HOME > Japan SPOTLIGHT > Article

A Perspective on the Chinese Economy in 2020

By Long Ke

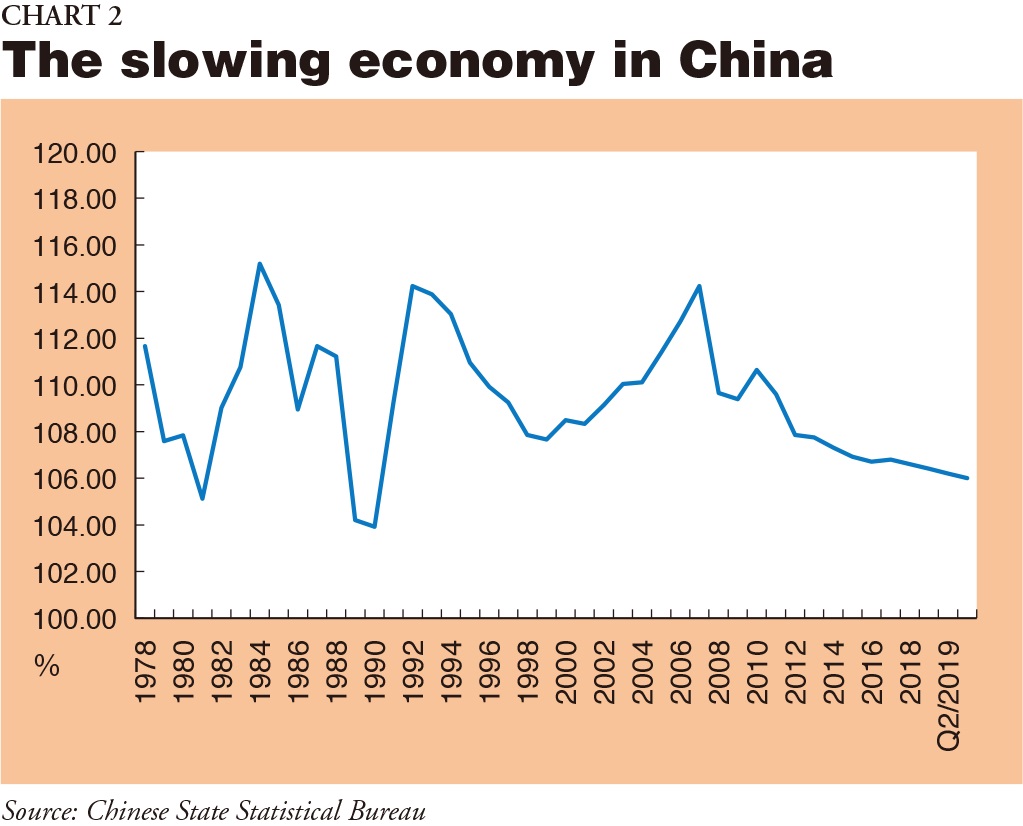

Six years ago Premier Li Keqiang described the Chinese economy as the "new normal" – meaning that it does not need to realize 8% to 9% growth – in the Government Activity Report at the National Congress. Growth of 6% to 7% would be enough. But since then the Chinese economic growth rate has slowed down to 6% in the third quarter of 2019, the lowest rate during the past 27 years. It is difficult for the government to maintain economic growth at the new normal level. Many economists and professors both in and outside China recognize that the real growth rate is much lower than the official data announced by the government.

Of course, it is easy for Chinese policy makers to explain why the economy slowed down. One reason could be that the economy has been damaged by the trade war with the United States. But the Xi Jinping administration emphasized at the start that China would win the trade war – meaning that although the trade war could damage the Chinese economy, it will damage the American economy much more. But a year later Chinese political leaders and policy makers have changed their attitude. It is clear that the trade war has damaged the Chinese economy seriously, and certainly is damaging the American economy too. The Chinese government made a mistake in continuing the trade war with the US. For China, the correct decision would be to end the trade war as soon as possible; otherwise the trade war will damage Chinese social stability.

The second reason to explain the economic decline is the economic and industrial structure problem. Over the past four decades China's economic development model has basically depended on cheap labor to produce huge amounts of cheap products, and most of the products are exported to American and European markets. Its trade surplus helped China to overcome its shortage of foreign currency, and China used the foreign currency to import high-tech equipment from developed countries to strengthen the competitiveness of its domestic manufacturing industries.

China has been reforming its economic system and gradually opening up the domestic market to foreign companies since 1978. It took 20 years for the Chinese economy to catch up. Since then China has come to play an important role as a global manufacturing center, which not only sustained Chinese economic development itself but also drove global economic development. Chinese nominal GDP accounted for 15% of the global economy in 2017. But under this economic development, labor costs increased rapidly. Since 2001 in big cities like Beijing, Shanghai and Guangzhou minimum labor costs have increased 10% annually till 2018. The Chinese government has no option now but to refuse to raise labor costs. The rise in labor costs is an indicator from the market that China needs to shift from low-end industry to high-end industry. To realize this goal, China needs to deepen reforms of the economic system, especially to privatize state-owned companies, no matter whether the government wants to or not. The real reason for the economic decline is the government's refusal to reform the SOEs. This is the major structural problem of the Chinese economy.

Role of the Market vs Role of the Government

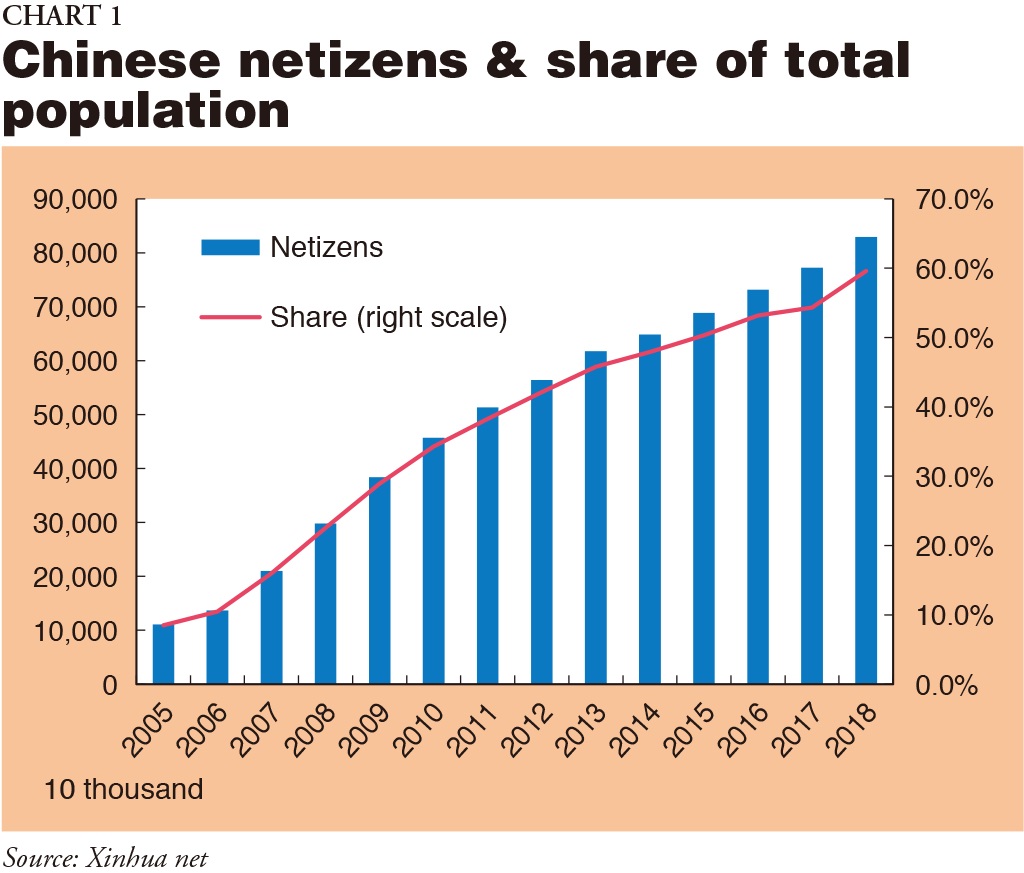

Although China's economic growth rate has declined from 8% to 6%, it doesn't mean this is due to economic fundamentals. Compared with other emerging economies, the Chinese education system from primary school to university is very good. The system has educated thousands upon thousands of elite students during the past four decades. The Chinese young generation is much more aggressive and challenging than those in other emerging countries. The background to the miracle of economic growth is that the government has implemented economic liberalization gradually, although it has refused to reform the political system to create a democracy in China. Chinese people have enjoyed much more freedom since 1978 than in Mao Zedong's era. Nowadays over 150 million people travel abroad every year. There are over 80 million people who use the Internet in China (Chart 1). The Internet gives Chinese people many more opportunities to experience and enjoy freedom. Forty years ago they could only get information from state media like the People's Daily and Xinhua news agency. But now fewer people read the People's Daily in China. Many young people in universities and colleges access the Internet and even use Facebook by virtual private networks (VPNs). The Internet is changing Chinese people and Chinese society, even though the government is trying to deny the people access to Facebook and YouTube with firewalls.

It is generally believed that the Chinese government can regulate the Internet selectively, but cannot stop people using it. People are expecting to enjoy much more freedom from now on, and this movement is going to change Chinese society and the economy. Xi made a speech at the Fourth Conference of the Central Committee of Communist Party in October 2019 in which he emphasized modernizing regulations and rules by law. He didn't define these modernizations, but it is easy to imagine what he meant – to use information technology and AI to monitor people's activities. Ever since Adam Smith, we have all known that a market economy needs freedom. Only price mechanisms can allocate resources efficiently. Here the question is how Xi can sustain economic development by using controls and regulations. Xi believes that allocation by the government can sustain economic development.

So Xi will aim to strengthen the competitiveness of SOEs and make them larger and stronger. Under socialist ideology the workers in the state sectors are the infrastructure of the socialist party. Logically, to strengthen SOEs could help Xi to strengthen the party. But in some sense this would mean a tradeoff between strengthening SOEs and sustaining economic development. According to the All-China Federation of Industry and Commerce, private companies only last on average four and a half years from establishment to bankruptcy. Most private companies are not allowed to apply for public infrastructure projects. SOEs always take advantage by applying for government projects, not only the central government but also local governments. Only if the project needs technology that only a private company has can SOEs not compete.

Yet private companies contribute much more to economic growth than SOEs and create more opportunities for employment. A strong state sector is not enough to drive economic growth. Meanwhile SOEs get huge amounts of subsidies from the government and borrow huge loans from the state-run commercial banks. The result of this is that SOEs have a huge over-capacity in equipment and huge non-performing loans. The Chinese government cannot sustain economic development without privatizing the SOEs.

Xi & His Economic Policy

China has been playing a role as a global manufacturing center since the 1990s. In the past decades thousands of multinational companies have invested in China, attracted by its cheap and high-quality workers. Most of the young workers come from the rural interior – Sichuan, Hunan, Henan, etc. Their household registration in their home regions cannot be transferred to the city where they work, for example Shenzhen, according to the regulations on registration. China is not a fair market for workers from the countryside. The supply of cheap and high-quality young workers has attracted many multinational companies to invest especially in coastal areas. The government has opened the market and shared part of it with foreign companies, earning foreign currency and gaining high-technology transfers. The weakness of the Chinese economy had always been the shortage of foreign currency and the lack of advanced technology, so the solution to catching up with developed countries was to open its market and liberalize and deregulate the economy.

Historically, Deng Xiaoping decided to open the market to foreign companies gradually. Deng not only wanted to attract more foreign companies to invest in China, but also to maintain the monopoly leadership of the Communist Party. The key point in his thinking was insistence on the leadership of the Party on the road of socialism and communism. But everybody knew Deng gave up this road instead of maintaining the leadership of the Party. The current Chinese economic system is not socialism; it is state capitalism, according to many Chinese watchers. As a result liberalization and deregulation of the economy enable China to catch up with developed countries.

Since the 1980s there has been an argument in the central government about how to reform the SOEs. The liberals, for example professors and economists in universities and official government think tanks like the China Social Science Academy, recommend reforming the ownership of SOEs, privatizing them gradually; otherwise China cannot sustain its economic growth. At the end of the 1990s Premier Zhu Rongji decided to deepen reform of SOEs. He aimed to liberalize and sell the small and medium-sized SOEs to the private sector. But he maintained state ownership of the big SOEs. Zhu's reforms created the infrastructure of the Chinese market-oriented economy, although they remain unfinished.

China experienced a lost decade under the Hu Jingtao administration (2003-2012). Hu was not a challenging leader, but a lucky one. Although he didn't try to deepen market-oriented reforms, China succeeded in hosting the Olympic Game in Beijing (2008) and the Shanghai Expo (2010). The infrastructure investment for these events definitely contributed to GDP growth much more than expected.

The current Xi administration has been pushing the Chinese dream to rebuild a strong China since 2013. Basically Xi himself and his team are a new generation, different from those in the former Deng, Jiang Zemin and Hu administrations. Xi's generation was educated during the Mao era. Xi himself was a little red guard when he was in middle school during the Cultural Revolution (1966-1976). This experience has made his administration's policy making more conservative. At first most China watchers expected that Xi could improve market reforms dramatically and accept the values of the global community, and even lead his people to create a democratic system in China in order to be integrated into global society. But the global community misunderstood Xi. He rejected the values of freedom, human rights and the rule of law. He told his people he would realize the Chinese dream of a national renaissance. China is coming to be the new leader in the global community. Xi is not a liberal, he is a nationalist. His economic policy is to reregulate and strengthen control of the economy. In a word, Xi is taking China back to Mao's era.

The Weakness of Risk Management

It is clear that Xi respects political power more than Jiang and Hu. For Xi, politics is power, or power is politics. To strengthen political power Xi is reviving personal dictatorship. The constitutional provision limiting presidential rule to two terms (10 years) has been deleted. It seems that Xi has now become to the most powerful leader in China. Over 2 million politicians and officials have been arrested under Xi's administration because of corruption. National renaissance is the dream that Xi has shown to his people, and to realize it Xi has pushed the "One Belt, One Road" initiative, originally designed as a measure against the framework of the Trans-Pacific Partnership (TPP).

Chinese diplomatic policy can basically be described as a "three worlds policy" created by Mao that divided the world into three parts: developed countries (the US, the United Kingdom, etc.), middle developed countries (Japan, Australia, etc.), and developing countries (China and African nations, etc.). The One Belt, One Road initiative cannot be regarded as an infrastructure project for developing countries only, for it is Chinese diplomatic strategy to aim at leadership regionally and globally.

Chinese GDP became the second largest in the world in 2010, and is expected to be the largest in the near future. That means China could replace the US as the leader of global society. To take global leadership economic power is important, but it is not enough. Here I'd like to point out the weakness of Xi's administration. It is the weakness of risk management about domestic and global problems. For example, at the beginning the trade war with the US was not so difficult to solve. President Donald Trump asked the Chinese government to protect intellectual property rights (IPR) by the rule of law, to stop forcing foreign companies to transfer their technology to Chinese companies, and to stop paying subsidies to Chinese SOEs, in order to create a free, fair and global market. This would not only be profitable to the US but also helpful to China, which cannot strengthen innovation without protection of IPR.

For Chinese manufacturing industries, the US is the most important market. It is hard to understand why Xi decided to continue the trade war with the US. Trump started the war because of the imbalance in international trade with China. For China, the best option is to try to rebalance trade. Of course, the war is damaging the US and importers of Chinese goods, especially American households. But it is believed the trade war will damage the Chinese economy and society much more than the US. Global supply chains and values have been rebuilt since the war began a year and a half ago. More and more foreign companies are moving their factories from China to other emerging countries, for example Vietnam. As a result, the unemployment rate in China is rising very rapidly, although the official statistics will never show the real situation. Nowadays thousands of workers from the countryside are losing their jobs in the cities. It will definitely damage Chinese social stability. Of course, the trade war is not an endless game, but China cannot expect the multinational companies to move their factories back to China because labor costs have risen so high. Chinese manufacturing industries have lost their cost competitiveness compared to other emerging economies, for example, Vietnam, Mexico, etc. The way out of this for China is to strengthen innovation. To realize this goal China must protect IPR by the rule of law.

Perspective on the Chinese Economy

It is important for China to rationalize the economic structure and to strengthen the efficiency and the price mechanism and deepen the market economic reform as Xi mentioned seven years ago in Beijing. But the Xi administration could not stop the economy's slowdown (Chart 2).

In the past decades it has been believed that China needs to realize an 8% growth rate in order to create more employment opportunities to stabilize society. But in regional areas, the governors of provinces and cities usually force the state commercial banks to generate much more liquidity for the SOEs to make investments. It doesn't matter whether it is necessary or not. The most serious problem is that in some provinces and cities the macroeconomic data are manipulated in order to be evaluated by the central government. This has damaged the reliability of macroeconomic data, and it is difficult for policy makers to pursue a rational and efficient policy mix because they cannot get the real economic data. And wrong policies will lead the economy onto the wrong road.

Since 2013 the Xi administration has stopped all market-oriented economic reforms. Vice Chairman Wang Qishan, whom Xi trusts the most in his administration, made a speech in a closed meeting of the Party and told the audience: "We will not reform anymore. How can they (people criticizing the administration over economic operations) do anything to us?" Meanwhile, Xi has emphasized again and again strengthening control of the economy, especially SOEs.

Theoretically a market-oriented economy and price mechanism will only work efficiently in a liberal market environment. It is understandable that China's economic growth rate has dropped so rapidly. The People's Bank of China cut the deposit reserve ratio to stimulate investment by companies, especially SOEs, but the policy has not worked. SOEs have invested too much since 2009, so that most of them hold huge amounts of excess equipment. Their debts are damaging their balance sheets and assets, as well as the state commercial banks. This is a potential risk to the Chinese economy and society. The IMF has warned the Chinese government many times to address the bad debt issue; otherwise it will lead the Chinese economy into a system crisis.

Nowadays few economists in or outside China can present an optimistic view of the economy. We don't need to be too pessimistic, but we need to recognize again the Chinese policy making process to avoid misunderstanding what will happen in China.

Investments by the private sector, consumption by households and external trade are the orthodox driving forces of the economy. But under Xi's administration the trade war with the US has not only damaged trade but also encouraged multinational companies to rebuild their supply chains and value chains. That means China has to improve its R&D and innovation in order to upgrade its industrial structure. In some sense, Trump's request that China protect IPR is not only for the benefit of American companies but also for Chinese. For most Chinese companies, especially private ones, there are no incentives to research and develop fundamental technologies. Chinese companies are usually very aggressive in developing profitable products. External trade, especially exports to the US, has peaked out obviously, and companies are very careful about investing in new projects. It is time for China to change its economic model.

In China the population is declining, and the problem of an aging society makes households save more money instead of consuming. The social security system in China has not been established perfectly, especially the public insurance system for health care. Since the Jiang administration, the government has emphasized the necessity of building a development model dependent on domestic consumption. This significant policy will help China to change its economic model, but the problem is how to improve reforms. During Hu's era China lost 10 years and few reforms were enforced.

In conclusion, I believe that to sustain economic development China must reform the current economic system and build a market-oriented one. It needs to privatize SOEs gradually. There is no way to sustain economic development without building a market-oriented system. China is a country of great diversity and Chinese people are very aggressive in taking risks to do new business. It will be impossible to sustain economic development under the framework of a centrally planned economic system. The Xi administration is strengthening control of the economy and society. But Xi has to change that policy and return to the framework of a free and open market designed by Deng. Otherwise the Chinese economy will fall into a serious crisis.

Japan SPOTLIGHT January/February 2020 Issue (Published on January 10, 2020)

(2020/01/14)

Long Ke

Long Ke is a senior fellow of the Tokyo Foundation for Policy Research, a project professor at the Global Center for Asian and Regional Research of the University of Shizuoka and a senior fellow of the Fujitsu Research Institute.

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27