HOME > Japan SPOTLIGHT > Article

White Paper on International Economy & Trade 2018 — Summary (Part 2)

By Policy Planning & Research Office, Trade Policy Bureau, Ministry of Economy, Trade & Industry (METI)

(2) Expanding External Trade and Investment

In just 15 years after joining the WTO in 2001, China became one of the largest trading powers in the world on a par with the US.

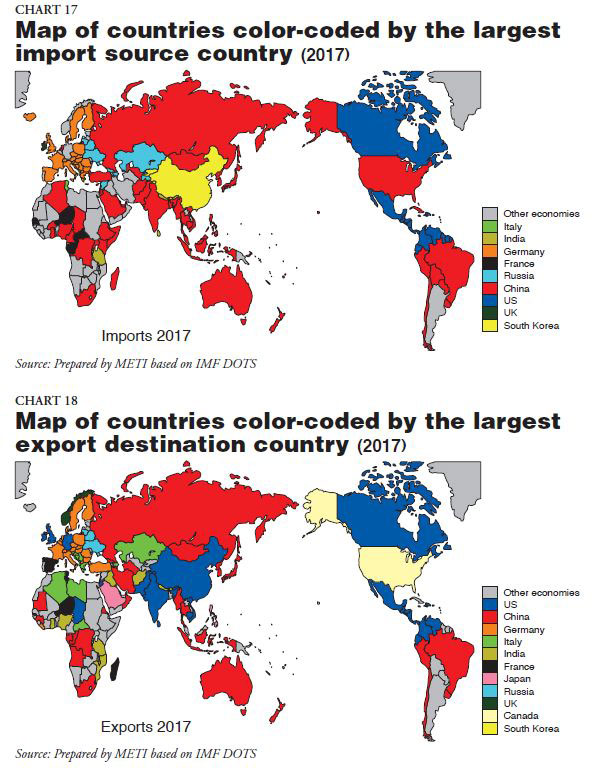

When we turn our eyes to the largest import source countries for countries around the world, countries for which China is the largest import source country have rapidly increased. In 2017, China was the largest source country for imports for around 30% of all countries worldwide excluding Canada, some Latin American countries, and European countries (Chart 17).

While the largest import source countries for Canada, Mexico, and European countries are the US and Germany, i.e. the main industrialized economies in their respective regions, China has become the largest import source country for the US and the second-largest import source country for Germany after the Netherlands.

A look at the largest export destination countries around the world shows that China overtook Japan as the largest export destination country for ASEAN and Australia in 2017, while it surpassed the US in many countries in Africa and South America. Although China is the largest export destination country for fewer countries than it is the largest import source country, at approximately 16% (30 countries) it is second only to the US (Chart 18).

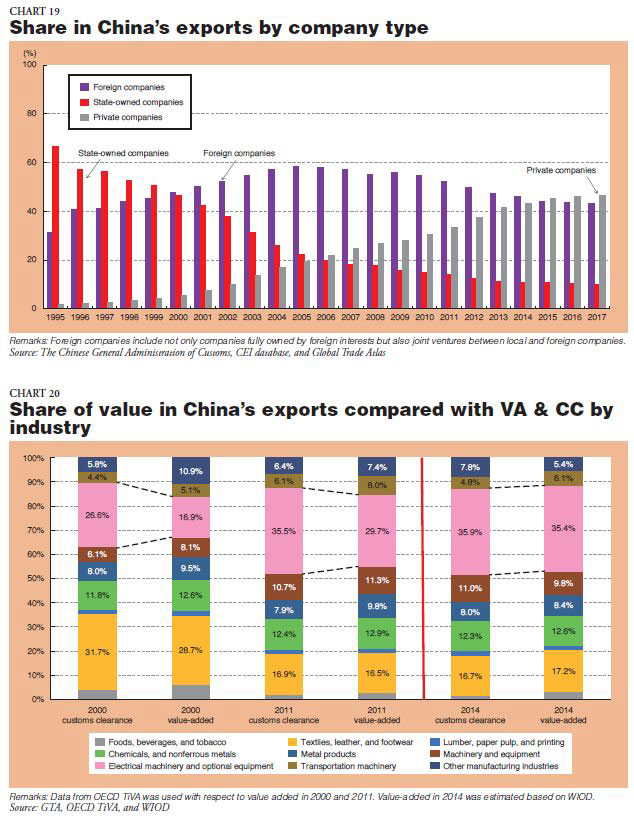

A look at the breakdown of Chinese exports by the nature of the exporters shows that the share of state-owned companies had been declining while foreign companies played a major role, increasing their share until the mid-2000s. However, private companies have been growing as exporters and recently surpassed foreign companies (Chart 19).

A look at the change in the industries that are the main drivers of Chinese exports shows that electrical machinery and optical equipment have replaced textiles as the main drivers of Chinese exports. The growth in the shares of China's electrical and optical equipment industry exports is higher on a value-added basis (VA) than on a customs-clearance basis (CC) (Chart 20).

A breakdown by industrial category shows that one characteristic in 2000 was the low proportion of value-added in China's electrical machinery and optical instruments industry, at approximately 30%. This was apparently the result of the active production taking place in this industry that utilized the global value chain by importing large amounts of semiconductors and liquid crystal display panels.

Meanwhile, the proportion of value-added rose from 2000 to 2011 and then to 2014, when it reached approximately 50%. From this, it can be seen that there has been progress in the local procurement of parts and components and in value-added in the final products (Chart 21).

Next, we look at trends in each country regarding trade with China.

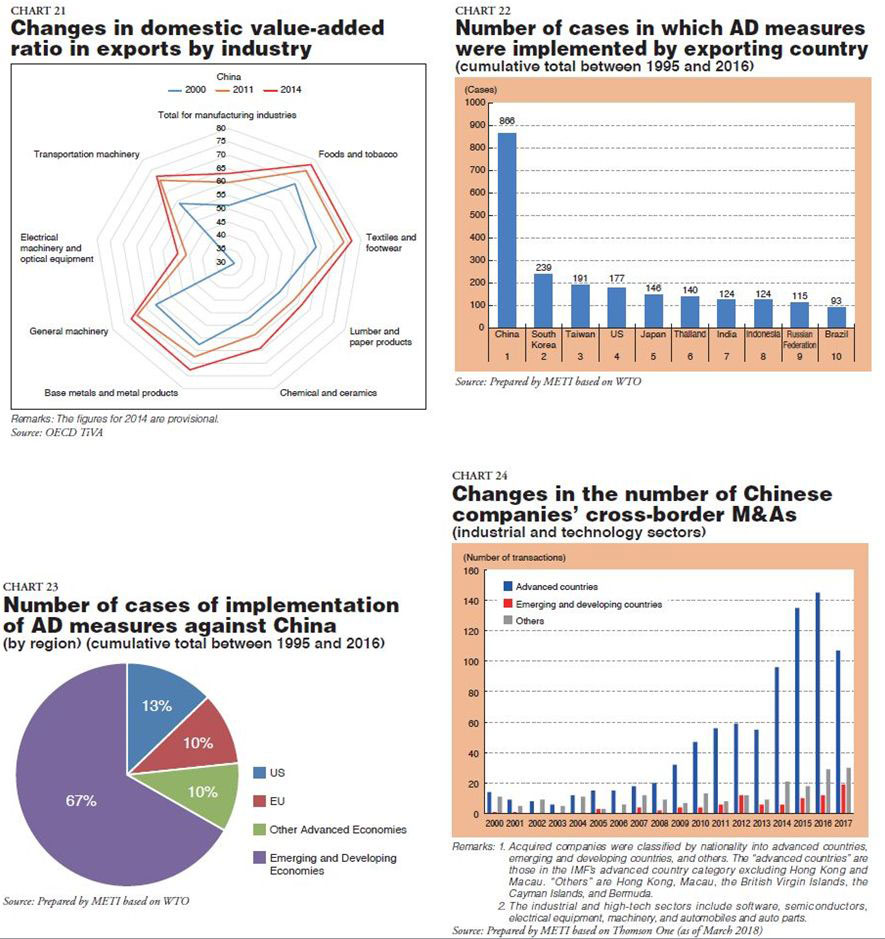

Following the establishment of the WTO, China was the most frequent target of anti-dumping (AD) measures (866 cases) from 1995 to 2016, followed far behind by South Korea (239 cases), Taiwan (191 cases), the US (177 cases), and Japan (146 cases) in that order. In recent years, the number of cases of implementation of AD measures against China has increased across the world: the number was 61 cases in 2015 and 44 cases in 2016, increasing steeply from 27 in 1995 (Chart 22).

A look at the number of anti-dumping measures against China shows that emerging and developing economies implemented anti-dumping measures against China in more cases than advanced economies. Among developed economies, the US and EU come in first and second (Chart 23).

In addition to implementing anti-dumping measures against China, the US has been studying and implementing other trade measures against China under Section 301 of the Trade Act of 1974 and other laws.

The US has increasingly taken anti-dumping measures against China based on the understanding that imports from China are harming domestic industries. In addition to anti-dumping measures, on March 23, 2018, the US began imposing additional tariffs on steel and aluminum exports worldwide, except for some countries but including China, under Section 232 of the Trade Act, citing national security as the reason. On March 22, 2018, President Donald Trump signed a memorandum ordering sanctions on China including a 25% additional tariff on specific goods under Section 301 of the Trade Act on the grounds that China was inappropriately intervening to transfer intellectual property and technology from US companies.

Europe has also taken many anti-dumping measures against China. It revised its anti-dumping regulations in 2017.

EU regulations determining the EU framework for anti-dumping measures were revised so that an alternative price in a third country can be used to calculate the "normal price" to be used in determining whether or not dumping exists when the market price or costs in the exporting country are distorted due to intervention by the government of the exporting country. In March 2018, anti-dumping measures were imposed on China under the new system.

Next, we look at China's expanding outbound direct foreign investment. Since the beginning of the 2010s, Chinese companies have become active in acquiring industrial and technology companies in advanced economies. The number of cross-border M&A by Chinese companies increased 14-fold from 44 in 2000 to 598 in 2016 although it declined to 463 in 2017 due to efforts by the Chinese government to reduce capital outflow. The Chinese government is actively promoting M&A as a national policy as a means to enhance innovation capabilities in technologies and industries whose development it wants to prioritize. A comparison between developed economies and emerging economies as the main sources for M&A target companies shows that M&A in manufacturing and high-tech fields is directed towards companies in developed economies, mainly in the US and Europe (Chart 24).

In response, the US is denying approval of purchases of US companies by Chinese companies and otherwise strengthening its regulations regarding inbound foreign direct investment. In the EU, the European Commission is proposing to establish a new framework for examining inbound foreign direct investment while there is also movement in Germany and other EU member countries to strengthen regulations.

(3) Opportunities for Japanese Businesses

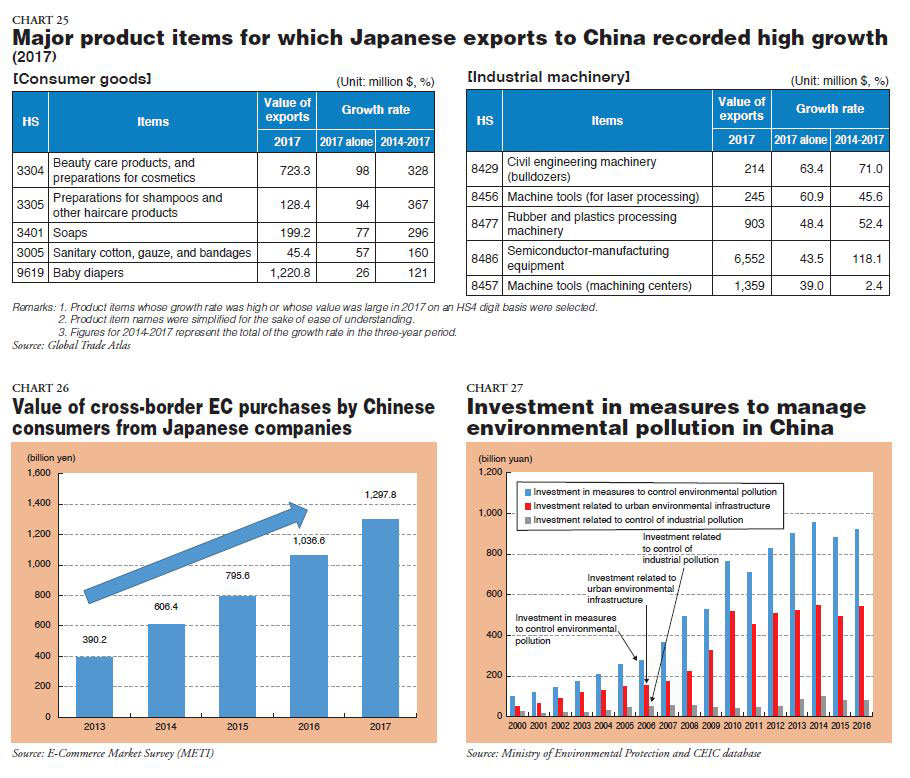

Japanese exports to China reached approximately 14.9 trillion yen in 2017, a historical high. Accounting for approximately 20% of Japanese exports, China is now Japan's second-largest export destination after the US, at approximately 15.1 trillion yen. Among consumer goods, exports of cosmetics, pharmaceuticals, travel goods and other entertainment-related items, and baby goods are growing rapidly. Among industrial machinery, exports of machine tools are growing rapidly, apparently reflecting labor-saving and rationalization investment in China. The rapid rising demand for semiconductors reflecting the growing Internet user population among other things has been noted. The value of semiconductor-manufacturing equipment exports is large and also growing (Chart 25).

It has been noted that cross-border EC from Japan to China has also been expanding rapidly. It is estimated that it crossed the 1 trillion-yen threshold in 2016 at 1,036.6 billion yen and 1,297.8 billion yen in 2017 (Chart 26).

China's consumption per capita grew by around 40% from 13,000 yuan to 18,000 yuan in the four years from 2013 to 2017. While the share of obligatory expenditures, which correspond to clothing, food, and housing, are more or less stable or declining, the share of education/culture/leisure and health/medical care is rising.

As environmental challenges are met in earnest, related markets are expected grow. In China, addressing environmental problems has become a major challenge. The value of investments made in measures to manage environmental pollution as announced by the Chinese government has been trending upward despite some year-to-year fluctuations (Chart 27). While Japanese companies also need to comply with environmental regulations, this may create business opportunities for companies in possession of superior environmental technologies.

Next, we take a look at the growing presence of Japanese corporate affiliates in China and the challenges that they face.

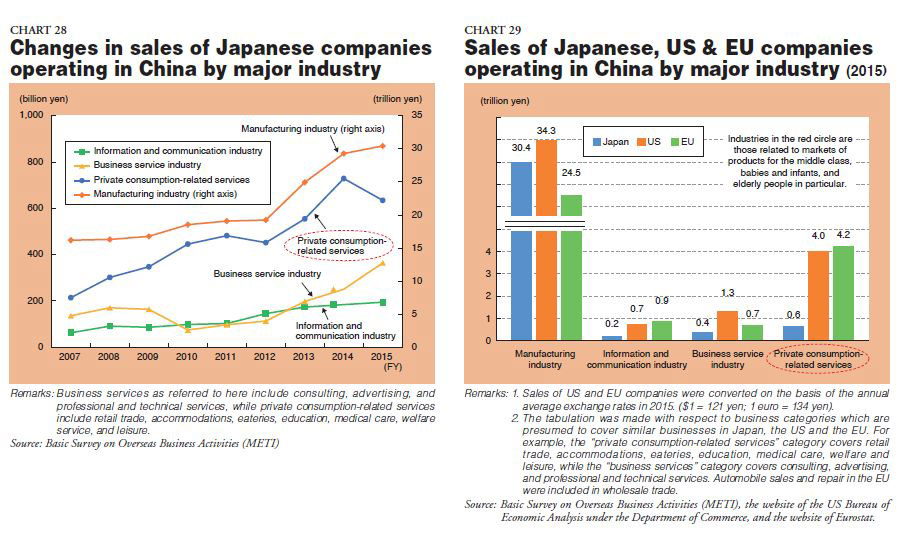

What is notable about sales by the local companies of Japanese companies operating in China is the large share of manufacturing companies, which are increasing both sales and profits by capturing robust domestic and external demand related to China. Although sales of private consumption-related services are also growing, they remain relatively low at approximately 600 billion yen in comparison to the approximately 30 trillion yen for manufacturing (Chart 28).

The Japanese service industry is lagging behind its EU and US competitors in China. The sales of private consumption-related services by local companies of the Japanese service industry are lagging behind those of its US and European competitors. In China, markets of products for the middle class, babies and infants, and elderly people are expanding. In this situation, Japanese companies may be lagging behind European and US companies, which have expanded into China and are already generating sales in those markets (Chart 29).

It is crucial to take advantage of the vitality of China, which continues to grow, to vitalize Japan through further business expansion of Japanese companies in China and cooperation between Japanese and Chinese companies in other countries.

Japan SPOTLIGHT September/October 2018 Issue (Published on September 10, 2018)

(2018/10/18)

Policy Planning & Research Office, Trade Policy Bureau, Ministry of Economy, Trade & Industry (METI)

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27