HOME > Japan SPOTLIGHT > Article

Central Banks Face Mounting Challenges Including Aging, Bubbles & Climate Change

By Sayuri Shirai

Central banks in developed economies have been struggling to achieve the around 2% inflation target for some time despite the unprecedented scale of monetary easing and diversity of tools adopted since the global financial crisis of 2008. This is true especially in Japan where the likelihood of achieving its 2% inflation target remains low and weak consumption demand appears to be closely associated with the rapid pace of aging in the population. Since the Covid-19 pandemic, moreover, central banks in developed economies have conducted an unprecedented scale of monetary easing by rapidly expanding their balance sheets to prevent their economies from falling sharply. However, the resultant substantial liquidity has amplified the risk of asset bubbles. The pandemic also provided an opportunity to the world that coping with climate change issues is essential to maintain our living standards. Central banks in Europe have begun to examine the implications of climate factors for the conduct of monetary policy. This article will cover the three topics – aging, bubbles, and climate risks – and describe associated challenges faced by central banks.

Japan's Low Inflation, Aging & Effectiveness of Monetary Easing

Since April 2013, the Bank of Japan (BOJ) has initiated bold, large-scale monetary easing under Governor Haruhiko Kuroda to achieve the 2% inflation target. The quantitative and qualitative monetary easing – which mainly purchases substantial long-term Japanese government bonds (JGBs) and also purchases some risky assets including stock exchange traded funds (ETFs) – was adopted in 2013 and was expanded further in 2014. A negative interest rate and the yield curve control were added in 2016. In the midst of the Covid-19 crisis, substantial monetary easing was added again – but this time mainly by providing short-term liquidity provision to banks and purchasing short-term government bonds. As a result, the BOJ's balance sheet swelled from around 165 trillion yen (about 32% of nominal GDP) to around 710 trillion yen (128% of nominal GDP) by January 2021. Currently, the BOJ holds nearly one half of outstanding government bonds issued. Together with the yield curve control that attempts to stabilize the 10-year yield at around zero percent with a negative interest rate applied to part of excess reserves, this has provided low and stable financing conditions to the government and the economy. The BOJ is also the only central bank that purchases ETFs as a monetary policy tool and has become the largest shareholder in the domestic stock market.

This is in contrast with some central banks in the world that purchase foreign stocks as a part of foreign reserve management strategies or purchase stocks to manage their employees' pension funds. In July 2018, two types of flexibility were added: doubling the 10-year yield target range from plus-minus 0.1% to plus-minus 0.2% (and further to plus-minus 0.25% in March 2021) and allowing the annual pace of ETF purchases to deviate from around 6 trillion yen depending on market conditions. The expansion of the 10-year yield target was understood by many market participants as the BOJ's intention to steepen the yield curve due to concerns that persistent low long-term interest rates would have an adverse impact on returns of institutional investors. The flexibility on ETF purchases reflected the BOJ's willingness to reduce ETF purchases. Nonetheless, the unstable US financial markets since the fall of 2018 and a subsequent shift in monetary policy by the Federal Reserve have made it difficult to raise the 10-year yield. When stock prices plummeted in March 2020, moreover, the BOJ decided to introduce the maximum annual pace of ETF purchases and set it at 12 trillion yen.

Despite this unprecedented scale of monetary easing and various innovative tools adopted, Japan's inflation excluding the direct impact of the consumption tax hike and volatile energy and food prices has remained well below 1% over the past eight years. Inflation has entered into negative territory since September 2020 reflecting a drop in energy prices, temporary downward pressures (such as subsidies provided to domestic accommodation for domestic travelers), and various base effects. Inflation is likely to pick up and enter into positive territory in 2021 as energy prices stop declining and various temporary factors fade away. Nevertheless, inflation is projected to remain well below 2% for a long time.

The persistently low inflation might be related to unfavorable demographics. Japan has the most rapidly aging population in the world. The population has been declining over the past years and people over 65 years old currently account for nearly 30% of the population. Many Japanese worry about their post-retirement life and try to save due to sluggish wage growth (reflecting sluggish productivity growth), limited public pension benefits, and longevity risks. Aging caused by an increase in longevity could be deflationary when the growing number of pensioners would pressure the government to lower inflation and maintain the real value of their savings and pensions through voting behavior. As people live longer and their life planning horizon becomes longer, their savings position is likely to change: young workers are more willing to borrow, while the retired or those close to retirement ages tend to accumulate more savings to maintain the same consumption pattern over a longer time horizon. In this circumstance, a change in the interest rate may have different implications for the young and the elderly: lower interest rates imply a reduced cost for the young who are indebted and thus stimulate residential investment and consumption of durable goods (such as cars and furniture), while the elderly may hardly react to lower interest rates due to reduced or limited demand for credit. Monetary easing may be more effective in an economy with an ample younger population, such as emerging and developing economies, than in an economy with a growing aging population. As Japan and Europe face aging, the feasibility of the 2% inflation target is increasingly being questioned.

Risk of Stock Price Bubbles, Inequality & Corporate Restructuring

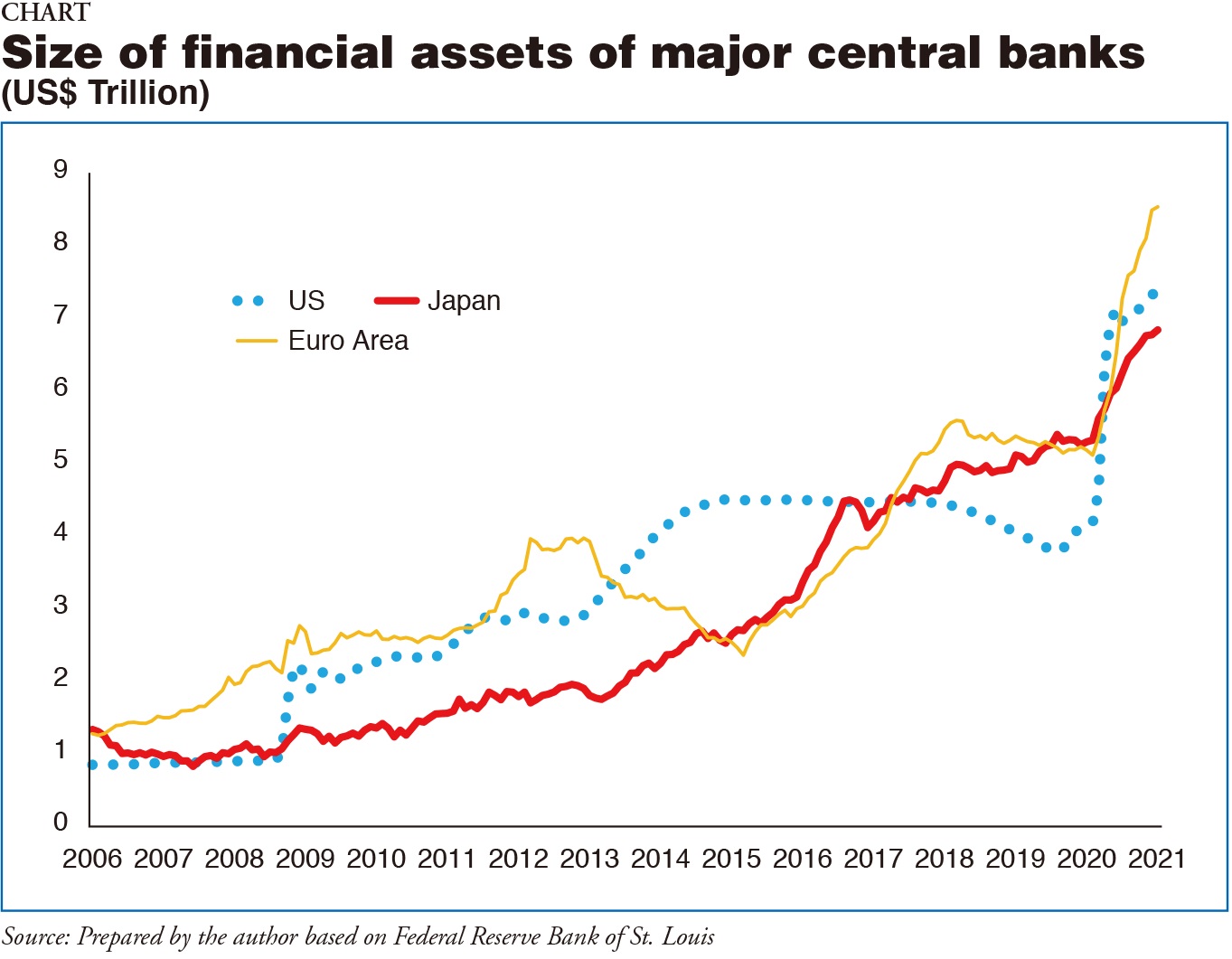

Global stock prices collapsed and stress in financial markets intensified in March 2020 due to growing concerns over the lockdown and resultant recession. Together with large-scale fiscal support (which deteriorated the fiscal balance by more than 10% of nominal GDP), central banks especially in Japan, Europe, and the United States reacted promptly and aggressively to deteriorating economic performance. Since the pandemic, the central banks' balance sheets expanded by over $3 trillion in the US and the euro area, and by about $1.2 trillion in Japan in 2020 (Chart). In response, stock prices quickly rebounded and hit a record high in the US and reached the highest level in Japan over the past 30 years, with the expectation that monetary easing will continue for a long time. The US stock price hike is also attributed to excellent earnings performance of big tech companies benefitting from new online business demand, large-scale fiscal stimulus, and the rapid pace of vaccination. US higher stock prices together with the BOJ's ETF purchases contributed to Japan's rapid stock price hike with the Nikkei 225 index exceeding 30,000 yen sometime in February and March 2021. The US has stronger economic fundamentals than Japan and Europe. High economic growth of around 5-6% is expected in 2021, thus enabling the economy to recover the level just before the Covid-19 pandemic this year. Meanwhile, US stock prices are viewed as overvalued even before the pandemic based on the historical price-earnings ratio. A quick rebound in US stock prices from the March 2020 sharp fall was possible with ample liquidity provided by the Federal Reserve, leading to a further overvaluation of stock prices. Ample liquidity has also contributed to higher commodity prices, precious metals, and crypto assets by generating speculation.

High stock prices (and real estate prices) in the US have enhanced wealth effects among high income people, but has deteriorated inequality further. The labor market has not yet recovered fully. Many non-regular workers cannot get back their jobs while skilled white workers could return to their jobs more easily than non-white workers. The Federal Reserve stresses the need to continue monetary easing due to the large number of unemployed people. As stock prices count on monetary easing, however, the central bank's dilemma may be emerging. Higher economic growth and inflation expectations in the US have begun to generate upward pressures on long-term yields from late 2020, amplifying downside risks on asset prices. Although the 10-year yields of around 1.5-1.7% remain well below the level in early 2018 (around 3%), the recent rapid pick-up has resulted in the correction of US stock prices at the end of February 2021. The rising yields may tighten the financial conditions, thereby possibly making it inevitable for the Federal Reserve to purchase more financial assets. This could add more liquidity and stimulate more speculative activities at the expense of deteriorating asset inequality further. Fiscal stimulus with targeted income support is more effective in reducing income inequality. Ironically, this effort might be somewhat offset by rising asset inequality driven by massive liquidity and associated bubbles and speculative activities.

The remarkable stock performance is also contrasted with the fragile economic conditions in Japan. After two consecutive positive growth periods since the third quarter of 2020, the economic recovery process has stalled as a result of the second state of emergency declaration in Tokyo and some prefectures during January-March 2021 of the Covid-19 pandemic. Japan's high stock prices are influenced by the BOJ's substantial intervention through mitigating downside risks on stock prices at the expense of causing market distortions. In a normal stock market, diverse investors perform transactions and discover fair stock prices while obtaining opportunities to promote sound asset formation. A company that loses the ability to sustainably earn profits should be delisted from the stock market while start-up companies will emerge, grow and eventually be listed. This kind of dynamism among firms is essential for the stock market to function well. The corporate governance code introduced in 2015 and its revision in 2018 aimed at reforming corporate management practices to enhance earning capacity sustainably and raise the long-term corporate value. The 2021 revision is expected to increase the number of independent nonexecutive directors and encourage management to make greater efforts to increase diversity and promote monitoring.

Long-term institutional investors (such as pension funds and insurance firms) and asset managers are increasingly engaging in constructive dialogue with listed companies and exercising their voting rights as shareholders to transform corporate behavior and increase long-term corporate value. Such value must be achieved in a sustainable manner from environmental, social and corporate governance (ESG) perspectives. In particular, companies urgently need to align their business models with the Paris Agreement of limiting global warming to below 2 or close to 1.5 degrees Celsius, compared to pre-industrial levels. Such ESG-oriented corporate management will be supported further in 2022, when the Tokyo Stock Exchange will reorganize the existing four market segments into three and replace the first tier market with a Prime Market comprising companies that meet the tougher criteria, including corporate governance standards for the first time. An expansion of ESG investment and a sustainable finance market is essential for Japan and the world to achieve the net-zero greenhouse gas emission target and the United Nations sustainable development goals (SDGs).

The BOJ is likely to hold stocks for an extended period without drastically exercising responsible ESG investment since the BOJ does not regard itself as a responsible investor. As long as the BOJ purchases ETFs and increases stock holdings temporarily as a part of monetary policy packages, this could be justified. However, the continuation of ETF purchases without the prospect of achieving the 2% inflation target may undermine corporate efforts and pressures arising from ESG investment. Overvalued prices regardless of ESG performance risk delaying corporate restructuring. As a way to mitigate this problem, the BOJ could stop purchasing ETFs when stock prices are overvalued and intervene in the market only when disturbances arise. In line with this view, the BOJ removed the expression of "around 6 trillion yen" on the annual pace of ETF purchases while maintaining the same upper limit in March 2021. By suggesting that large-scale purchases will be conducted only during times of heightened market instability, the ETF purchases could be nearly zero when the stock market is performing well. In any case, stopping ETF purchases completely and beginning to sell those holdings are challenging for the BOJ since they would trigger a sharp fall in stock prices.

Growing Awareness of Climate Risks & Impact on Monetary Policy Conduct

Many economies, including the European Union (EU), Canada, China, Japan, and the US, have committed to achieving net-zero emissions by 2050 (2060 in the case of China). Climate change could have a significant impact on GDP, prices and asset prices. Central banks may have to measure price stability by taking into account the direct and indirect impact of climate change. A growing number of extreme weather events is likely to make it difficult for firms to continue activities in stressed areas. Corporate funding costs might rise as the collateral value (such as real estate and equipment) falls in such areas. Coal-fired power plants will no longer become profitable in the face of tighter environmental regulations and higher carbon taxes. Therefore, firms must assess the expected impact of climate risks on their long-term financial performance. Through forward-looking investment and innovation, firms are able to make their business models more sustainable and enhance international competitiveness. Firms also need to make more research activities and invest in costly, but essential new technology development – including renewable energy, batteries, and grids; hydrogen and ammonia fuel technology; and carbon, capture, and storage (CCS) or carbon capture, utilization, and storage (CCUS) technology.

The Financial Stability Board established the private sector-led Task Force on Climate-related Financial Disclosures (TCFD) in 2015 and published recommendations on climate-related information disclosure for companies in 2017. The TCFD recommendations are increasingly adopted by large listed firms globally. In 2017, central banks and financial regulators established the Central Banks and Supervisors Network for Greening Financial System (NGFS) to explore ways to integrate climate factors into their operations. Following the BOJ, the ECB and many other central banks, the Federal Reserve finally became a member of NGFS in December 2020. Central banks find it necessary to develop an econometric model that incorporates climate factors into existing statistical macroeconomic models that cover the transmission process of monetary policy. In June 2020, the NGFS published practical guidelines for central banks and financial supervisors to quantify the impact of climate risks on financial institutions and aim for international standards. The guidelines help determine the resilience of banks' assets and insurance companies' liabilities up to 2050 under various climate scenarios including the scenario in line with the Paris Agreement.

In June 2020, the Bank of England (BoE) released its first own report based on the TCFD recommendations. Furthermore, the UK government has begun to require listed firms and major financial institutions to disclose information based on TCFD recommendations from 2021 in collaboration with the BoE. The BoE already conducted climate-related stress tests on major insurance companies in 2014 and is preparing a comprehensive stress test on banks and insurance firms in 2021. The European Central Bank (ECB) has also called on banks to account for climate risks in their business strategies and risk management.

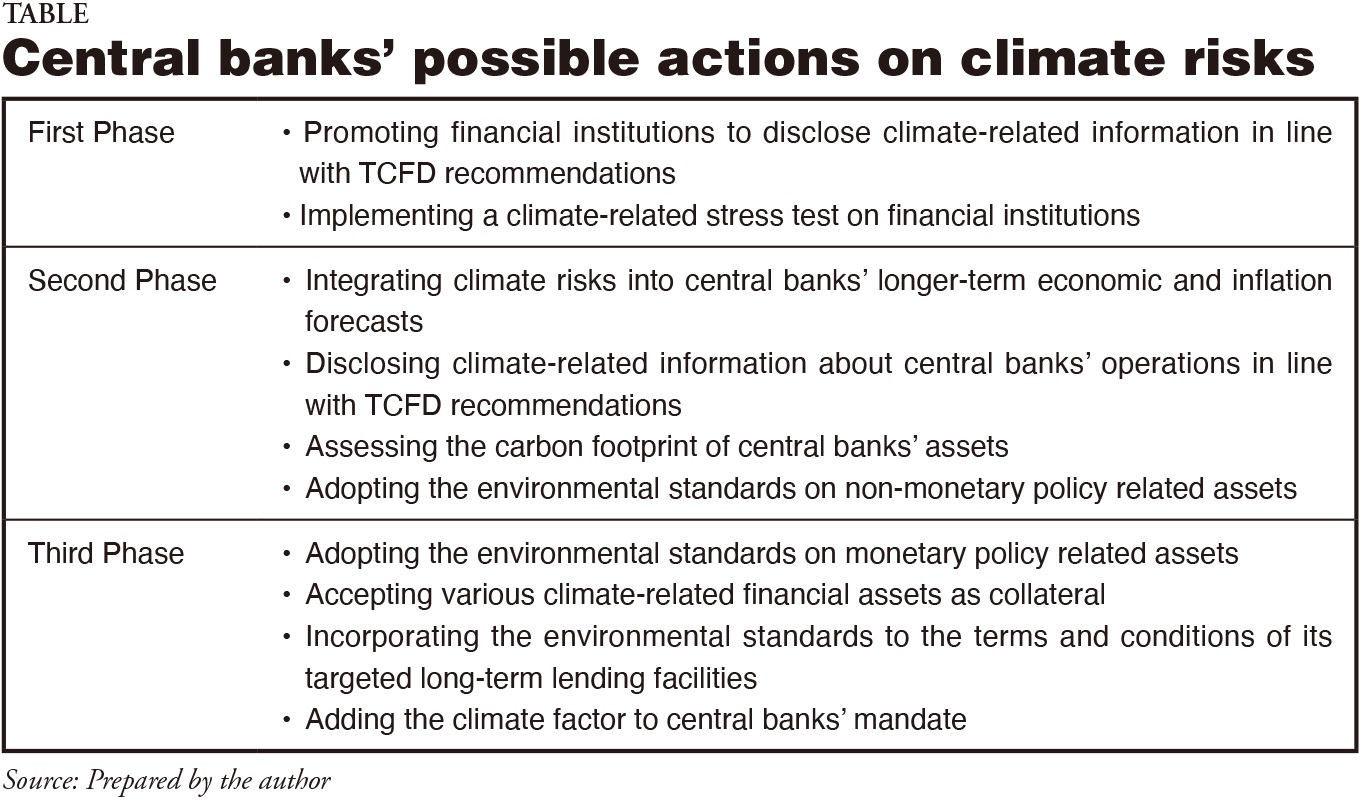

As financial institutions are encouraged to make their business models and portfolios greener, it is natural that such actions will be demanded on central banks as well by verifying their assets' carbon footprint (Table). Central bank assets include foreign currency reserves, employees' pension assets, as well as those purchased and loans to financial institutions for monetary policy purposes. The BoE already disclosed its first assets' carbon footprint in the 2020 TCFD report and concluded that emissions linked to its government bonds have decreased compared to other G7 economies, but the UK government must make greater reduction efforts in the future. As for corporate bonds, the central bank admitted that many issuers are carbon intensive. In March 2021, the BoE became the first central bank in the world that added climate factors in its monetary policy mandate in addition to the existing 2% inflation target by reflecting the government's economic strategy of achieving a net-zero economy. The central bank plans to announce details in the next few months on how climate factors will be reflected in its reinvestment policy over its holdings of corporate bonds when the next timing arises in October-December 2021. Green sovereign bonds will also be purchased when the government begins to issue them for the first time in 2021.

Furthermore, ECB President Christine Lagarde intends to make the central bank's portfolio greener as well. The monetary policy strategy review, which is expected to be completed before the middle of 2021, covers the issues of how the ECB can respond to climate change effectively. The ECB has been purchasing green bonds as part of its asset purchase programs since around 2015. Since January 2021, furthermore, the ECB began to accept sustainability-linked bonds as collateral and making them eligible for its ongoing asset purchase programs. The sustainability-linked bonds refer to bonds whose issuing conditions (such as coupon rates) are adjusted based on the pre-set performance. If issuers improve performance, more favorable issuing conditions (i.e. lower coupon rates) are provided. The coupons must be linked to a performance target referring to one or more of the environmental objectives set out in the EU Taxonomy Regulation and/or to one or more of the SDGs relating to climate change or environmental degradation. The ECB is also purchasing more green bonds as the German government began to issue green bonds for the first time since 2020 and the EU began to issue green bonds to finance one-third of the €750 billion NextGenerationEU recovery fund in 2021.

These central banks maintain the "market neutral" principle of buying financial assets according to the size of the market for each asset. The urgent need to promote green actions may eventually lead to the abandonment of the principle, allowing more active purchases of bonds that finance green projects and low-emission companies. Given that emission-intensive firms tend to be capital-intensive and dominant issuers of corporate bonds, the market neutral principle may end up favoring high emission companies over small or newly emerging low emission companies and hamper the economy from achieving the net-zero emission society. Moreover, central banks may find it necessary to provide long-term liquidity to banks actively supporting green projects and low-emission firms.

In the future, frequent extreme natural disasters and rising global population may complicate monetary policy as they may amplify the price volatility and generate upward pressures on general prices through higher commodity and food prices. In such a circumstance, central banks in advanced economies may witness upward pressures on inflation driven by non-monetary policy factors. This may lead to a reexamination of the 2% inflation target; and central banks may begin to prioritize supporting a smooth transition to a net-zero emission society by 2050. It should be aware that climate change has the potential to fundamentally change the central banking operations.

Japan SPOTLIGHT May/June 2021 Issue (Published on May 10, 2021)

(2021/06/10)

Sayuri Shirai

Sayuri Shirai is currently a professor of Keio University. She holds a Ph.D. in economics from Columbia University. She was a Member of the Policy Board of the Bank of Japan (BOJ) in 2011-2016.

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27