HOME > Japan SPOTLIGHT > Article

Interview with Dr. Linda Yueh, an economist at Oxford University and the London Business School, and author of The Great Economists: How Their Ideas Can Help Us Today

Learning from the Author of The Great Economists – Linda Yueh

By Japan SPOTLIGHT

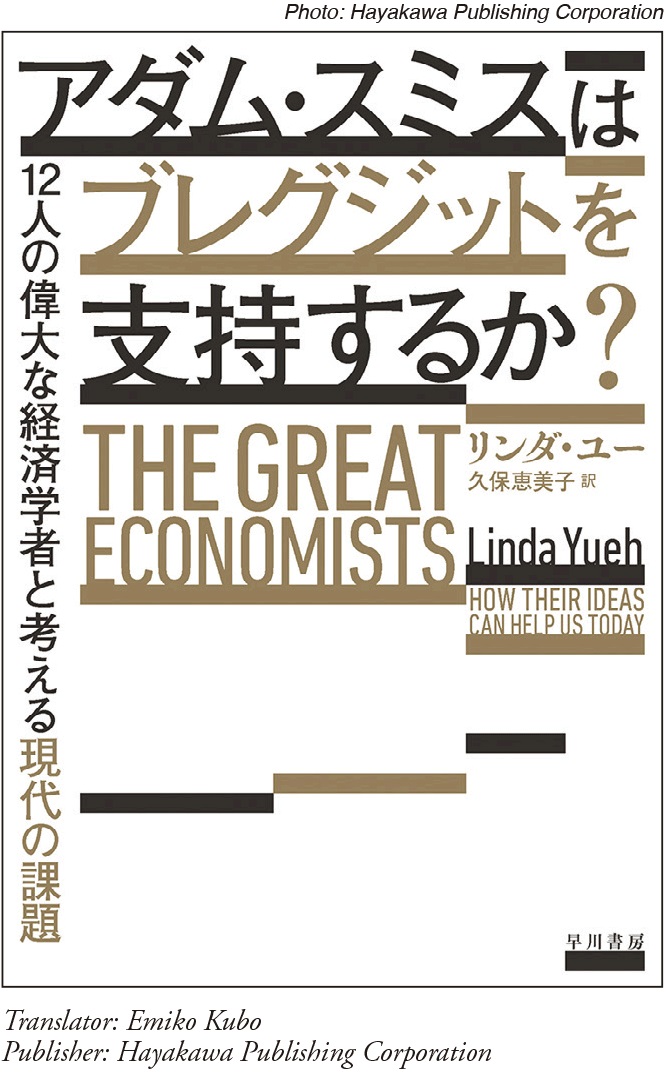

Her latest book, The Great Economists: How Their Ideas Can Help Us Today, was one of The Times's Best Business Books of 2018. It discusses what the ideas of history's greatest economists would tell us about the most important economic issues of our time. Prof. Yueh kindly responded to our questions by e-mail as below. (Responses received on Sept. 4, 2019)

JS: There is a general consensus today that we are in a geopolitical recession, meaning that the economy itself is emerging from the continued negative impact of the financial crisis in 2008 but that geopolitical risks such as the US-China technology war are beginning to negatively affect the world economy. Do you share this view?

Yueh: We are in a global cyclical slowdown as economic growth likely peaked in advanced economies last year. This past decade was unusual for major economies because there was a slow recovery from the worst systemic banking crisis since the 1930s. At this part of the cycle, downside risks such as US-China trade tensions are particularly worrisome. I examine the 1930s in my book, The Great Economists: How Their Ideas Can Help Us Today, and there are certainly lessons to be learned from that period to avoid making similar mistakes today.

JS: Some may regard the decline in the importance of economics as a result of the increasing impact of politics on the economy, since political movements are now key to any economic consequences. But do you think this must be wrong?

Yueh: Economics, throughout history, has provided the analytical tools and the empirical evidence that can help inform public policy. The objectives of those policies are set by politicians and the implementation of those policies by civil servants and other policymakers. These are all affected by the political environment; notably, the political will of the people as well as political feasibility are important in taking any policy decision. The Great Economist Alfred Marshall that I write about re-named the subject over a century ago to make this distinction between economics and politics clear – he changed the former from "Political Economy" to be called "Economics" to try and remove politics from economic analysis. He considered calling it "Social Economics" at one point because the subject is ultimately about how people interact. Given the vast technological changes in the 21st century economy today, we need economic analysis just as those who came before us did when they tried to understand the vast changes wrought by the Industrial Revolution.

JS: Rising populism is considered a principal culprit for the geopolitical crisis, such as the US-China high-tech war or anti-globalization sentiment. Increasing income gaps likely caused by globalization must certainly be one reason for such populism. Political scientists, however, may argue somewhat differently. There may be people in the lower middle-class without a high educational background who feel less secure or frustrated by increasing immigration. They may feel left behind and ignored by politicians. Elderly people may also feel lonely and insecure in an aging society. How do you think these people's social concerns can be allayed by economics?

Yueh: There have been periods in history when consensus around economic policies broke down and there was also a backlash against globalization. The challenge for economic policy is to address those concerns by ensuring that globalization, technological change, and the whole economic system are working to the betterment of everyone in society. For instance, it has been understood since at least the times of the father of international trade, the Great Economist David Ricardo, that trade produces "losers" when the economy specializes in some sectors and less so in others. The distributional impact of trade can be partly addressed through fairer trade rules but also through domestic policy to reduce disparities in incomes and circumstances. Economic analysis has a role to play in both sets of policies.

JS: Which do you think would have more impact upon income inequality, globalization or the Fourth Industrial Revolution?

Yueh: It's very difficult to disentangle these effects, which economists refer to as skill-biased technical change. In other words, technology and globalization interact and have throughout history. For some aspects of wages and employment particularly in blue collar jobs, the evidence is that automation is more important than globalization. Income inequality is in any case a complex topic that goes beyond these factors, which I write about in my book in the chapter titled "Is Inequality Inevitable?"

JS: Globalization itself can have great benefits for the world economy and enhance people's living standards. But many people think the distribution of benefits has not been done fairly or equally. What do you think would be most effective in convincing people of the benefits of globalization?

Yueh: Only by showing that the economic system will make trade fairer through creating a level playing field – and for trade policies to take into account the distributional impact on the society as a whole; plus also using domestic policy to help out those who lose. These are the ways in which support for globalization could begin to be re-gained.

JS: How do you think the Great Economists would suggest achieving more equal distribution of the benefits of globalization?

Yueh: Many of the Great Economists in my book would likely focus on achieving genuine equality of opportunity through policies that improved people's prospects. The redistributive policies which help people afterwards are necessary but insufficient, so it is time to debate new approaches. One would be to consider pre-distributive policies. That would try to ensure that people had the skills to adapt to a changing economy through education and training. It would be a way of trying to ensure there was equality of opportunity. A specific measure that would support pre-distribution could be government-led investment, along with private funding, in infrastructure that takes advantage of today's low interest rates. Those projects could employ those who have lost their mid-skilled jobs due to automation and globalization and improve their skills through working on more technologically advanced infrastructure projects which often involve digital aspects. That's one example that I discuss in my book as to how pre-distribution policies could work.

JS: In order to achieve more income equality, do you think more government interventions must be allowed, as they would be necessary to correct the bad outcomes of market mechanisms?

Yueh: The answer is yes in a market economy, but the level of income inequality is a function of political choice. So, it's up to governments to fashion policies that reduce inequality which is how policymakers addressed the Gilded Age of the late 19th century. The Great Economists like Alfred Marshall at the time offered economics as a tool for policymakers to determine the distributional impact of their policies and showed that lower inequality did not hamper economic growth. As the United States is now in the Second Gilded Age, it's time to have those discussions once again.

JS: Education and social welfare policies are more important than ever, as both could help achieve more equality in a technology-driven economy and aging society. Do you think economic policies in the future will be more socioeconomic?

Yueh: Education is important in pre-distributive policies while welfare policies are central to redistributive policies, so both have been important historically and certainly will be for the future, where aging will likely worsen income inequality whilst at the same putting more pressure on social welfare systems.

JS: With all the developed nations suffering from tremendous government debt and low interest rates, Keynesian policies may not work well. What policy do you think would contribute most to stimulating economic growth?

Yueh: In my chapter on John Maynard Keynes, I ask the question whether governments should invest. And if so, in what? And what would be the effect on government debt and economic growth? The answers center on the second question: what is the government investing in? If it is in human capital and essential infrastructure, including digital, that would be capital spending and not current spending. Such investment could be assessed separately in terms of the budget deficit. Throughout history, it's evident that only by investing in people and capacity can societies raise their standards of living and boost their growth rates. Yet investment is low at present and many countries are concerned about a slow-growth future. This complicated issue is addressed as well in the final chapter of my book.

JS: Overall, what do you think about the capitalist economy's future in the light of what the Great Economists have achieved so far? For example, after seeing the possible negative consequences of some anti-globalization policies, would people recognize again the merits of globalization, and thus the crisis of capitalism would be over?

Yueh: In my book, I examine over two and a half centuries of economic history. There have been historic periods when capitalism was in crisis and people supported communist and socialist regimes en masse. The battle of ideas that ensued helped transform the capitalist system of Adam Smith's day in the 18th century, which I write about in the first chapter of my book, to the welfare state capitalism of the 20th century that is prevalent in advanced economies today. By changing the economic system to suit the conditions of the present day and arguing for how to do so, that's how societies have come through times previously. The current breakdown in consensus around the economic system poses an opportunity for another battle of ideas to ensure that the system is reformed and made suitable for the needs of a 21st century society. And this is a debate that we will all need to engage in. Otherwise a new consensus won't be achieved. The Great Economists that I write about were all actively involved in the policy debates of their day. Many did so by writing accessible books, so I hope that my book will do its small part in contributing to a discussion of these critical issues for all of our futures.

(Japanese translation of The Great Economists: How Their Ideas Can Help Us Today available at:

https://www.hayakawa-online.co.jp/shop/shopdetail.html?brandcode=000000014178&search=%A5%EA%A5%F3%A5%C0%A1%A1%A5%E6%A1%BC&sort=)

Japan SPOTLIGHT November/December 2019 Issue (Published on November 10, 2019)

(2019/12/18)

Japan SPOTLIGHT

Formatted by Naoyuki Haraoka, editor-in-chief of Japan SPOTLIGHT & executive managing director of the Japan Economic Foundation (JEF)

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27