HOME > Japan SPOTLIGHT > Article

White Paper on International Economy & Trade 2021 – Summary

By Policy Planning & Research Office, Trade Policy Bureau, Ministry of Economy Trade & Industry (METI)

Introduction

The White Paper presents the four international trends that should be the basis of trade policy in the age of living with the novel coronavirus: (1) the expanded role of government in the economy, (2) national efforts to enhance economic security, (3) the growing interest in the environment, human rights, and other common values in international economic activities, and (4) business digitalization. It explains the need to update the free trade system to enable it to deal with issues such as the expanded role of government in the economy as part of the process in the recovery of the global economy from the Covid-19 crisis; the growing interest in the environment, human rights, and other common values and other momentous changes in progress; continuous trade restrictions to prioritize the home country; and the damage to the conditions for fair competition caused by market-distorting measures. This analysis is the basis of the call for utilizing digital technology to build resilient supply chains and to secure new market opportunities to achieve sustainable growth in Asia as broad directions going forward. The White Paper also takes note of the importance of undertaking the development of new international rules and norms to support the free trade system and for the private and public sectors to work together to develop a value chain that plays to Japanese strengths.

Part I, Chapter 1. Economic Situation Surrounding Japan & Trends That Will Shape Trade

Part I, Chapter 1 explores changes in the economic circumstances since the publication of the White Paper on International Economy and Trade 2020, which focused on the impact of the Covid-19 crisis, and presents the four major international trends that should be the basis of Japan's trade policy and are the perspectives for the analysis in this White Paper.

For now, countries around the world must manage their economies while performing the difficult balancing act between containing novel coronavirus transmission and resuming economic activities. Future recovery, moreover, will not only depend on the effectiveness of vaccines and the level of their acceptance but will also be affected significantly by hard-to-predict factors such as the emergence of new variants and their infectiveness. As this state of living with the novel coronavirus becomes the norm, tectonic movements in the geopolitical environment are accelerating with the policy shift in the United States, inauguring a new stage in the political environment surrounding Japan.

The following is an analysis of the four major international trends that should be the basis of trade policy and business activities in Japan going forward, given the uncertain outlook for the global economy and the new international political environment.

The first trend is the expanded role of government in the economy.

As the impact of the Covid-19 crisis drags on, countries are taking active economic measures with a focus on industry and households, areas of concentrated economic damage from the pandemic, on a scale that exceeds the response to the global financial crisis. It is also notable that the measures taken by governments do not stop at providing relief but offer support for digitalizing society, creating a green society, and otherwise transitioning and adapting to a post-Covid-19 economic structure.

These major moves by governments can also be viewed as a search for ways to qualitatively strengthen the role of governments. They emphasize the role of governments such as actively engaging in a rapid transition to a digital society in order to effectively handle the Covid-19 crisis and making the future more foreseeable for companies through clear policies and support measures in order to encourage private investment aimed at achieving carbon neutrality.

The second trend consists of the national efforts to enhance economic security.

In recent years, with the struggle for technological hegemony between the US and China as the backdrop, these and other major countries have stepped up their efforts to enhance their economic security, with a growing impact on companies' business activities. It is against this background that the Covid-19 pandemic exposed the vulnerability of supply chains. In response, those countries are working to make supply chains more resilient and otherwise enhance their economic security. Here, it is important to take note of the growing trend toward exploring cooperation among like-minded countries to undertake the development and management of advanced technology and to work to enhance the resilience of supply chains.

As for companies, it is becoming increasingly important to develop business strategies that reflect a strong awareness of the diplomatic positions and economic security policy of each country.

The third trend is the growing interest in common values in international economic activities.

The new millennium has seen progress in international efforts to secure human rights, the environment, and other common values, prominent examples being the United Nations' Guiding Principles for Business and Human Rights, Sustainable Development Goals (SDGs), and the COP21 Paris Agreement on climate change. With the US rejoining the Paris Agreement and starting to cooperate with Europe following its change of administration in January 2021, efforts to strengthen international cooperation based on common values are intensifying. To give one example, more and more companies are setting goals to reduce greenhouse gas emissions (science-based targets, SBT) that are consistent with the levels required by the Paris Agreement. The ongoing legislative efforts in the US and Europe on human rights due diligence legislation that will require accommodation by companies outside those regions is another example.

This international trend of seeking to secure common values through companies' business activities takes a comprehensive view of the activities of companies engaged in transactions and requires them to be equally responsible for human rights and the environment. While there is a growing risk that constraints will be imposed on business activities that are incompatible with internationally shared values, contributing to solving social issues with more awareness than ever of these common values could present companies with new business opportunities.

The fourth trend is the growing interest in business digitalization.

The Covid-19 pandemic has accelerated digitalization as the need to simultaneously prevent transmission and conduct economic activities expanded the use of digital technology in a wide range of circumstances. In business activities, for example, workstyles are changing as remote technology is incorporated, and e-commerce is expanding. Digitalization is permeating the daily life of the individual, and a wide range of technologies such as contact-confirmation applications are being introduced to deal with Covid-19. To be sure, digitalization has been on the march since the turn of the millennium. This is evident in the global flow of funds: while payments for intangible assets such as royalties and licensing fees have grown significantly, the flow of direct investment has only increased moderately. This shows that the dominant business model for international business has become one in which companies use alliances to secure a return on their intellectual assets without having to invest capital. That said, the Japanese business model is one where companies secure a return on their intellectual assets while maintaining strong relationships through capital ties, since both royalties and other payments and investment flows are showing similar growth.

In order to continue to enjoy the benefits of international trade in the world of living with the novel coronavirus, it is essential to construct business models and social infrastructures that are adapted to digital technology. It is also important to change how companies' bases are located and change the international division of labor. Developing international rules that ensure both trustworthiness in privacy protection and data security and the smooth flow of data is also an urgent task.

Part II, Chapter 1. Toward Building Resilient Supply Chains

This chapter revisits the development of the Asian supply chains of Japanese companies against the background of the trends examined in Part I and explores resilient supply-chain management and relevant policy efforts that take into account the growing interest in common values for economic activities.

Section 1. Asia-wide changes in supply chains

Looking back at the global development of the Japanese manufacturing sector since the turn of the millennium, Japanese companies accelerated their overseas expansion led by corporate clusters, most prominently in the automobile industry. China's accession to the WTO ignited its rapid expansion as a destination for production bases and trade, but this was matched by a simultaneous rise in investment in North America, Europe, and ASEAN. Direct investment balances broadly show a regionally balanced investment profile.

For Japanese companies, China was a part of "triangular trade" where basic materials, parts, and components are exported and assembled as final products to be reexported. Today, "local production for local consumption", where the products are sold in China, as well as the export of intermediate goods, make up a significant part of the production.

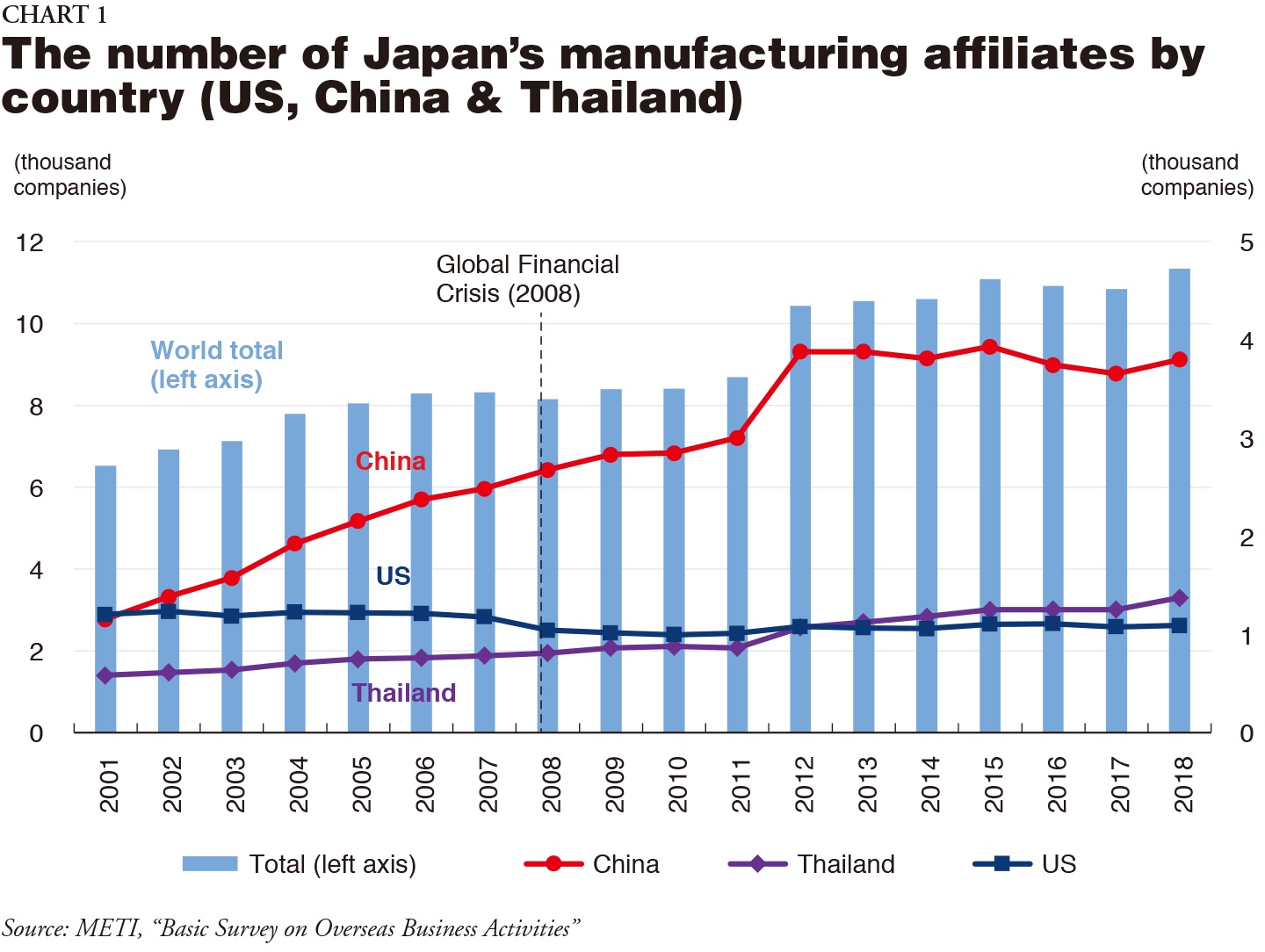

Last year's White Paper revealed the growing concentration of import sources in Japan's supply chains in recent years. On the other hand, the medium-term trend is that Japanese companies' drive to set up locations in China peaked in 2012 and is now declining, both in terms of the number of companies being established and China's share of the direct investment balance. From a macro perspective, production bases in Asia are gradually becoming more diversified. As a result, the shares of imports from China for some major machine parts and components have plateaued while the shares of imports from Thailand, Vietnam, Indonesia, etc. have increased. The widespread adoption of the "China+1" model by Japanese companies may also be contributing to this. Under this model, new production bases are selected by taking into consideration the overall cost and the stability of the business environment (Chart 1).

Section 2. Supply chain risks and recovery from crises

Disasters have seriously impacted supply chains in the past. Companies assess the risks from various perspectives including their predictability and frequency, ease of control and management, and the scale of impact, and make plans accordingly. Corporate responses to questionnaire surveys taken after natural disasters often "consider distribution of production bases". This also figured prominently in the response to the Covid-19 crisis.

That said, many events that occurred before the Covid-19 crisis also disrupted supply chains, but they did not necessarily result in the reorganization of production bases. For example, no significant change was observed in the location of Japanese affiliates in Thailand after the 2011 floods there.

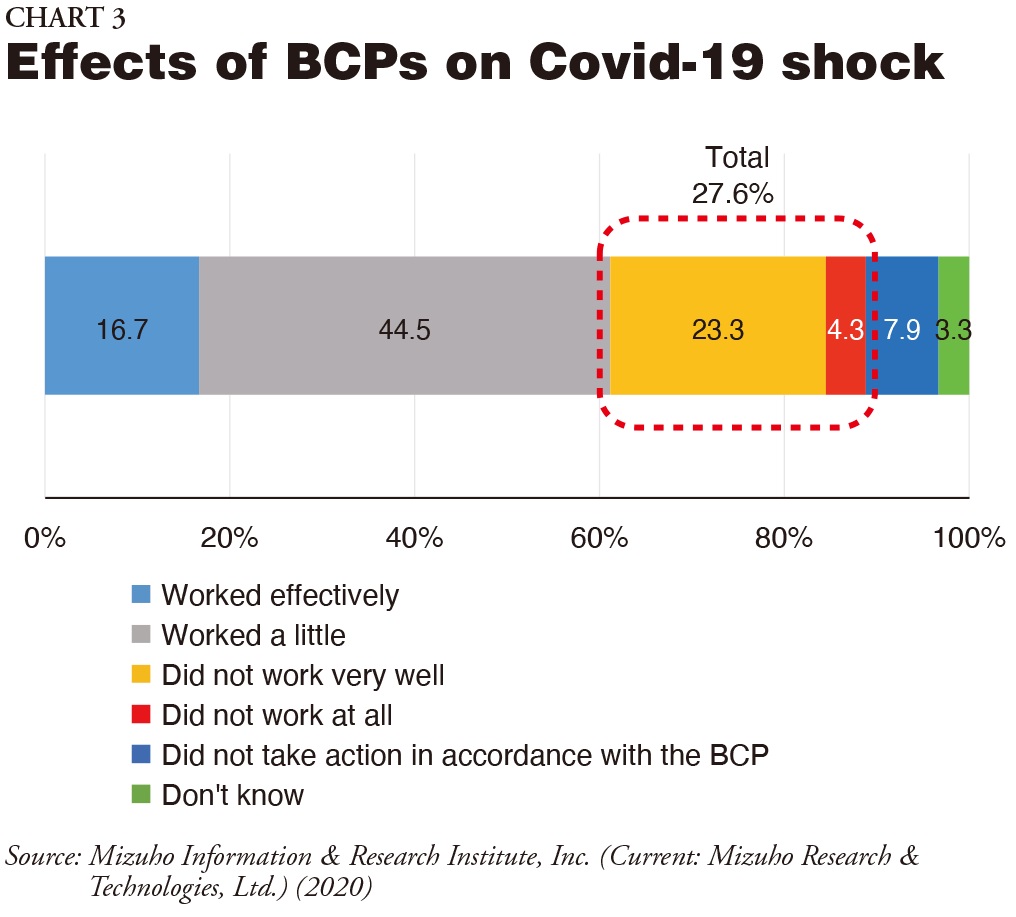

As for changes to their supply chains being considered, while the fact that the current business environment is increasingly uncertain and many companies face a downturn in their business outlook should be taken into consideration, distributing and diversifying sources is the most frequent response, followed by strengthening mutual assistance networks with other companies, etc.

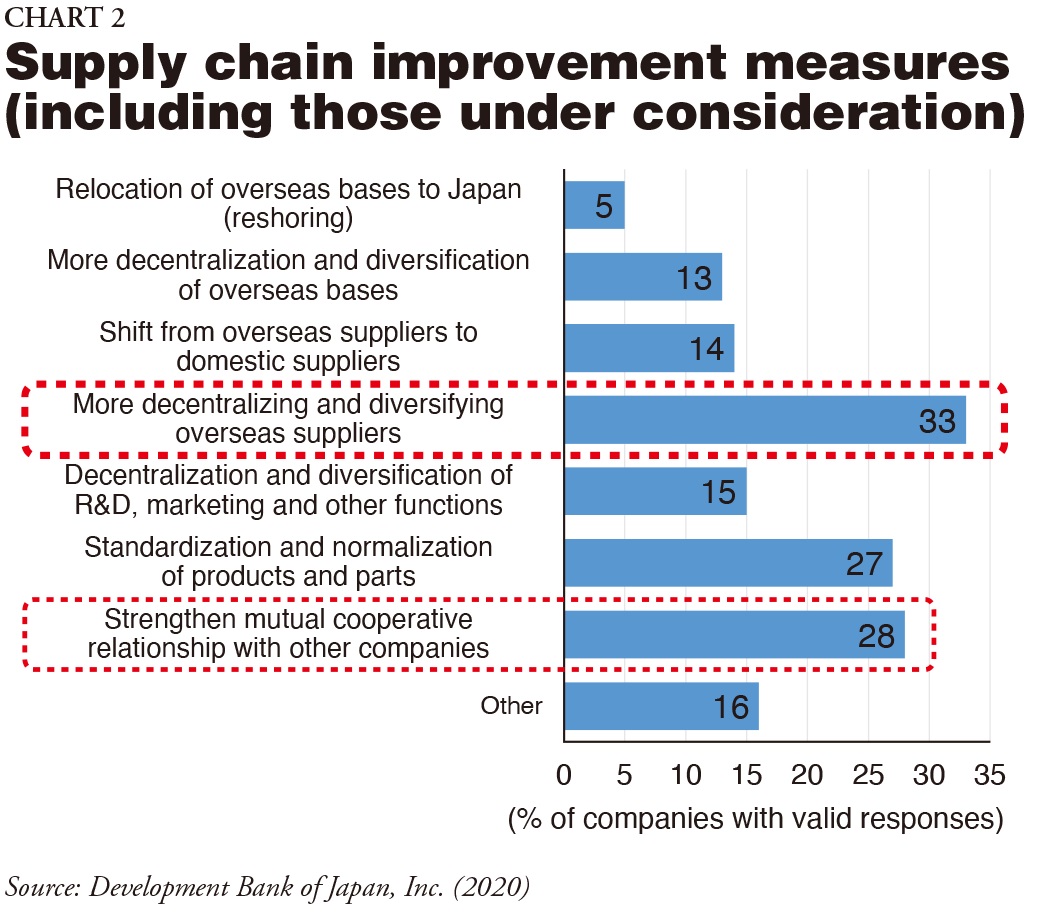

The disruption of supply chains caused by the Covid-19 crisis has once again made clear the need to go beyond direct suppliers and take into account the entire, multi-level supply chain. There is also the possibility that unforeseen risks will disrupt supply chains in the future. In fact, some assessments report that preexisting business continuity plans (BCP) did not work. There is increasing awareness of the importance of formulating BCPs and managing supply chains in ways that address a wide variety of risks that go beyond transient disasters (Charts 2 & 3).

Section 3. Additional considerations in supply chain management

In addition to the diversification of risks explained so far, matters to be considered in managing supply chains are becoming more complex and sophisticated against the international background of growing calls for economic security and interest in common values.

With many countries around the world likely to advance their efforts toward net-zero greenhouse gas emissions, it is expected that there will be ever more efforts by companies to manage not only their own CO2 emissions but also those from their overall supply chains including suppliers. Europe is taking the lead in the growing efforts to make it compulsory for companies to identify, assess, and disclose the human rights violation risks of their own and their suppliers. Japanese companies operating in Europe and elsewhere are already taking steps to comply with these initiatives. More and more companies will be subject to such mandates or will be required to undertake due diligence through their transaction partners.

In addition, given the need for some goods and sectors to comply with the relevant countries' export and procurement regulations established for economic security purposes, companies are evermore required to have a detailed understanding of the circumstances surrounding their supply chains and take measures accordingly.

The first step for companies in dealing with this situation is to understand their supply chains beyond primary suppliers. They must also recognize that the environment, human rights, and other common values are now part of the competitive environment and intensify their efforts in accordance not only with the law but also to meet the expectations of their stakeholders.

Part II, Chapter 2. New Model for Growth That Incorporates Common Values

This chapter takes up the growing international interest in common values explained in Part I and explores ways to incorporate this international trend as the basis of more sustainable and inclusive economic growth while minimizing the risk from delays in response.

Section 1. Growing expectations regarding corporate behavior toward a sustainable and inclusive society of the future

Since the 1990s, with the rise in the international demand to deal with environmental challenges, social inequality, and other aspects of the dark side of globalization, there has been a gradual but steady rise in the willingness of companies, given their significant impact on social and economic activities, to contribute to the resolution of the social issues facing the international community. The UN Guiding Principles for Business and Human Rights issued in 2011 and the SDGs adopted by the UN in 2015 are part of this trend.

The interest in common values has swelled of late into an international tidal wave. Here are three of the most prominent examples.

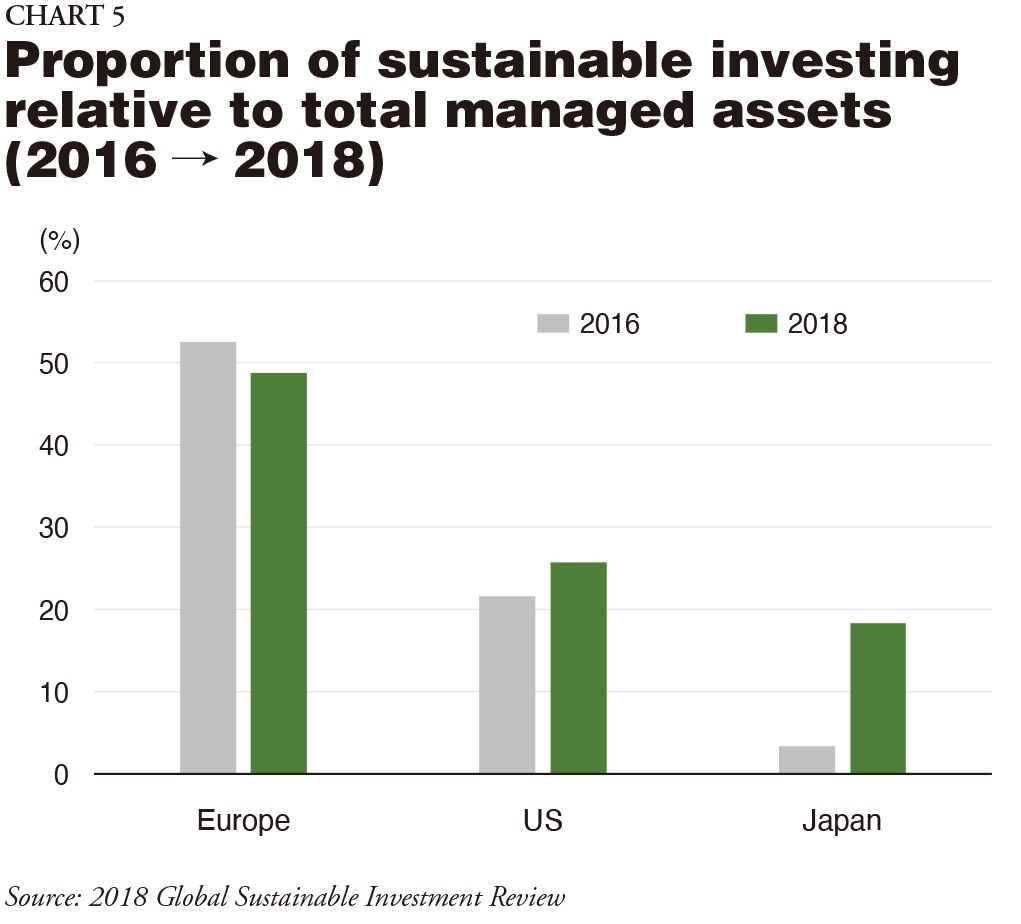

First, the efforts by companies to tackle social issues have become an important perspective for the financial markets in evaluating them as the result of financial institutions and institutional investors incorporating Environment, Social and Governance (ESG) factors in their investment and lending and asset management. Most recently, there has been a move toward incorporating longer-term risks and opportunities in assessing corporate value; the Task Force on Climate-related Financial Disclosures (TCFD) is a public-private joint initiative to that end. Given the expansion of the scope of information disclosure required by capital markets and overseas regulatory authorities, it is also important for companies to view the growing demand for information disclosure not only as a matter of "accountability" to the market but also as an opportunity to transform corporate management (Charts 4 & 5).

.jpg)

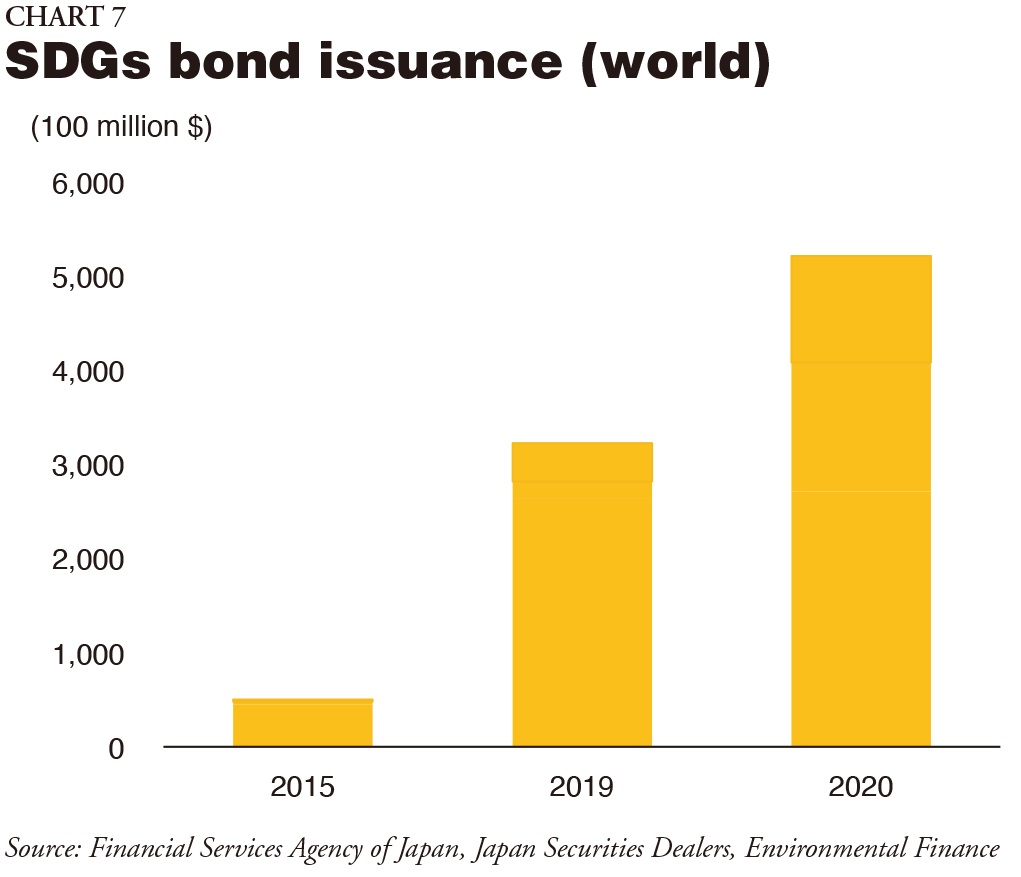

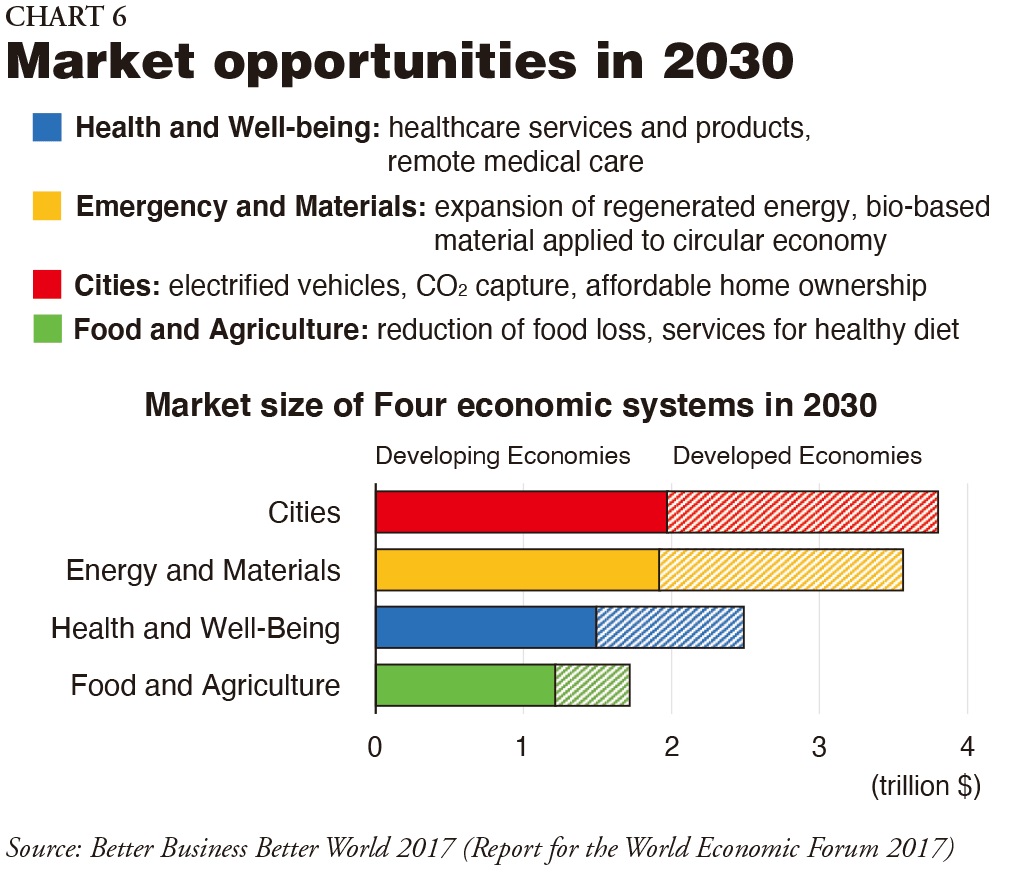

Second, interest in how social issues are addressed is growing in ways that affect companies' competitive environment. In conducting ESG investment, for example, there are cases where statements of the raison d'être of the companies are evaluated or investment strategies are adopted that incorporate the "impact" of the business activities as externalities. The more people empathize with the globally shared values of SDGs and sustainability, the larger the markets those values create will be. Given that younger generations are clearly showing a tendency to attach importance to these "common values" not just in Japan but also globally, it is essential for companies to position common values in their business management appropriately in gaining market opportunities and acquiring human resources in the labor market in order to secure a competitive advantage (Charts 6 & 7).

Third, efforts by governments in Europe and the US to build institutional frameworks for incorporating values across the entire supply chain as part of foreign economic policy are becoming more pronounced. European countries and the US regard human rights and democracy and other basic values as elements of their foreign economic policy. More and more, they are imposing the above-mentioned human rights due diligence and related disclosure obligations as well as unilateral sanctions on companies established outside their jurisdiction.

Japanese companies must accommodate the policy measures being taken by European countries to incorporate "respect for human rights" into "foreign economic policy". How have Japanese companies handled this? Adopted in 2015, SDGs in particular have had a large impact on corporate management in Japan. SDGs are increasingly recognized, and more than 30% of the big businesses responding to a questionnaire survey in 2020 answered that they had incorporated SDGs in their management policies and business operations.

At the same time, there is insufficient awareness of the shift in the risks and opportunities for companies caused by the growing focus on common values and not enough investment in intangible assets based on the changes in the competitive environment. As the influence of the future-oriented values of sustainability grows, it is more necessary than ever to identify and invest in intangible assets that contribute to sustainability. In addition, it is also important to give accurate "expression" to how companies contribute to increasing corporate value in order to be recognized appropriately by the capital market.

Part II, Chapter 3. Taking Measures Toward Building a "Trustworthy" Global Value Chain

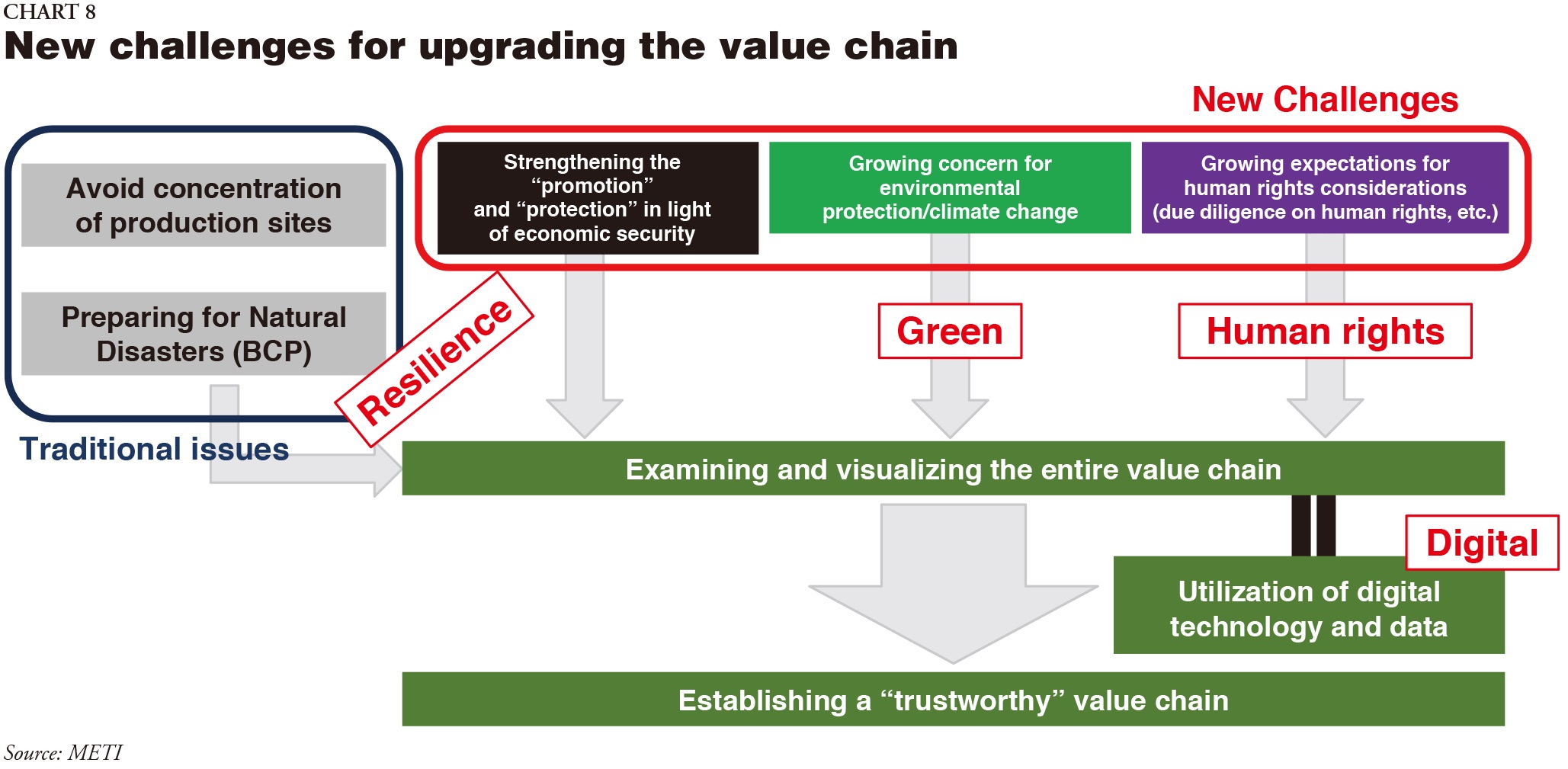

What should trade policy be like in the world of living with the novel coronavirus – a world where the role of governments is expanding, dealing with economic security is the norm, and governments and companies alike work to contribute to common values? The following sections present broad directions for this (Chart 8).

1. Momentous changes in progress all over the world

The variables to be considered in managing global value chains such as economic security and how to address the growing interest in the environment, human rights, and other common values, are increasing in number and complexity as a consequence of the four trends explained in Part I. Establishing value chains using digital technology and data to respond to this growing complexity has become a major strategic issue in corporate management and policymaking.

In addition, there is a growing need to upgrade free trade in order to sustain and enhance the liberal and open socio-economic system. In other words, the challenge is not only to create a business and investment environment that supports the free movement of goods and multi-tiered supply chains that transcend national borders but to also develop norms aimed at achieving sustainability, fairness, and social justice.

2. Action toward strengthening economic security and industrial competitiveness

In order to ensure Japan's economic security, it is important to reduce the level of concentration of suppliers for important materials and products with heavily concentrated overseas production bases and to build global supply chains focused on "trustworthiness" with the US and other like-minded countries through such means as supporting the diversification of production bases and forming strategic alliances with overseas companies.

It will also be important to work on controlling sensitive technologies and to encourage research and development and capital expenditures on "chokepoint" technologies including through collaboration with like-minded countries. Through these efforts, Japan will develop important domestic production bases through appropriate role-sharing with like-minded countries, establish an important position in the cutting-edge technology development community, and "overcome vulnerability" and "secure superiority" in technologies and goods important to economic security.

3. Challenges and initiatives in the digital field

Japan will take the lead to prevent the expansion of digital protectionism, which can hamper corporate business opportunities, and achieve "Data Free Flow with Trust" (DFFT), the development of international rules that ensure both free flow of data and trustworthy privacy protection, security, etc., thereby contributing to the creation of new value that data will bring about and to economic development.

"Trustworthiness" in transactions regarding data protection and other aspects will also be an important factor in decision making. It is necessary to work with lending countries in order to visualize "trustworthiness" as a common factor for evaluation.

4. Addressing common values (environment, human rights, etc.)

Based on the "Green Growth Strategy through Achieving Carbon Neutrality in 2050", it is important to take the lead in the strategic competition surrounding green growth to work with the US and Europe to substantiate cooperation, make progress in international rule-making, and steadily implement industrial policies at home and abroad. In Asia, where energy demand is expected to grow, it is essential to employ various forms of pragmatic energy transitions utilizing all energy sources and technologies. Aiming to simultaneously achieve both sustainable economic growth and carbon neutrality, Japan has initiated the Asia Energy Transition Initiative (AETI), and will work with ASEAN member countries.

Another challenge in global corporate management is the urgent need to adapt to the international trend of incorporating respect for human rights and other social issues in management strategy. It is important to improve Japanese companies' understanding of "business and human rights" through such means as raising awareness of the "National Action Plan" formulated last October and to foster an environment in which corporate value is enhanced by strengthening such measures.

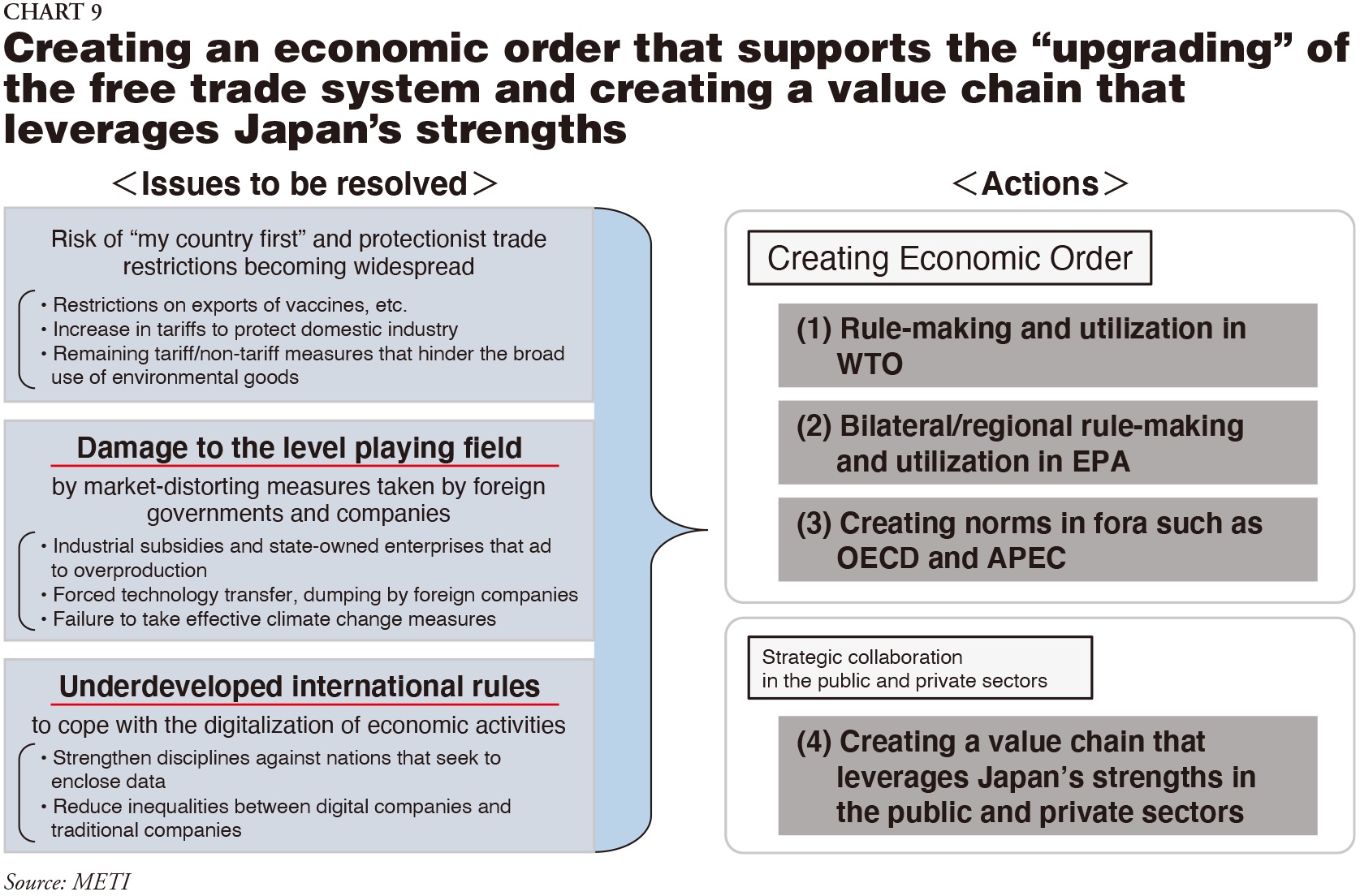

5. Upgrading the free trade system

To further enhance the global value chains that build on the strengths of Japanese companies, it is necessary to form an economic order that addresses the current challenges and to have a strategic partnership between the public and the private sectors.

Specifically, the issues are as follows: the danger of me-first and protectionist trade restrictions such as export restrictions on vaccines, etc. and tariff hikes to protect domestic industries becoming the norm; the damage to the level playing field caused by market-distorting measures by foreign governments, businesses, and other actors; and the inadequacy of international rules for an increasingly digitalized economy. This makes it important to take a multi-layered approach that includes not only hard law, such as the WTO laws and Economic Partnership Agreements (EPAs), but also soft law, such as the norms being developed around the OECD and APEC (e.g. data governance), as well as public-private efforts to enhance the value chains that leverage Japan's strengths (e.g. the Supply Chain Resilience Initiative (SCRI), cooperation with the US and Europe) (Chart 9).

In the WTO, Japan will actively participate and show leadership in talks among like-minded countries in new areas such as e-commerce, trade and health, trade and environment, and other new areas for negotiation, and strengthen efforts in cooperation among like-minded countries, such as the Trilateral Meeting of the Trade Ministers of Japan, the EU and the US to deal with market-distorting practices and achieve a level playing field. It will also promote efforts to improve the dispute settlement function, including the reactivation of the Appellate Body.

The task lying ahead for Japan on EPAs is to effectively implement the free and fair trade and investment rules for the 21st century established by the CPTPP, the Japan-EU EPA, the Japan-UK EPA and other agreements in the Asia-Pacific region and to extend their reach beyond. Japan will also take the lead in efforts aimed at the early entry into force of the RCEP Agreement and the reincorporation of India therein.

The OECD is holding talks on principles for government access to personal data and on the revision of rules regarding international taxation in the digital economy. APEC is taking stock of issues concerning the cross-border transfer of personal information, reviewing and expanding the list of environmental goods, and identifying the scope of environmental services. Japan will actively promote these rule-making efforts in the OECD, APEC, and elsewhere.

In addition to these efforts to establish rules and norms, the public and private sectors must work together on efforts around value chains that play to Japan's strengths. The dramatic economic and social shifts including the need to resolve social issues in Asian and developing countries must be taken into account when promoting infrastructure development and collaboration between Japanese and local companies in emerging markets and elsewhere. In the ASEAN region in particular, it is necessary to explore an alliance-based approach to business expansion in a departure from the project-based "vertical integration" business expansion model that has developed around the intra-region supply chains, mainly in the automobile sector.

On the policy front, the Japanese government is working to enhance the resilience of the Japanese and ASEAN economies by adopting the "ASEAN-Japan Economic Resilience Action Plan", launching the "Dialogue for Innovative and Sustainable Growth (DISG)", holding the "ASEAN-Japan Business Week" and providing support for ASEAN's diverse and realistic energy transition. It will also utilize the "Supply Chain Resilience Initiative (SCRI)" agreed to at the Australia-India-Japan Economic Ministers' Meeting held on April 27, 2021, and the "Supply Chain Resilience Forum", an Australia-India-Japan-ASEAN public-private undertaking, and other venues to create a virtuous circle of enhanced supply-chain resilience and industrial competitivity on an Indo-Pacific scale with the aim of achieving sustainable economic development in the region. Furthermore, it will work to effectively connect India, the world's second-most populous nation and key source of IT talent, and ASEAN, where Japanese companies have established sophisticated manufacturing supply chains, to construct overarching regional supply chains – a transition from "China+1" to "India Inclusion."

Japan SPOTLIGHT September/October 2021 Issue (Published on September 10, 2021)

(2021/09/15)

Policy Planning & Research Office, Trade Policy Bureau, Ministry of Economy Trade & Industry (METI)

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27