated into 1% growth in average household disposable income (Chart 2). The estimated curve is broadly flat at the unitary elasticity. It can thus not be rejected that GDP growth has had the same impact across the distribution of household disposable incomes. The cautious conclusion would be that although growth has been associated with rising income inequality in many OECD countries over the last three decades, there is no evidence of a causal effect from GDP growth to inequality. These findings are to be interpreted as "long-run" effects of growth in GDP per capita on growth in household incomes across the distribution insofar as they take into account income convergence between countries as well as a number of confounding factors that could drive a wedge between household incomes and GDP per capita, such as persistent external macroeconomic imbalances.

Decomposing the growth dividends: the role of productivity and labor utilisation

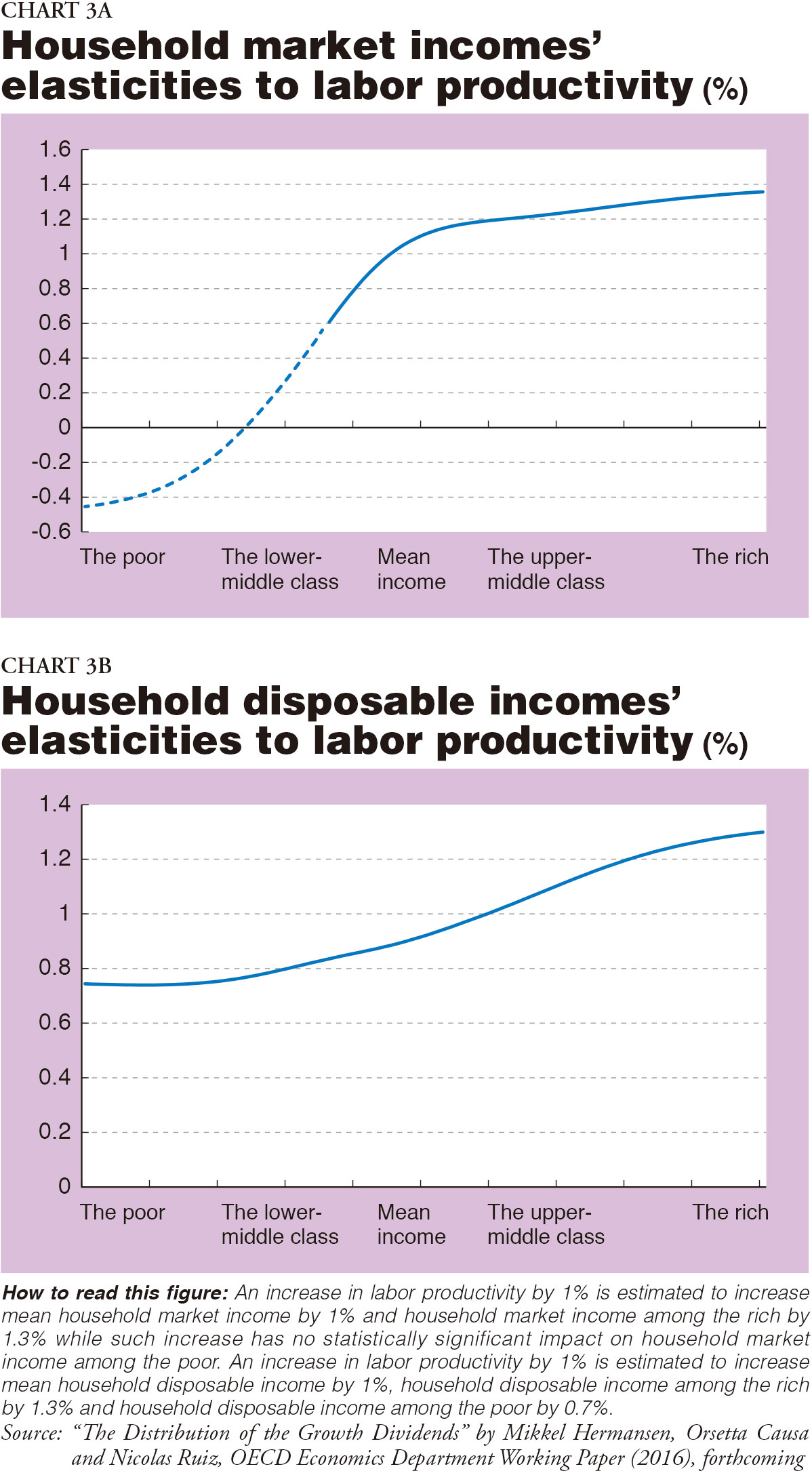

The distributional incidence of growth is found to crucially depend on the nature of growth, that is, on whether growth in GDP per capita is driven by growth in labor productivity or growth in labor utilisation; and on whether incomes are considered before or after redistribution through taxes and transfers.

Growth in labor productivity tends to be disequalizing. Indeed, across OECD countries and for the period going from the mid-1980s to around 2012, labor productivity gains were fully transmitted to household incomes, but associated income gains were unequally distributed: such gains accrued only to middle-class and rich households, when considering the distribution of income before taxes and transfers (Chart 3A). By contrast, when considering the distribution of income after taxes and transfers, productivity gains also accrued to poor households, but were of somewhat lower magnitude compared to those accruing to rich households (Chart 3B). Productivity-driven increases in market income dispersion are likely to reflect increases in wage dispersion, which have been the main driver of increasing income inequality across OECD countries over the last decades. Top gross earnings (wages) - measured as the upper bound of the 9th decile of the earnings distribution for full-time employed - have risen 0.6% faster per annum than those at the bottom (upper bound of the 1st decile) over the two decades up to the crisis ("Gross Earnings Inequalities in OECD Countries and Major Non-member Economies: Determinants and Future Scenarios" by Henrik Braconier and Jenifer Ruiz Valenzuela, OECD Economics Department Working Paper No. 1139, 2014). This increase is found to reflect that skill-biased technological change (SBTC) has more than compensated for the effects of rising levels of educational attainment and per capita income growth, which both have tended to lower earnings dispersion. It could also reflect the effect of outsourcing on wage inequality, as this has been found to increase the relative demand for skilled labor and, as a result, wage inequality, especially in advanced countries shifting low-skill activities to emerging economies. Identifying the relative contribution of trade versus technology in explaining increasing wage dispersion has proven a difficult task, though ("The Impact of Outsourcing and High-Technology Capital on Wages: Estimates for the U.S., 1979-1990" by Robert C. Feenstra and Gordon H. Hanson, Quarterly Journal of Economics, August, 114(3), 1999).

The disequalizing effects from productivity growth have been alleviated (though not neutralised) through the process of income redistribution. Indeed, the comparison between market income-based and disposable income-based results would suggest that redistribution via taxes and transfers allowed for productivity gains to accrue to less affluent households, again across OECD countries and for the period going from the mid-1980s to around 2012: the poor and the lower-middle class were taken on board when moving from market to disposable income, which reflects income transfers from the upper part of the market income distribution. One interpretation is that productivity gains lifted market incomes among the middle class and above and part of the associated gains were taxed away to redistribute income to more vulnerable households. Still, even when considering post-redistribution incomes, the estimates suggest that productivity growth was slightly disequalizing.

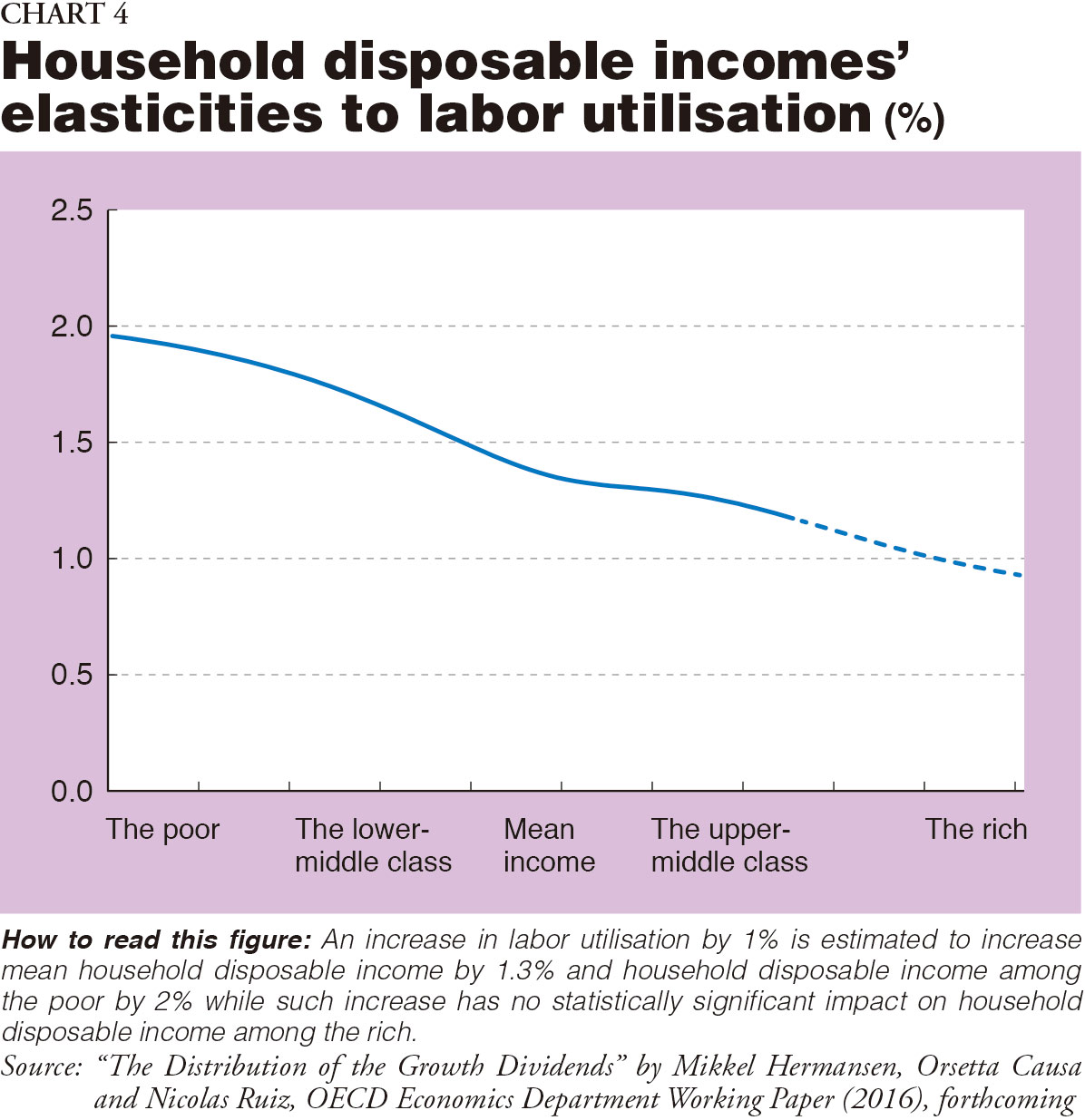

Growth in labor utilisation is clearly equalising, in contrast with growth in labor productivity. Across OECD countries and for the period from the mid-1980s to around 2012, the distributional incidence of growth in labor utilisation was opposite to that of growth in labor productivity: higher labor utilisation boosted incomes for middle-class and poor households, while rich households were largely disconnected from that process (Chart 4). This holds for both market and disposable income. The results, taken at face value, deliver large effects: a rise in labor utilisation by 1% is estimated to lift market incomes among the poor by roughly 3%, more than one percentage point compared to incomes of middle-class households. Employment growth has thus contributed to mitigate the disequalizing effect from rising wage inequality across OECD countries over the last decades. These results imply that making growth more inclusive requires making growth employment-rich, as well as, crucially, sharing more equitably the gains from higher productivity - as productivity growth remains the fundamental and much needed driver of long-term increases in people's living standards.

Future Challenges

The results from this new research suggest that growth itself has not been the driver of the increase in inequality observed across OECD countries over the last decades. However, future growth is likely to further push income inequality upwards, due to the nature of its driving sources. Population aging will result in a decline in the labor force which will reduce the growth contribution from labor utilisation, especially in high-income OECD countries. As a result, growth will increasingly become dependent on labor productivity, in particular on multifactor productivity, on the accumulation of skills and knowledge-based capital. Assuming that technological progress will continue at a similar pace in the future, there is little reason to expect a halt in the trend towards higher wage dispersion. If anything it may intensify, as the effectiveness of education in increasing the relative supply of skilled workers diminishes, given that the share of the population with higher-educational attainment is unlikely to continue rising as rapidly in the future. In fact, the OECD 50-Year Global Scenario (2014) suggests that wage inequality could grow by between 17% and 40% within the OECD countries by 2060 if the same trend of SBTC observed over the past 25 years persists. According to this scenario, in Japan, inequality between top and middle earners could become slightly higher than it is today in the United States. This is just a stylized scenario and needs to be taken with caution. However, it points to the size of the challenge for policymaking.

Policy Implications for Japan

How to boost growth and make it more inclusive? Policymaking should exploit synergies across the objectives of raising growth and that of mitigating inequality, while taking into account country-specific challenges as well as country-specific social preferences.

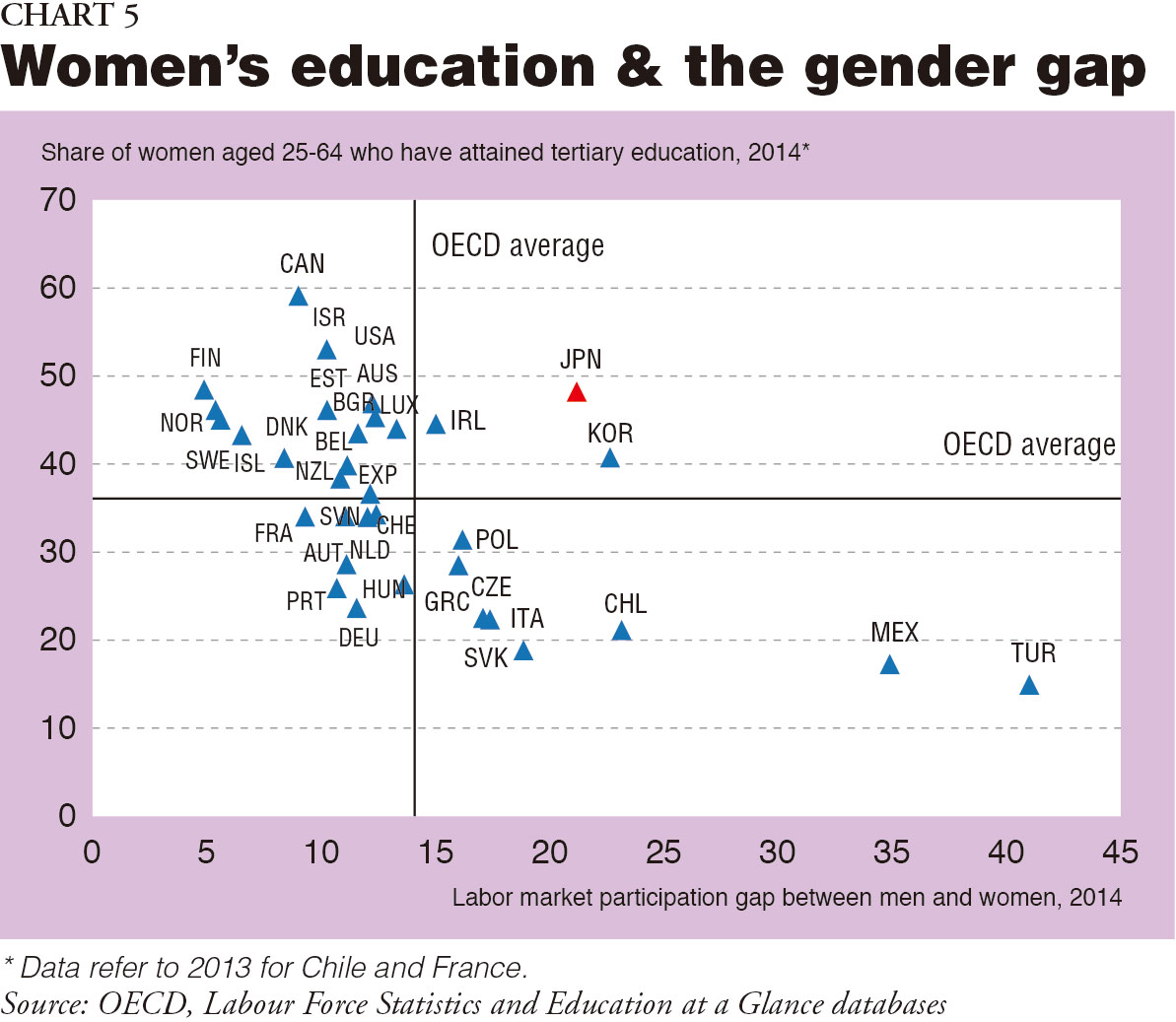

In Japan, priority should be given to addressing the gender gap by strengthening the inclusion of women in the labor market (Chart 5). Progress in this area would boost growth and make it more inclusive, hence mitigate rising earnings dispersion. Japanese women suffer from high unemployment as well as high wage gaps with respect to men. Indeed, not only are women underrepresented in the labor market, but also overrepresented among non-regular workers, which implies lower wages, less training and poorer career prospects, as well as limited social protection. Yet this is somewhat a paradox and evidence strongly suggests that Japanese women represent an important potential pool of skilled labor: they tend to have very high graduation rates as well as very high proficiency levels. Facilitating the entry of women in the labor market would align efficiency and equity objectives in Japan, reducing the country's relatively high level of income inequality while increasing its relatively low level of productivity. This would also ease the long-term challenge of aging in Japan - the working-age population is projected to diminish by 40% by 2050. Reforms to enhance labor market inclusion should extend to multiple dimensions covering taxes and benefits systems, public services and labor regulations, as well as increasing the supply of childcare facilities. Progress has been achieved in Japan in recent years, but efforts in this area should be pursued (see Going for Growth, OECD, 2016).

(2016/11/04)

Orsetta Causa

Orsetta Causa is a senior economist in the structural surveillance division of the OECD Economics Department. She is an expert on structural policies, growth, income distribution and inequality, and has a number of publications in this area. She has been responsible for the OECD flagship publication Going for Growth for five years. She holds a PhD in Economics from the Paris School of Economics.

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27