HOME > Japan SPOTLIGHT > Article

White Paper on International Economy & Trade 2017 - Summary

By Policy Planning & Research Office, Trade Policy Bureau, Ministry of Economy, Trade & Industry (METI)

Introduction

Dissatisfaction with globalization and free trade has been growing and doubts have been raised about the free trade system in some advanced countries against the background of growing domestic income inequality. Meanwhile, among emerging countries there is a growing trend of pursuing the development of domestic industries through market-distorting measures.

This year's White Paper explores the issues that trade policy faces going forward against the backdrop of this dramatic shift in the environment surrounding free trade.

First, regarding the growing skepticism towards free trade, mainly among advanced countries, the White Paper reemphasizes the importance of free trade by revealing through empirical analysis that "free trade is the engine of economic growth and contributes to reducing income disparities."

Next, it reveals that Japanese global companies are less profitable than their US and European counterparts and highlights the necessity of creating high value-added goods and services that are free from price competition pressures; developing global markets by promoting "connected industries" that create new added value through the combination of these various connections and bolstering investment in human resources.

Finally, it highlights the necessity of undertaking supportive policy for the overseas development of local small and medium enterprises (SMEs) in light of the importance of supporting businesses experiencing difficulties in entering global markets which would allow them to benefit from free trade.

Based on this analysis, the Ministry of Economy, Trade and Industry will comprehensively promote the construction of free, fair and high-level trade rules and the advancement of connected industries, and provide support for the overseas development of SMEs.

World Economic Trends & Risks

The world economy is on track to recovery as a whole, but the pace remains moderate. In 2017, the world economy will maintain its upward momentum which began in the latter half of 2016, and it is expected to maintain a moderate recovery that will not reach pre-world economic crisis levels.

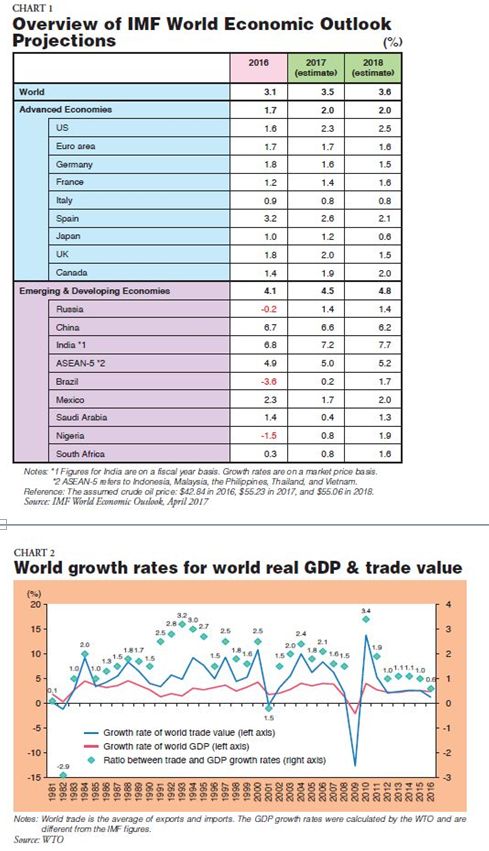

The International Monetary Fund (IMF) projects the world GDP growth rate at 3.5% in 2017 and 3.6% in 2018. At the same time, rising protectionism pressures, the impact on emerging economies of a faster-than-anticipated tightening of global financial conditions, geopolitical tensions in the Middle East, Asia and elsewhere and other risks command ever more attention (Chart 1).

Global trade grew at twice the pace of real GDP up to 2007. However, trade has grown more slowly than real GDP for five straight years since the trend began in 2012. The IMF, the World Trade Organization (WTO) and other international organizations call this "slow trade" and many studies have been published regarding this matter (Chart 2).

The Merits of Free Trade

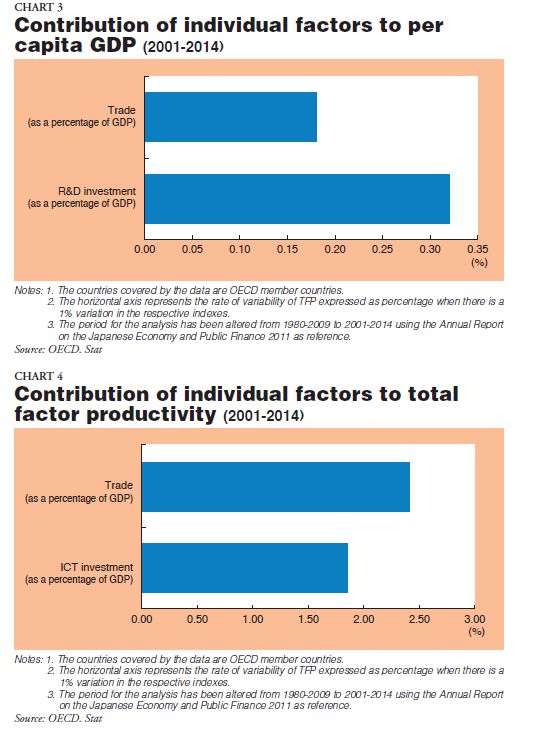

Free trade is essential to the expansion of the economic pie. Chart 3 shows that while per capita GDP grew 0.18% due to a rise of 1% in the trade value as a percentage of GDP, it grew 0.32% due to a rise of 1% in R&D investment as a percentage of GDP. The results indicate that like R&D investment, which is considered to make significant contributions to economic growth, trade also contributes to per capita GDP growth.

In addition, Chart 4 shows that while total factor productivity rose 2.41% due to an increase of 1% in the trade value as a percentage of GDP, it rose 1.85% due to an increase of 1% in ICT investment as a percentage of GDP. The results indicate that trade contributes more to a rise in total factor productivity than ICT investment, which is generally said to be closely related to a rise in the total.

So far, we have looked at the macroeconomic factors. Enhancement of productivity of individual companies should also be examined from a microeconomic perspective. Companies which did not engage in export in 2000 were divided into two categories - those which started exporting in 2001 and those which did not - and the figure shows changes in the average logarithmic value of the labor productivity of these two groups of companies from 1998 to 2008. The companies that started exporting in 2001 already had higher productivity before the start of the fiscal year and that difference grew over the following years (Chart 5).

Moreover, according to the results of a questionnaire, many companies exporting directly increased both their sales and ordinary profits, at least in part because of rising productivity due to exports, and 30-40% of the responding companies stated that they were also able to increase employment and wages. Given the results of this research, supporting efforts by non-exporting companies with relatively high productivity can be expected to increase not only sales but also profits (Chart 6).

Factors of Income Inequality

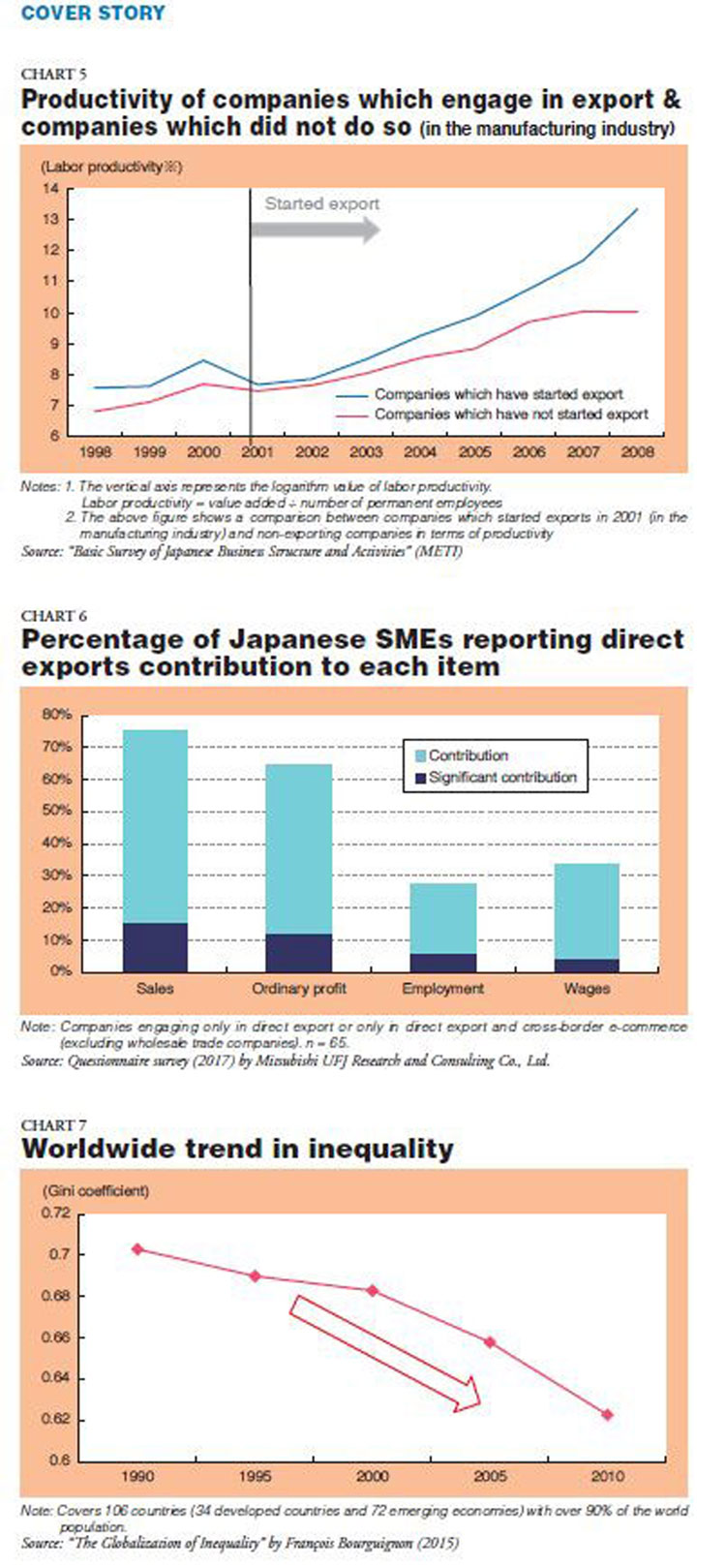

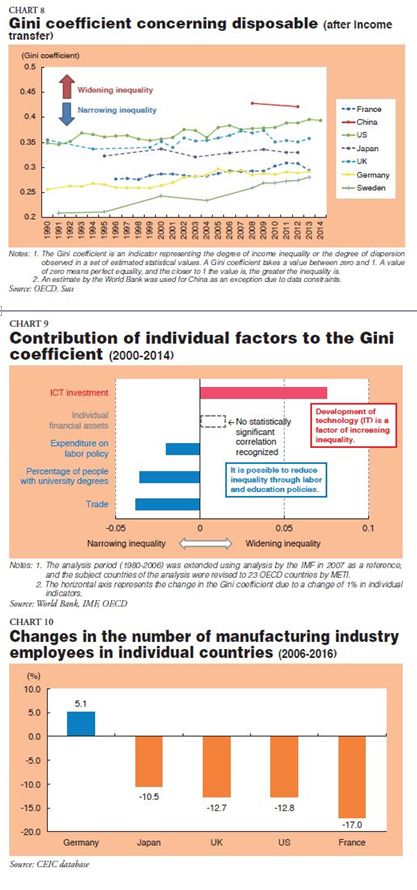

As for global income inequality, the Gini coefficient narrowed from 0.70 in 1990 to 0.62 in 2010. In particular, the pace of the narrowing has been rapid since 2000. It is believed that this has been mainly driven by the rapid rise of emerging countries in Asia, such as China and India.

However, despite the downward trend, it is important to keep in mind that the latest available global Gini coefficient, at 0.6 in 2010, is still quite high in comparison to a level of lower than 0.4 in advanced countries (Chart 7).

Meanwhile, an international comparison of the Gini coefficient among advanced countries shows that the domestic inequality gap has been widening in all advanced countries except Japan (Chart 8). The IMF concluded that "the main factor driving the increase in inequality has been technological innovation" from an analysis of the factors of changes in the Gini coefficients of 51 countries consisting of 20 advanced countries and 31 emerging economies from 1980 to 2006.

An attribution analysis of the Gini coefficients for advanced countries only from 2000 to 2014 using the IMF analysis for reference also showed that technological innovation (ICT investment) was the main reason for the increasing inequality within advanced countries and that trade, like education policy and other factors, was a factor that narrowed the inequality gap.

That said, promotion of ICT investment is essential to enhancing Japan's economic growth potential. Therefore, ICT investment must continue to be pursued aggressively while dealing with wealth inequalities through domestic policies (labor policy, education policy, etc.) separately from trade and investment policies.

An analysis was conducted adding personal financial assets as an explanatory variable since financial assets held by people in high-income brackets is mentioned in certain advanced countries as a factor behind the growing income inequality. However, no significant correlation was recognized in this survey (Chart 9).

International Views on Inclusive Growth

On the other hand, the IMF revealed that imports from emerging countries have affected employment in the manufacturing industry in some regions of advanced countries. Indeed, manufacturing industry employees are forming an ever-decreasing portion of the middle class in most advanced countries. However, the situation does differ from country to country, with the number of manufacturing industry employees increasing in some countries, including Germany.

One possible reason for the increase in Germany is that labor market reform, in addition to the expansion of exports including high-value-added products, has produced positive effects (Chart 10).

According to a report produced jointly by the WTO, IMF and World Bank, "with the right policies, countries can benefit from the great opportunities that trade brings and lift up those who have been left behind. Those policies ease adjustment to trade, and strengthen overall economic flexibility and performance." (Chart 11).

.jpg)

The Environment Surrounding Japan's Trade Policy

The environment surrounding Japan's trade policy has changed significantly in terms of both the actual economic circumstances and new developments in international trade theory. In terms of the actual state of economic activities that govern the economy, the information revolution caused changes that began at the end of the 1980s and led to a technological upheaval in the movement, storage and processing of ideas and a dramatic decline in communication costs.

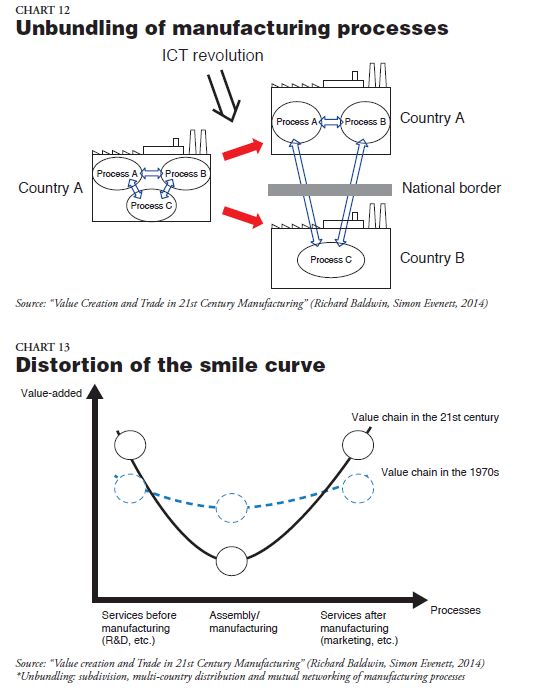

The major effect of the change was the development of cross-border distribution networks. According to Richard Edward Baldwin (professor of International Economics at the Graduate Institute, Geneva, since 1991 after serving as an economist of the President's Council of Economic Advisers during the George H. W. Bush administration from 1990 to 1991), the new communication networks changed the situation where multiple processes had to be conducted in a single physical space for the sake of efficiency, so that businesses could now "unbundle" the processes (by dividing the processes between multiple manufacturing processes and work sites located in different regions or countries) and construct optimal supply chains (Chart 12).

As a result, the global value chain supported by cross-border movement of goods, people, money and information has developed remarkably. Due to the unbundling of manufacturing processes, pressure on value added in intermediate manufacturing processes has increased significantly, as exemplified by the transfer of some of those processes to emerging countries with low-cost labor. Specifically, added value in assembly work located in the middle of manufacturing processes has declined due to unbundling, while the added value related to prototyping upstream and after-manufacturing services in the downstream have both increased, altering the shape of the so-called "smile curve" (Chart 13).

As a further change, public distrust of "free trade" is deepening, while public calls for efforts to overcome this distrust have been growing. In addition, with the increasing need for support for entry into global activities indicated by the firm heterogeneity model (pointing to the potential for non-export companies to become exporting companies depending on policy support), there is a strong need for a "21st century-style trade policy".

Trade Policy in the 21st Century

In light of these changes in the environment surrounding trade, Japan's trade policy as a "21st century-style trade policy" supports innovation and aims for inclusive growth. This trade policy will be promoted while organically coordinating the formulation of free, fair and high-level trade rules, the promotion of "connected industries" that generate new value through their various connections, and the support of overseas business expansion for SMEs using the Consortium for New Export Nation.

Enhancing the Profitability of Japan's Multinational Companies

With the rapidly and dramatically changing environment, it is necessary to encourage Japanese multinational companies to enhance their profitability with the aim of revitalizing and sustaining the growth of the Japanese economy. While Japanese companies are capable of enhancing productivity, they are unable to increase their control of pricing. The growth in profitability (value-added per employee) of Japanese industry as a whole has declined significantly relative to the United States and Germany.

.jpg)

The decline of the value-added deflator indicates that because of weak pricing power Japanese corporations could not have made their business profitable even if they had improved their real labor productivity (Chart 14). This fact indicates that Japanese companies are being subjected to greater price competition pressures in the global market than US and European companies.

According to a questionnaire conducted by METI and industry associations this year, a majority of 58.9% of responding companies answered that they "do not have" the power to determine prices, while only 24.2% of the companies responded that they "do" (Chart 15).

.jpg)

In view of these facts, it appears necessary not only to focus on enhancing productivity but also on bolstering price-setting powers. Additionally, investing more in human resources development and innovation are effective in raising profitability. Japanese companies, however, trail their counterparts in other advanced countries in achieving the following four types of innovation: product innovation (introduction of new or significantly improved technical specifications, components and materials, embedded software, etc. for goods and services), marketing innovation (significant changes in the design or packaging of goods and services and introduction of new marketing methods regarding sales routes, sales promotion methods or pricing), process innovation (introduction of new or significantly improved production processes, distribution methods, etc.) and organizational innovation (introduction of new methods of operation, workplace organization or inter-company relations) (Chart 16).

.jpg)

"Connected Industries"

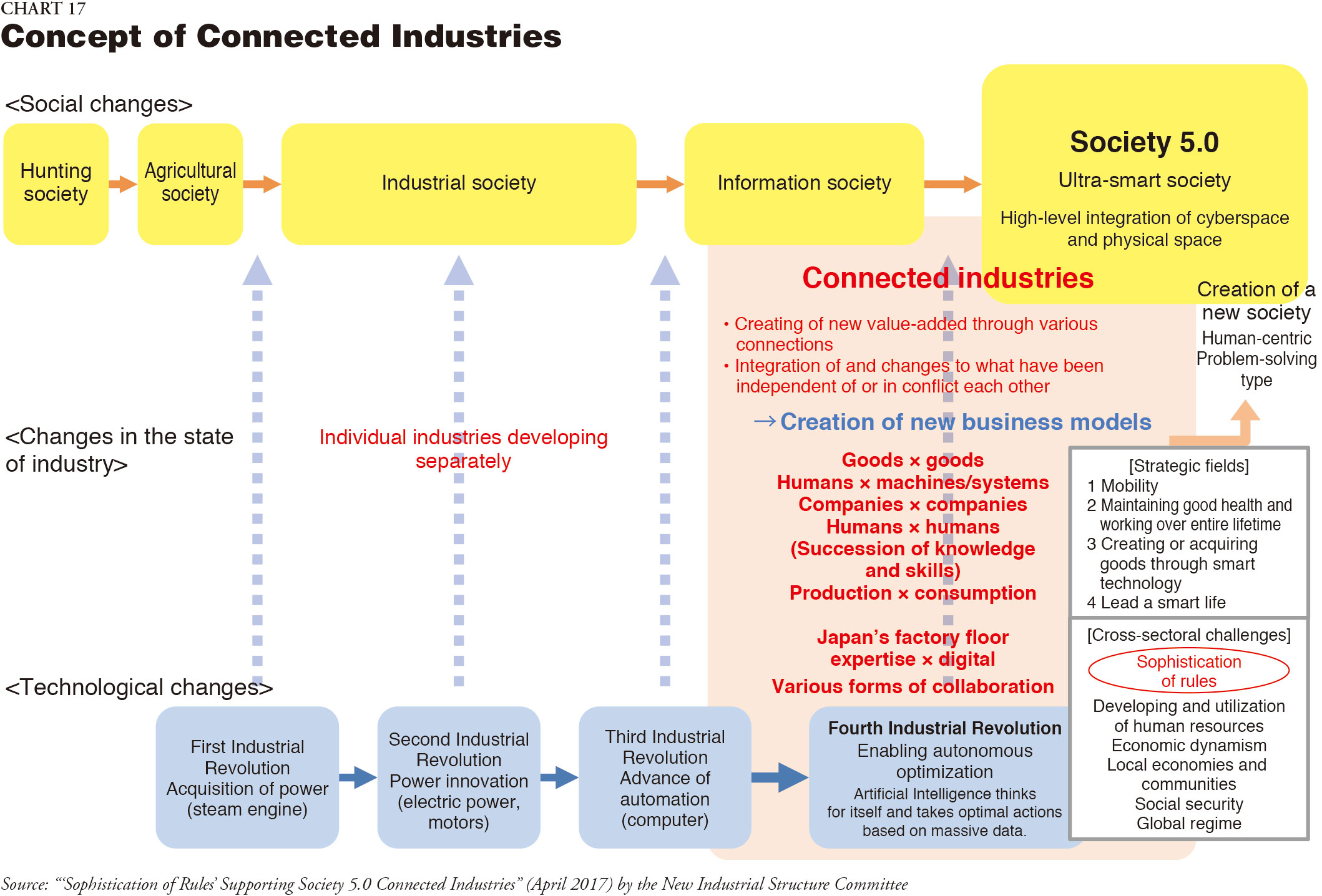

With the ongoing digitization, it is necessary to aim to establish a new, solution-oriented industry that takes advantage of Japan's strengths in technological superiority and advanced factory-floor expertise. Japan should create a human-centric industry that can take advantage of flexible problem-solving capability and continuous kaizen improvement activity underpinned by in-depth knowledge concerning factory-floor activity. "Connected industries", which create new added value through their various connections, are important. It is also necessary to create Society 5.0, in which cyberspace and physical space are integrated (Chart 17).

* The Japanese government disseminated the concept of "connected industries" at the German exposition CeBIT held in March 2017. "Connected industries" means industries that create new added value and solutions to societal challenges by optimizing the connections between a variety of things, including data, technology, people and organizations.

Current State of Affairs & Challenges in Human Resources Investment & Open Innovation

Creating a human-centric industry utilizing Japan's technological and factory-floor capabilities and developing new business models based on a total connectivity calls for "investment in human capital", where Japan trails the US and Europe, and the promotion of "internationalization from within" including inbound direct investment and acceptance of high-level foreign human resources.

It is important to promote investment for acquisition of human resources from different fields and for human resource development in AI and IoT with an eye to the Fourth Industrial Revolution.

As employment modalities have become more fluid and the number of non-regular employees has increased, the incentive for in-house training and education has declined, leading some to point out that a gap has emerged between private and public interests regarding the development of highly skilled workers. In fact, investment by Japanese companies in developing human resources is low compared to international standards. Japanese companies began reducing training and education expenses as the economic bubble burst, and made further significant cutbacks in the wake of the financial crisis in order to reduce costs. There is also the possibility that the incentive to conduct in-house training and education has reduced as routine work demand has come to be fulfilled by non-regular workers (Chart 18).

.jpg)

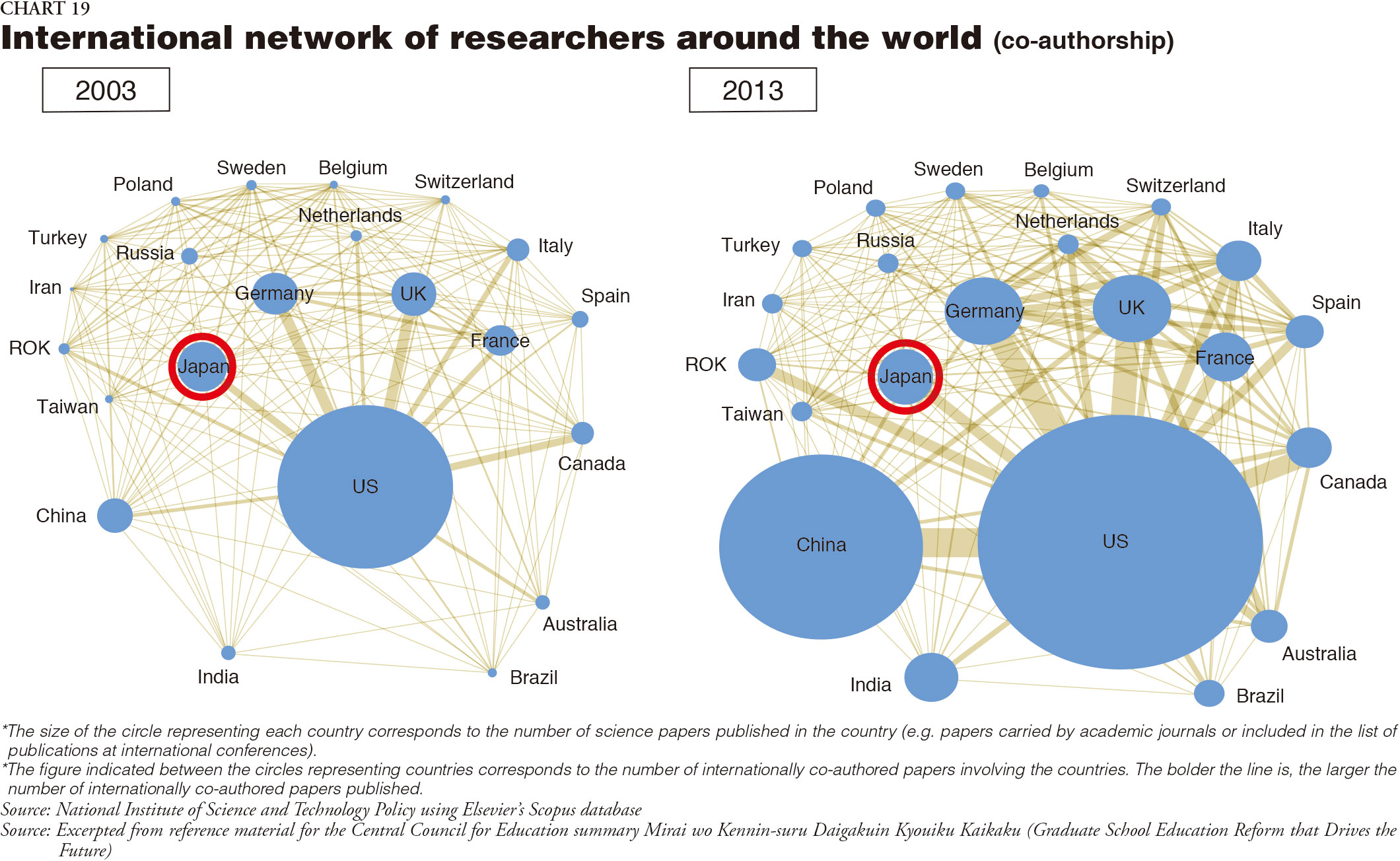

It is also important to accelerate the development of international research networks towards open innovation. The number of joint papers published by international teams grew significantly worldwide between 2003 and 2013, but the number of such joint publications including Japanese researchers is relatively low. By comparison, China significantly increased both the number of scientific papers and such joint papers published between 2003 and 2013, and advanced countries such as Germany and the United Kingdom are also showing increases. Japan is being left behind by these countries (Chart 19).

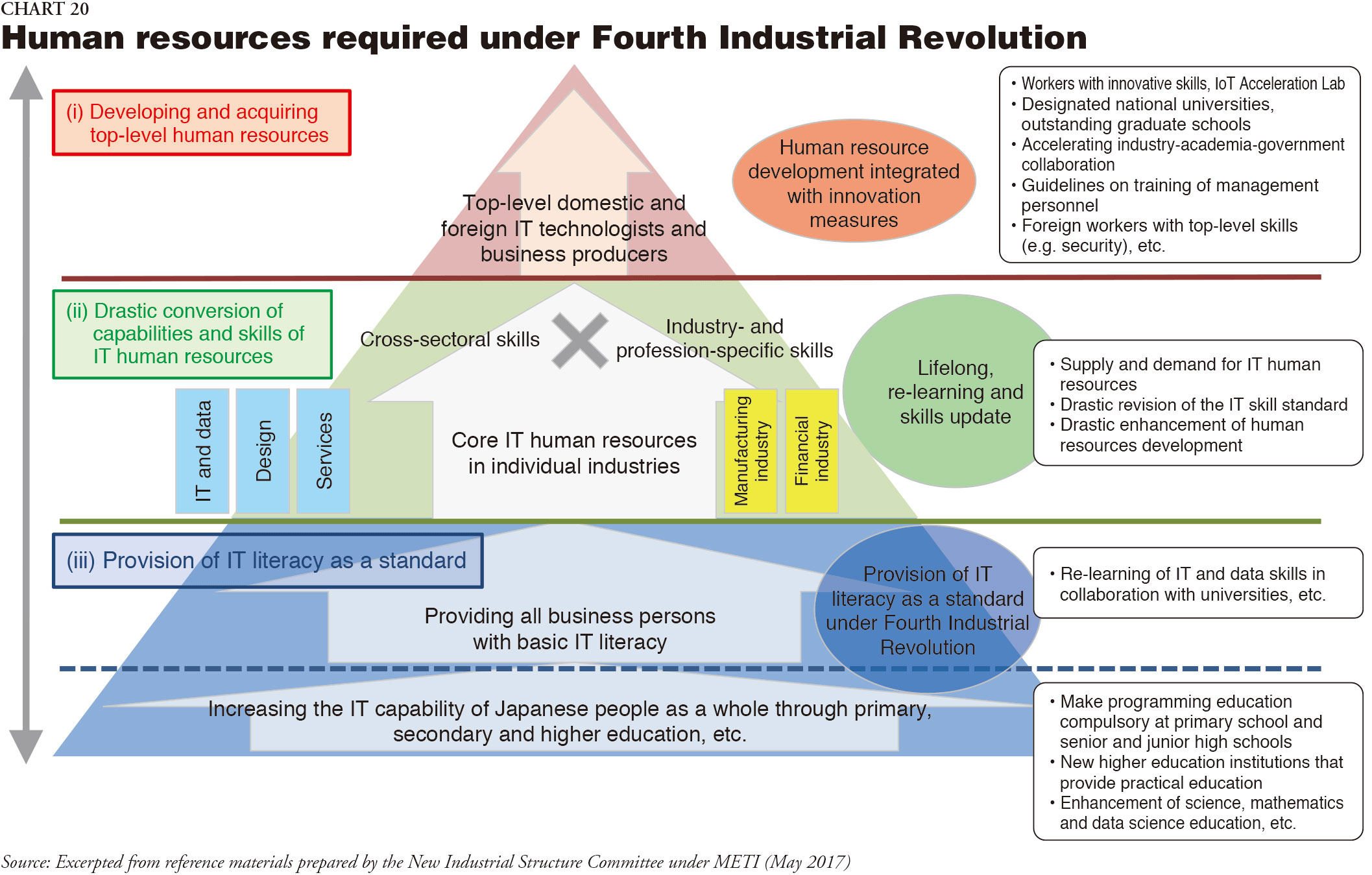

Given this situation, it is important to construct an ecosystem for basic, intermediate and top-level human resources development and education/training centered around IT and data, where there is a massive human resources deficit in order to equip the labor force with new skills and competencies.

While the emergence of AI, robotics and other technology will reduce the need for labor both for routine and non-routine work, leading to the elimination of the labor deficit, it is highly likely that back-office and other conventional middle-skill white collar work, comprising the majority of Japanese employment, is likely to decline significantly.

At the same time, the changes in business processes that the Fourth Industrial Revolution has caused will generate demand for new employment including middle-level skills. Therefore, it will be necessary to develop human resources that match this shift in the job structure and to shift labor to growing sectors.

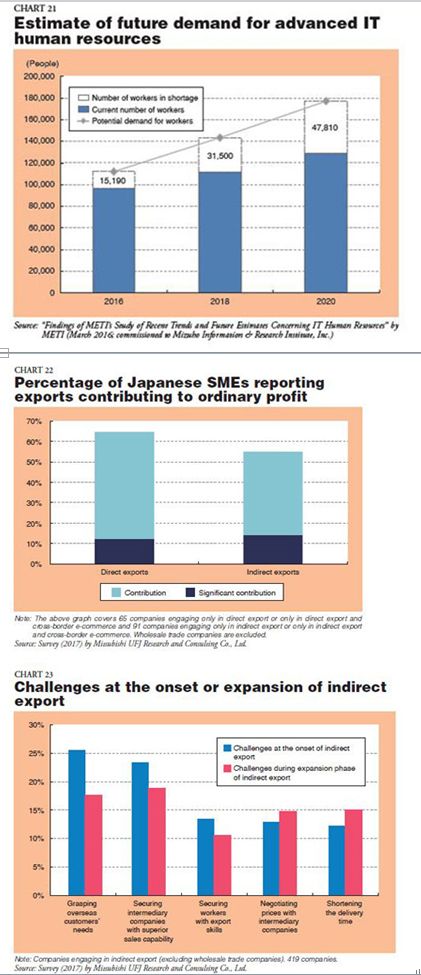

Experts in AI, big data, robotics and IoT will grow in importance under the Fourth Industrial Revolution. One estimate shows that there will be a shortage of approximately 50,000 people in these cutting-edge IT human resources by 2020 (Chart 20 & 21).

Bolstering Efforts Aimed at Inclusive Growth

The firm heterogeneity model set forth by Marc Melitz and others differs from preexisting trade theory in that it explains how a gap is created between exporting companies and non-exporting companies in the same industry depending on their ability to bear the fixed costs for exports. In addition, the firm heterogeneity model explained that there were many companies among those which had found it difficult to enter the global economy that could become global businesses through properly designed policy measures.

According to a questionnaire conducted by METI on indirect exports, 50-60% of SMEs responded that indirect exports helped increase ordinary profits, a figure not that different from direct exports (Chart 22).

Supplying products to overseas markets requires high levels of productivity to allow companies to bear the necessary fixed export costs and still secure profits. However, even SMEs that do not have adequate productivity for direct exports can access overseas demand through indirect exports, and it can lead to an increase in ordinary profits.

Moreover, only 5% of Japanese manufacturers export directly, but the percentage of those that engage in indirect exports is much higher. Indirectly exporting companies comprised 39% of all manufacturers and 42%, 33% and 50% of employment, sales and added value of manufacturers, respectively. In terms of added value, they have a larger share than either directly exporting companies or non-exporting companies. (For your information, due to data constraints, "indirectly export companies" are defined here as companies selling products to wholesale trade companies or manufacturers engaging in direct export. It should be noted that exports do not account for all of their business (See Notes). Thus, it is estimated that many companies are already exporting indirectly, but there is room for further growth.

(Notes: 1. Due to data constraints, indirectly exporting companies are defined as companies that sell to retail companies and manufacturing companies. Note that not all business transactions actually represent exports. 2. "Added value" is the share of the added value including domestic demand (Ishikawa, Saito, Taoka, Chiiki ni okeru Kansetu Boueki no Yakuwari (Role of Indirect Exports in the Regions), 2017).

As a challenge for indirect exports, it is necessary to partner with intermediary companies with strong sales capacity and networks, but only a small percentage of companies engaging in wholesale trade have strong overseas sales networks (Chart 23). In other words, it is unlikely that wholesale trade companies whose strengths lie in overseas sales routes and wholesale trade companies whose strengths lie in Japan where the merchandise is sourced are the same. When wholesale companies with a good grasp of the strengths of local products turn their attention to overseas markets, the first matter they need to address is to enhance their export capabilities. In other words, it is important to strengthen the export capabilities of the wholesale companies in addition to matching manufacturers and wholesale companies in order to expand indirect exports.

In addition to indirect exports, cross-border e-commerce (overseas e-commerce) provides easy access to overseas customers, increasing its potential as an effective means to enhance access to overseas markets for SMEs that lack both information about overseas markets and export networks.

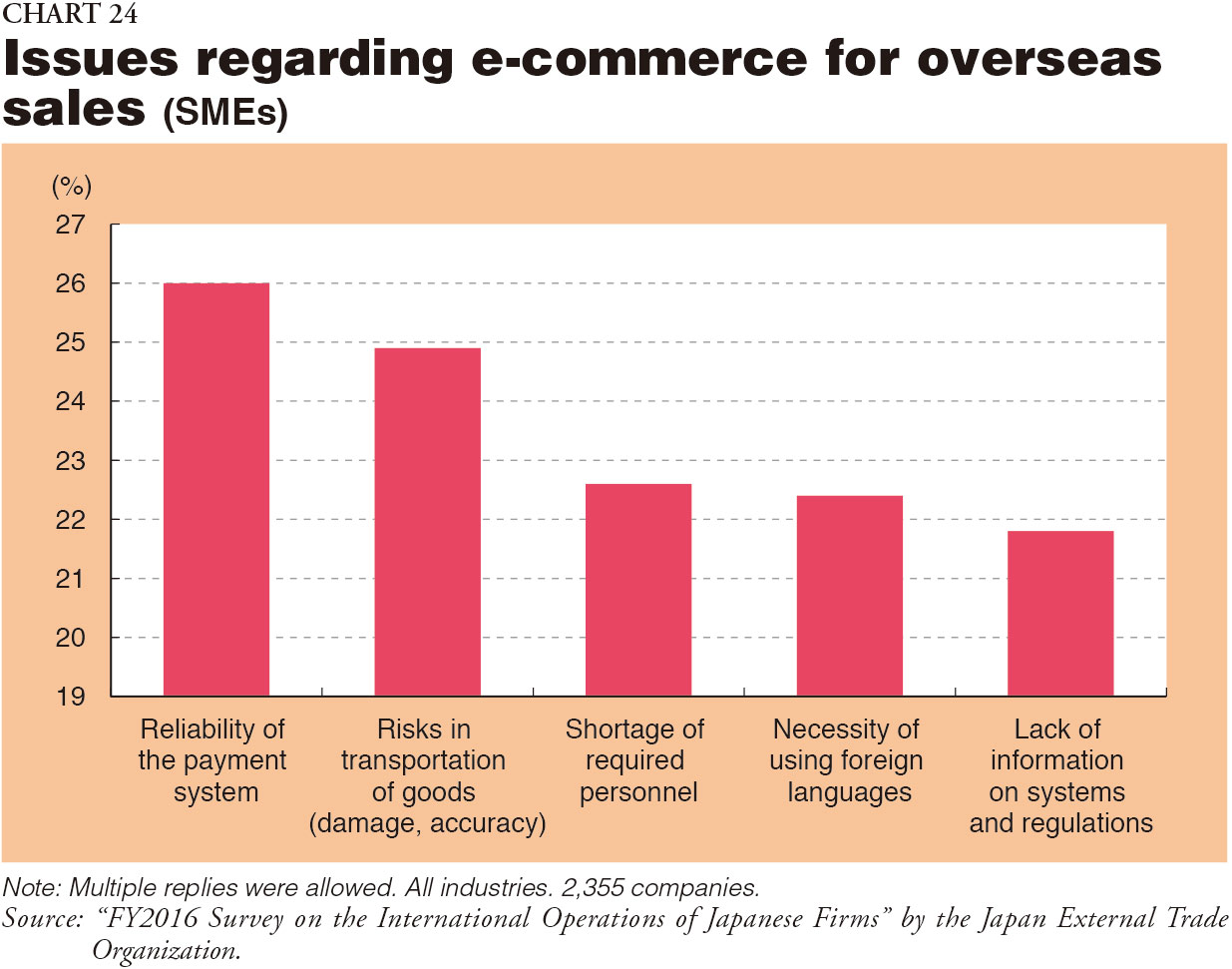

However, according to a survey conducted by the Japan External Trade Organization (JETRO), many companies highlighted risks concerning payment systems and delivery as issues for cross-border e-commerce. Large numbers also raised export and customs procedures and duties payment as issues for concern (Chart 24).

The Consortium for New Export Nation

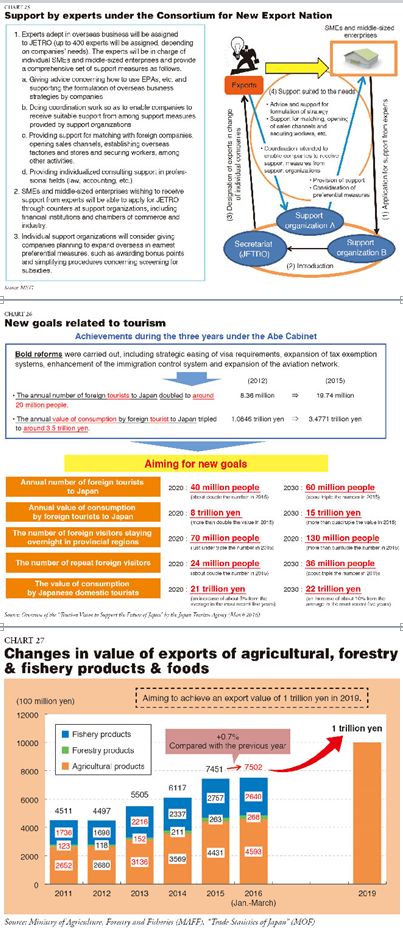

The overseas development of small, medium and intermediate enterprises presents a wide range of problems, so it is important to provide expert support tailored to individual needs. According to a questionnaire conducted by JETRO, many companies highlighted a wide variety of issues that they face, such as difficulty in securing local business partners and personnel capable of undertaking overseas business activities, and acquiring information on overseas regulations and other institutional information including information about local markets. Support for the overseas development of small, medium and intermediate enterprises must begin with support in ensuring product development satisfies international standards and extent to developing sales routes that match the individual needs of companies by using the New Export Power Consortium Framework, among other things (Chart 25).

Responding to Inbound Demand

In March 2016, the government adopted the "Tourism Vision to Support the Future of Japan" concerning new governmental measures, including the goals of increasing the annual number of foreign visitors to Japan to 40 million people and the annual value of consumption by foreign visitors to 8 trillion yen by 2020.

The Tourism Vision sets forth the following three goals based on the understanding that "tourism should be a main pillar for Japanese economic growth and regional revitalization": first, "to enhance the appeal of tourism resources to aid local revitalization"; second, "to evolve tourism into a core industry by reforming business frameworks and improving international competitiveness"; and third, "to improve soft infrastructures facilitating the world's most convenient comfortable travel". It lays out 35 policy measures based on the three goals on which the relevant ministries and agencies are collaborating (Chart 26). Collaborative efforts between the public and private sectors on tourism policy measures have led to 24.039 million foreigners visiting Japan in 2016 (estimate up 21.8% year on year) and spending 3.7476 trillion yen (up 7.8% year on year), both record highs since tourism statistics began being compiled.

Food Exports

Concerning agricultural, forestry and fishery products and foods, the Working Group on Strengthening the Export Capability of Agricultural, Forestry and Fisheries Industries was established within the government in January 2016 in order to achieve the goal of increasing the annual value of exports to 1 trillion yen by 2019. In 2016, the most recent year for which data is available, total export value came to 750.2 billion yen. While the growth rate has declined due to the weakening effects of the yen's depreciation, the government aims to increase the export value by around 250 billion yen over the coming three years (Chart 27).

In light of these circumstances, METI is undertaking a variety of measures in collaboration with various other ministries and agencies. Specific examples include the establishment of the Japan Food Product Overseas Promotion Center, the spread of Japanese food products in collaboration with convenience stores and the development local systems to respond to overseas import restrictions, etc. In order to promote regional tourism and exports of agricultural, forestry and fishery products and foods, it is important for the government to continue supporting investment in regional assets for the future.

Japan SPOTLIGHT September/October 2017

(2017/09/11)

Policy Planning & Research Office, Trade Policy Bureau, Ministry of Economy, Trade & Industry (METI)

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27