HOME > Japan SPOTLIGHT > Article

Trends in Monetary Policy & Exchange Rates, & Outlook for the Japanese Economy in 2023

By Koichi Kurose

Monetary Policy

The top priority for the Bank of Japan (BOJ) is to achieve a 2% rise in the consumer price index. In order to hit this target, the BOJ together with the Japanese government released a joint statement in January 2023 announcing that commitment. Under the leadership of Haruhiko Kuroda, who took office as governor in April 2013, the BOJ set a timeline of two years to achieve the price target, and immediately implemented quantitative and qualitative monetary easing. Concrete measures on monetary easing began with purchases of government bonds, stocks and Real Estate Investment Trusts (REITs), qualitative easing, and in addition from 2016 a negative interest rate policy and Yield Curve Control (YCC) policy were introduced. These policies are collectively referred to as unprecedented monetary easing. Many of these monetary easing methods are common with the US Federal Reserve System or the European Central Bank but purchases of stocks and REITs and a YCC policy are unique to Japan. Purchases of stocks and REITs began with the aim of lowering the risk premium. The YCC policy sets the target rate of 10-year government bonds at zero interest and allows fluctuation within a fixed range. The range initially began with plus-minus 0.1%, but was gradually expanded, and most recently in December 2022 it was expanded from plus-minus 0.25% to plus-minus 0.5%.

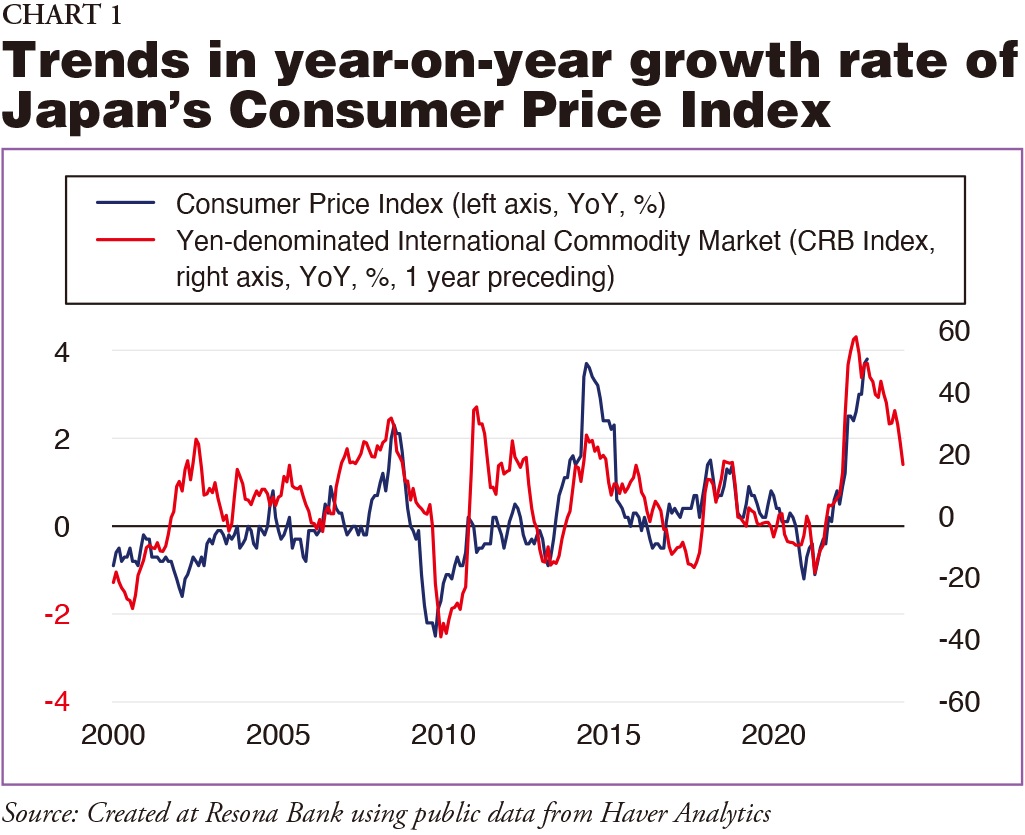

The 2% rise in the consumer price index had not been achieved after eight years. But in April 2022, the rise exceeded the target 2% for the first time and continued to accelerate, reaching 4.0% in December 2022. But the BOJ is still basically maintaining its unprecedented monetary easing, claiming that the rise in prices is not a stable rise of over 2% but only reflects a hike in import prices due to energy prices and a weak yen. This diagnosis is thought to be correct as shown in Chart 1.

But the BOJ's stance of maintaining unprecedented monetary easing, with slight revisions such as expanding the allowance range of the YCC policy, has produced increasing skepticism. The biggest problem is that growth in wages is not keeping up with the rise in prices. There are more than a few economists who argue for a transition to monetary tightening to stabilize prices.

Kuroda's tenure ends in April 2023, and there are views in the market that this unprecedented monetary easing will undergo a change with a new governor – specifically, measures such as revisiting the effects and side-effects of the monetary easing policy, reviewing conditions and procedures for reevaluating the policy, reviewing the joint statement by the government and the BOJ, another expansion of flexibility in the fluctuation band for interest rates under the YCC policy, and cancellation of negative interest rates.

In addition, there are also prospects that the deflation gap, which was the source of deflation, could shift to an inflation gap within a few years. Also, looking at the National Short-Term Economic Survey of Enterprises in Japan (BOJ Tankan), which is a questionnaire survey conducted by the BOJ, there is an extreme labor shortage at almost the same level as at the height of the "bubble" era in the 1990s, and production capacity index is shifting from an excess to a shortage. So 2023 could well be a year when the BOJ starts to revise its unprecedented monetary easing.

Exchange Rates

Since 2021 the yen has been continuously depreciating against the US dollar, and in October 2022 the market saw a substantial depreciation as the exchange rate exceeded 150 yen to the dollar for the first time since 1990 when the bubble began to burst. The dollar remained strong against almost all other currencies, but the fall in the yen was sharp with no comparison to other currencies.

The reason the yen continued to weaken this much was a widening gap in interest rates between the United States and Japan and Japan's current account deficit, caused mainly by rising energy prices. But since the early fall of 2022, these two factors have shown stronger signs of reversing, and the yen began a sharp appreciation. With inflation in the US beginning to calm down, the rise in the terminal rate, which is thought to be the final destination of interest rate hikes, has almost stopped, and the gap in interest rates between the US and Japan has begun to turn from expansion to contraction. The current account deficit is also highly likely to move towards improvement with the fall in energy and metal prices, and further also with great improvements expected in the travel balance with inbound travel restarting as restrictions are lifted. This trend is expected to continue in 2023.

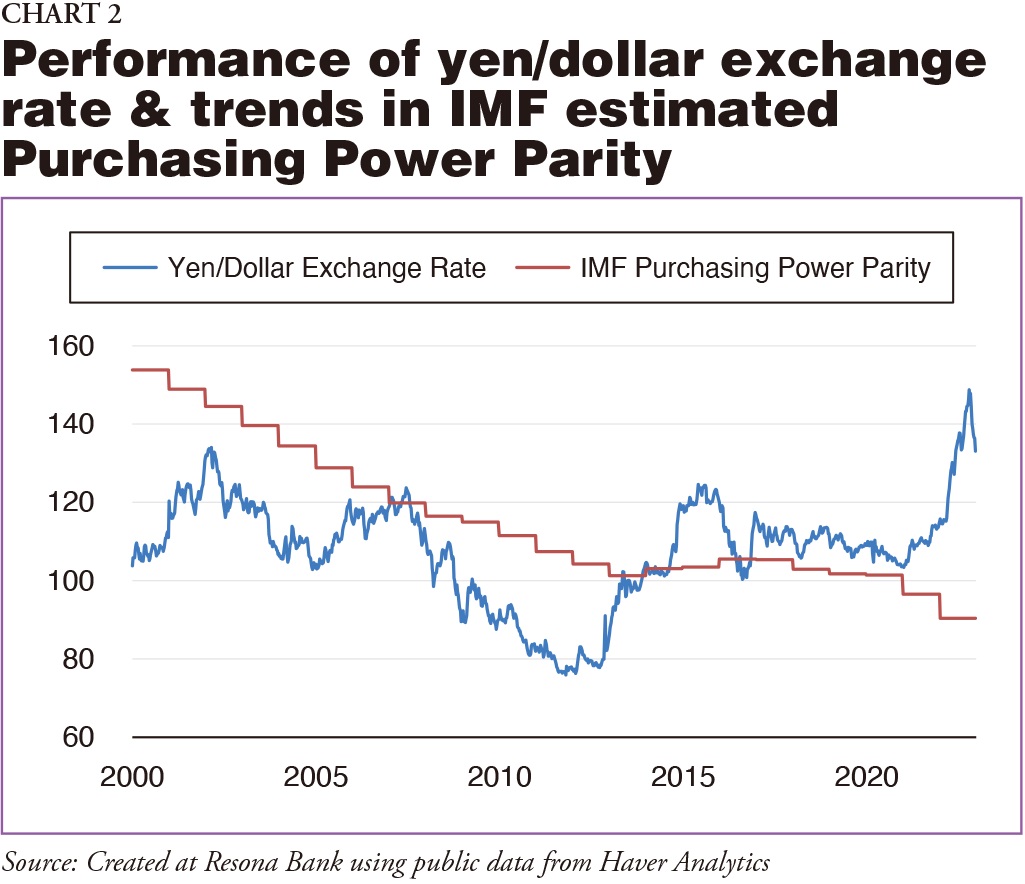

Purchasing power parity as calculated by the IMF is 87.83 yen for 2023. The current exchange rate of 130-135 yen shows approximately a 50% depreciation of the yen against the dollar. In the US, a strong dollar, which has the effect of pushing down prices, is thought to be tolerated because inflation control is a top priority. However, business executives, mostly of US global enterprises, have openly expressed their dissatisfaction about a strong dollar in announcing their financial statements. In addition, the cumulative effects of hikes in interest rates will likely lead to a worsening US economy in 2023. There are views asserting that if inflation control is in sight, the intentions of US industries and government are to move towards a weaker US dollar in order to stimulate the economy (Chart 2).

Overall, the tendency toward a strong yen is expected to continue. According to the BOJ Tankan, which was released in December 2022, the yen-dollar exchange rate businesses are assuming in their budget plans is 130.03. It is difficult to assume a stronger yen beyond this standard, but there are some who anticipate a sharper yen appreciation.

Trends of the Japanese Economy in 2023

The Japanese economy in 2023 is expected to achieve relatively high economic growth. According to forecasts in the IMF World Economic Outlook (October 2022), Japan is expected to grow at 1.6%, the highest amongst advanced nations. The US is estimated to grow at 1.0% and Germany at -0.29%. It is extremely rare for Japan to have the highest growth rate amongst the G7 nations. According to outlooks from Japanese research institutions and financial institutions, bullish outlooks are around 1.8% while many bearish outlooks are around 1%. Since there are many uncertain factors such as a revision of China's zero-coronavirus policy and the extent of economic slowdowns of the US and Europe, it is characteristic that a moderate outlook was not the majority and that there was a division between the bearish and the bullish.

Some factors behind the anticipated high growth of the Japanese economy are: (1) Japan has not implemented a sharp hike in interest rates nor is it expected to; (2) re-opening of the economy from the coronavirus pandemic was delayed until mid-2022, (3) re-opening of in-bound spending was also delayed until the early fall of 2022; and (4) implementation of large-scale economic measures such as subsidizing energy expenses. Economic measures are expected to push up GDP by 7 to 10 trillion yen, or around 1.2-1.8% of GDP. Subsidizing energy expenses will be very significant, and approximately 13 trillion yen is expected to be poured in. This will push down prices sharply and as a consequence consumer price index is expected to increase around 1.7% year-on-year.

On the other hand, it has been pointed out that businesses have awoken to investments as a sign of the Japanese economy improving structurally. This is on the back of factors such as huge improvements in the deflation gap, domestic investments becoming more advantageous compared to foreign investments due to a weaker yen, increasing need for labor saving investments as a response to the labor shortage, and a heightened need to address decarbonization and economic security.

Business Challenges for Japanese Corporations

Japanese corporations which had long suffered from deflation have refrained from capital investments and staff recruitment. The capacity utilization index for the manufacturing industry declined by 15% in October 2022 compared to its peak in 1997-1998. In the meantime, the number of employees increased from 65.84 million people to 67.36 million people. But looking at its content, the number of full-time male employees with high wages has declined whilst the number of part-time female employees with low wages has increased significantly. The reduction in costs also extended to investments in human capital. Japan had originally offered generous in-house job training opportunities on the basis of life-time employment, with few people changing jobs.

The management policies of Japanese corporations which have long favored cost-cutting began to receive strong criticism from around 2018 in the context of shareholder capitalism and sustainability. The administration of Prime Minister Fumio Kishida, who took office in 2021, put forward a new form of capitalism as a policy challenge and supports investment in people as a top priority with a budget of 1 trillion yen.

Since 2022, investments by Japanese corporations in equipment and people have begun to be more aggressive. This could prove to be a structural change in achieving forward-looking business strategies away from the backward-looking cost-cutting of the deflation era. Indications of forward-looking movements are anticipated to long continue.

Japan SPOTLIGHT March/April 2023 Issue (Published on March 10, 2023)

(2023/03/15)

Koichi Kurose

Koichi Kurose joined Resona Bank (currently Resona Asset Management Co., Ltd.) in 1987. An investment strategist since 1999, he contributes market comments for Nikkei (TV BS7), BizSquare (TV BSTBS), Market Analyze (TV BS12), and The Money (Radio Nikkei).

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27