HOME > Japan SPOTLIGHT > Article

The Debate on Taxing Digital Services, Where Interests Clash

By Shigeki Morinobu

Background

The development of the digital economy has impacted the tax system on two major fronts: the deficits in national tax revenues as a consequence of tax avoidance by multinational enterprises, and fairness of the competition against businesses that pay taxes properly. In 2012, the OECD and G20 countries launched the Base Erosion and Profit Shifting (BEPS) Project to consider new international taxation rules that match up to the digital economy. The final report was issued in 2015. However, further study was deemed necessary on a tax system for the digital economy, so the discussions entered the post-BEPS stage in 2016.

The post-BEPS discussions have been conducted under the Inclusive Framework on BEPS. The Inclusive Framework is not limited to OECD member countries. It covers 137 countries and jurisdictions, including the tax havens and lightly taxed countries whose agreement is required in creating a new regime. In January, it reached an agreement in principle on a proposal from the Secretariat that would grant taxing rights to user/market jurisdictions over part of the profit of gigantic IT companies, a decision endorsed by the G20 Finance Ministers Meeting the following month. Many issues remain, though, and the complicated task of reconciling national interests will continue in order to achieve the goal of final agreement on a specific solution by the end of the year (http://www.oecd.org/tax/beps/statement-by-the-oecd-g20-inclusive-framework-on-beps-january-2020.pdf). The following is an overview of the discussions and the impact on Japan.

Taxes Unable to Keep Up With the Digital Economy

In the digital economy, where information technology reigns, transactions in goods are increasingly replaced by transactions in services. Books and music are migrating from paper and plastic to Internet download services. Targeted online advertising using personal big data, selling goods in online marketplaces, sharing services using idle resources, and other new, previously nonexistent business are sprouting up. These services have become a huge presence as they spill over national borders and spread globally, with gargantuan platforms generating enormous profits.

This business model transition poses a challenge for the tax authorities. Google, Apple, Facebook, and Amazon – the platforms called collectively GAFA – are at the forefront of IT companies that are now able to do business in a market jurisdiction to which they provide services without having a branch office, factory, or other permanent establishment (PE) there. The market jurisdiction would no longer have taxing rights, losing tax revenue that it would otherwise be receiving (tax revenue shortfall).

Moreover, more and more IT companies are avoiding taxation by transferring patents, copyrights, and other intangible assets that are the nucleus of corporate value to lightly taxed countries such as Ireland, as well as tax havens, in order to concentrate income there. Indeed, many American IT companies led by GAFA are avoiding taxation by such tax planning. According to a European Commission survey, the average tax rate for digital businesses is 9.5%, which is less than half that of the 23.2% for traditional business models. This is at the root of the level playing field issue – fairness of the competition against the local businesses that pay the full taxes.

This issue has been considered as the divergence between the location of value creation and location of tax payment. According to an estimate by the Secretariat, $100 billion to $240 billion in corporate income taxes are lost annually as a result of tax base erosion and profit shifting by multinational enterprises. Under the latest agreement, tax revenues would increase by up to $100 billion (Secretariat estimate, February 2020).

As we have seen, the aim of the discussions on international taxation in the digital economy is twofold: to make the terms and conditions of competition fair by preventing tax avoidance by multinational IT firms and having them bear an appropriate share of the tax burden, and to reallocate tax revenue sources between their place of residence (largely the United States) and lightly taxed countries and the market jurisdictions (Europe, Japan, emerging markets, and developing countries) where they actually do business and gain profits.

The January Agreement in Principle by the G20

What does this agreement in principle contain? It has two major pillars.

Pillar 1 allocates taxing rights to market jurisdictions that match the value created there (creates "new taxing rights" independent of existing rules). It allocates taxing rights (the tax base) to a market jurisdiction even when there is no physical base in the form of a PE there if the total value of sales crosses a certain threshold. Specifically, the taxing rights for part of the profit above a certain threshold in a market jurisdiction of a multinational enterprise that is an automated digital service or consumer-facing business with global revenue above a certain threshold in excess of the normal profit of the corporate group as a whole will be transferred to the market jurisdiction.

Pillar 2, called a "minimum tax", deals with tax evasion. This is a rule that would secure a minimum level of corporate taxation over all multinational enterprise groups. The rule consists of two elements. One is a tax imposed in the country where a parent company is located on the income attributable to subsidiaries, etc. located in lightly taxed countries at a rate that remains for future agreement. The other is a rule under which, when a parent company pays royalty on intangible assets and the like to a related company in a lightly taxed country, the country where the company making the payment – the parent company – is located imposes a tax by denying the payment. The objective of the two pillars is to prevent a race to reduce the corporate tax rate to attract businesses. A similar tax is already in place in the US.

The First Pillar

This essay will look into Pillar 1, which is drawing much attention from Japanese businesses, on three fronts: the "businesses in scope", the "new nexus", and "profit allocation rules".

Let's begin with the "businesses in scope" – the multinational enterprises that are automated digital service and consumer-facing businesses with operating profit margins exceeding 10% and gross revenue exceeding 750 million euros including overseas subsidiaries. The former includes online search engines, social media platforms, digital content streaming, online gaming, and cloud computing services. The latter was included in the scope because the US claimed that a proposal that targeted GAFA was unacceptable, so the scope was broadened to cover multinational enterprises like Nike, Louis Vuitton, and Sony, who make "residual profit" in marketing jurisdictions by using "intangible marketing assets". One way of looking at this is that agreement is impossible if the US decides to make a stand. Manufacturers of raw material and intermediate products are outside the scope, but could be included if they are branded and acquired by consumers for personal use. Bridgestone tires, for example, could become an issue. In any case, there is an urgent need to determine the specifics of the scope.

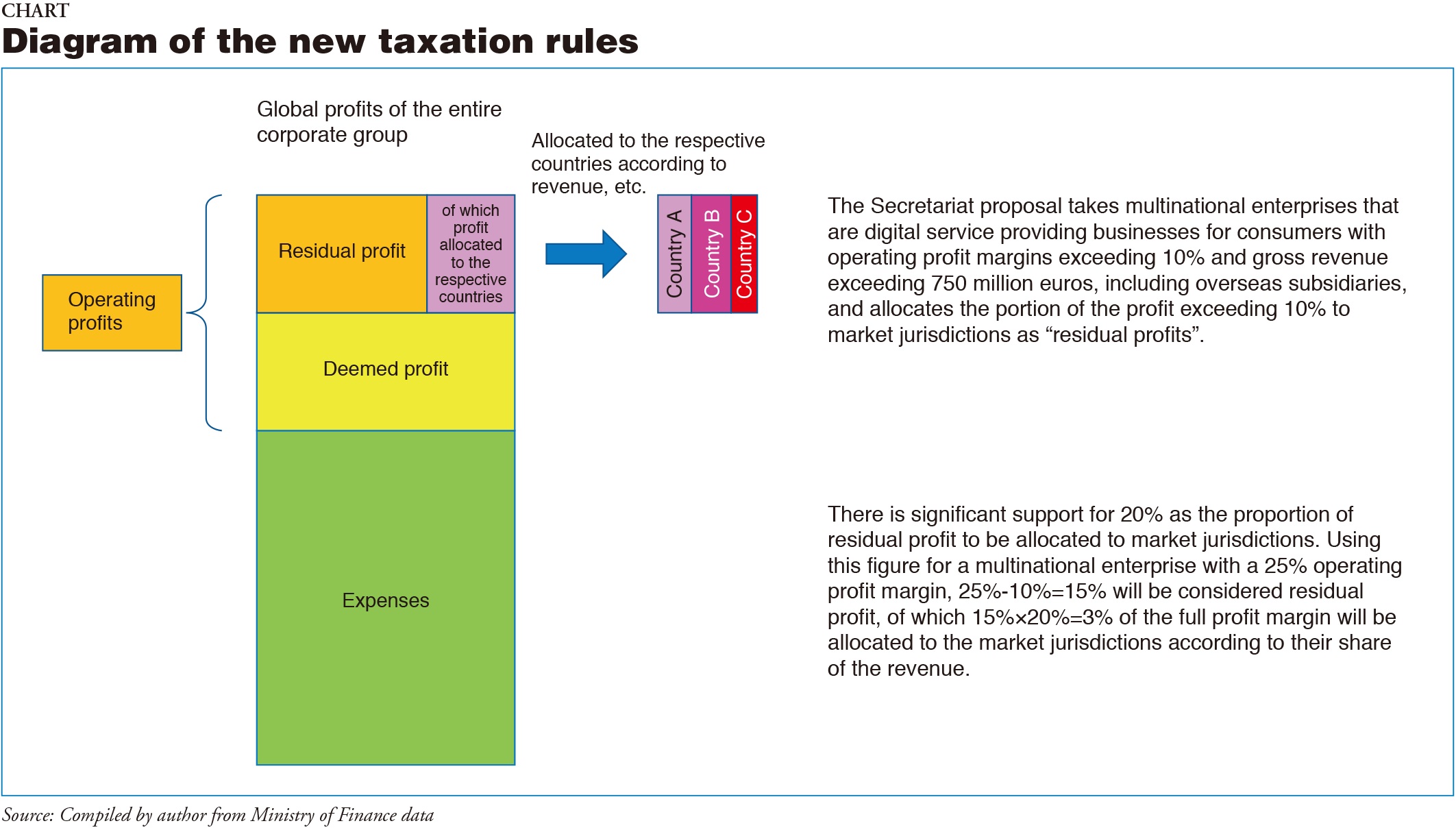

A share of the profit exceeding 10% will be allocated to market jurisdictions as "residual profit". This can be seen as the part of the profit that US IT companies and the like earn in market jurisdictions that cannot tax them (do not receive tax revenue) because the companies do not have a PE there.

Note that the 10% threshold is not yet final since some countries have not accepted it. Emerging economies among others are reportedly arguing that the scope should be expanded by lowering the threshold. Whether it should be calculated for the company as a whole or for individual business lines is also a matter left for future consideration.

Next, let's turn our attention to the "new nexus" – that is the source of the new taxing rights. Under the agreement, it will no longer be limited to a physical base in the form of a PE. Revenue from market jurisdictions (taking the economic scale of the respective market jurisdictions among other things into consideration) will also be considered as a significant indicator. It will be applicable to business conducted through related parties' or unrelated parties' distributor subsidiaries, as well as sales from distant locations (remote sales), and otherwise seeks neutrality in its application regardless of the business model.

Finally, the profit allocation rules are left to subsequent agreement. There is currently significant support for 20%.

Using this figure for a multinational enterprise with a 25% operating profit margin, 25%-10%=15% will be considered residual profit, of which 15%x20%=3% of the full profit margin will be allocated to the market jurisdictions according to their share of the revenue.

In this manner, a nexus will be recognized if there is a certain level of revenue from the market jurisdiction even if there is no PE there, giving the market jurisdiction taxing rights. The challenge is to come up with a working framework for collecting the tax. Here, it will be necessary to take the compliance costs of the businesses into consideration, making it as simple as possible. This will also help avoid unwanted disputes regarding tax collection (Chart).

As for the impact on national tax revenues, this results in a $100 billion increase in annual corporate tax revenues. Generally speaking, it is believed that Ireland, Hong Kong, and other investment hubs will see their tax revenues reduced while Japan and other developed countries and developing countries will see theirs increased.

Impact on Japanese Businesses

How will Japanese businesses be impacted? Further study will be necessary to answer this question since Pillar 2, the minimum tax, must also be taken into consideration. Generally speaking, though, the tax burden will increase for multinational enterprises that engage in tax planning such as the transfer of intangible assets to lightly taxed countries, but should not change much if at all for companies that pay taxes without engaging in aggressive tax avoidance. This is where the main significance of this project lies.

The impact of the agreement on manufacturing including parts and components manufacturers, where Japanese businesses have an edge, is limited since the businesses subject to reallocation are "businesses providing automated digital services" and "consumer-facing businesses". It is necessary to keep an eye on developments, though, since businesses providing autonomous driving and other data-oriented services, branded parts and components, and the like may also be included.

A back-of-the-envelope calculation indicates that there are just under 200 Japanese companies with operating profit margins of 10% or higher and consolidated gross revenue of 90 billion yen or higher, according to the latest financial statements. Of this, the profit from the profit margins exceeding 10% (in accounting terms) amounts to about nine trillion yen. Of this amount, part, say 20%, of the profit of consumer-facing businesses that derive a high proportion of their revenue from overseas and receive revenue from overseas, which will be subject to the tax, will be allocated to market jurisdictions in principle according to the share of the revenue from those jurisdictions.

This does not necessarily mean that profit will be allocated away from Japan to other market jurisdictions. The profit to be allocated here is the global residual profit. This will include the profit at overseas subsidiaries that possess intellectual property and regional headquarter companies to which high profit levels are attributed.

Unilateral Tax Measures by European Countries & Pushback from the US

Keep an eye on what the future holds for unilateral tax measures by European countries. In 2018, the European Commission proposed new rules for the taxation of digital business activities. Before this, the Commission had dealt with international tax avoidance by GAFA through such means as competition law (for state subsidies) and privacy law. In March 2018, just after the G20 Finance Ministers and Central Bank Governors Meeting in Argentina, it published its response on the taxation front. The proposal consists of two elements: a complete overhaul of the taxation system (the full proposal), and a digital services tax (DST) as an interim measure.

The full proposal would enable the income of a company that is generated in the European Union/market jurisdictions to be taxed even if the company does not have a physical presence there if certain conditions for a significant digital presence are satisfied, including annual revenues exceeding seven million euros. The ultimate aim is to adopt a method that allocates revenue according to a fixed formula that is linked to the Common Consolidated Corporate Tax Base (CCCTB).

In the meantime, the interim measure imposes a 3% indirect tax on the revenue from online advertisements, online platforms, and user data, and other digital services of businesses such as those that have an annual global revenue of 750 million euros or more.

However, this proposal was dropped because of opposition from Ireland and Luxembourg among others, a consensus being required for its adoption. US Secretary of Treasury Steven Mnuchin made support for American businesses clear by issuing a statement that said, "The US firmly opposes proposals by any country to single out digital companies."

In response, France, Spain, Italy, and others decided to unilaterally institute the DST, in which each country would tax digital advertisements, sales in online marketplaces, and the like until an agreement is reached.

France decided to impose a 3% indirect tax on revenue from digital services including online advertisements, digital platforms, and user data and an obligation on foreign businesses to file tax returns. The tax, with its scope limited to businesses with annual global revenue of 750 million euros or more, went into force on Jan. 1, 2019. The administration of President Donald Trump responded with a threat to impose retaliatory tariffs on French exports, with the result that France suspended taxation as of 2020 until an agreement is reached in the OECD.

Meanwhile, preparations are underway in the United Kingdom on legislation for a 2% tax to come into effect as of April, though the actual tax collection will begin in April 2021. Italy, Spain, Austria, and others have also decided to adopt the tax, but Germany, fearful of retaliatory tariffs by the US, has not considered any unilateral tax measures at all.

This unilateral taxation, where revenue from digital services is taxed at a specific rate, is an indirect tax that uses revenue as the tax base. As such, loss-making businesses are also liable for tax payment. Moreover, unlike direct taxes, it cannot be adjusted to avoid double taxation, which is a serious problem. (An indirect tax can be adjusted through foreign tax credits.) If countries adopt this tax measure one after another, trade in digital services will suffer a serious blow.

It was under these circumstances that in December 2019, Mnuchin, who was supposed to have been enthusiastic about the OECD discussions, sent a letter to the OECD secretary-general arguing that businesses should be able to choose between the existing tax system and the OECD proposal. Some say that the reason for this new US position is the Trump administration's judgment that it would be difficult to secure Congressional approval for the OECD proposal, as well as lobbying from pharmaceutical companies and other businesses that may be affected significantly. It drew a negative reaction from the OECD Secretariat and European countries, who complained that it was too late to be acceptable, and was the cause of much debate at the G20 meeting in January. The G20 participants reconfirmed their commitment to reach an agreement on new rules for corporate taxation by the end of the year, but the new US proposal remained on the table for future consideration.

International Cooperation & the Role of Japan

National interests are increasingly complicated, and an agreement by the end of the year will not be easy under the circumstances. But unless an agreement is reached on a new taxation regime for the digital economy, the situation in which countries impose a unilateral tax will not be limited to Europe but will spread to India, Singapore, Australia, and elsewhere in Asia. It is the US firms that will suffer most from such a state of affairs. Although the US is, from an objective perspective, in a position to seek an OECD agreement in order to avoid international trade from falling into confusion as the European approach of different national tax systems becomes the norm worldwide, Japan and other non-European countries must nevertheless work to bring the US on board..

Coordinating the interests of the respective countries is the essence of international taxation; it is a matter of how the "wealth" that the digital economy generates should be allocated between the US, Japan and Europe, emerging markets, and developing countries. World politics may be caught up in the enormous tides of international trade being divided by Trump's policies, but the spirit of international cooperation is alive in taxation. Japan should play a positive role aimed at creating consensus to maintain the framework for international cooperation.

Japan SPOTLIGHT May/June 2020 Issue (Published on May 10, 2020)

(2020/05/11)

Shigeki Morinobu

Shigeki Morinobu is research director of the Tokyo Foundation for Policy Research.

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27