HOME > Japan SPOTLIGHT > Article

The Rise & Fall of the Chinese Economy Under Xi Jinping

By Ke Long

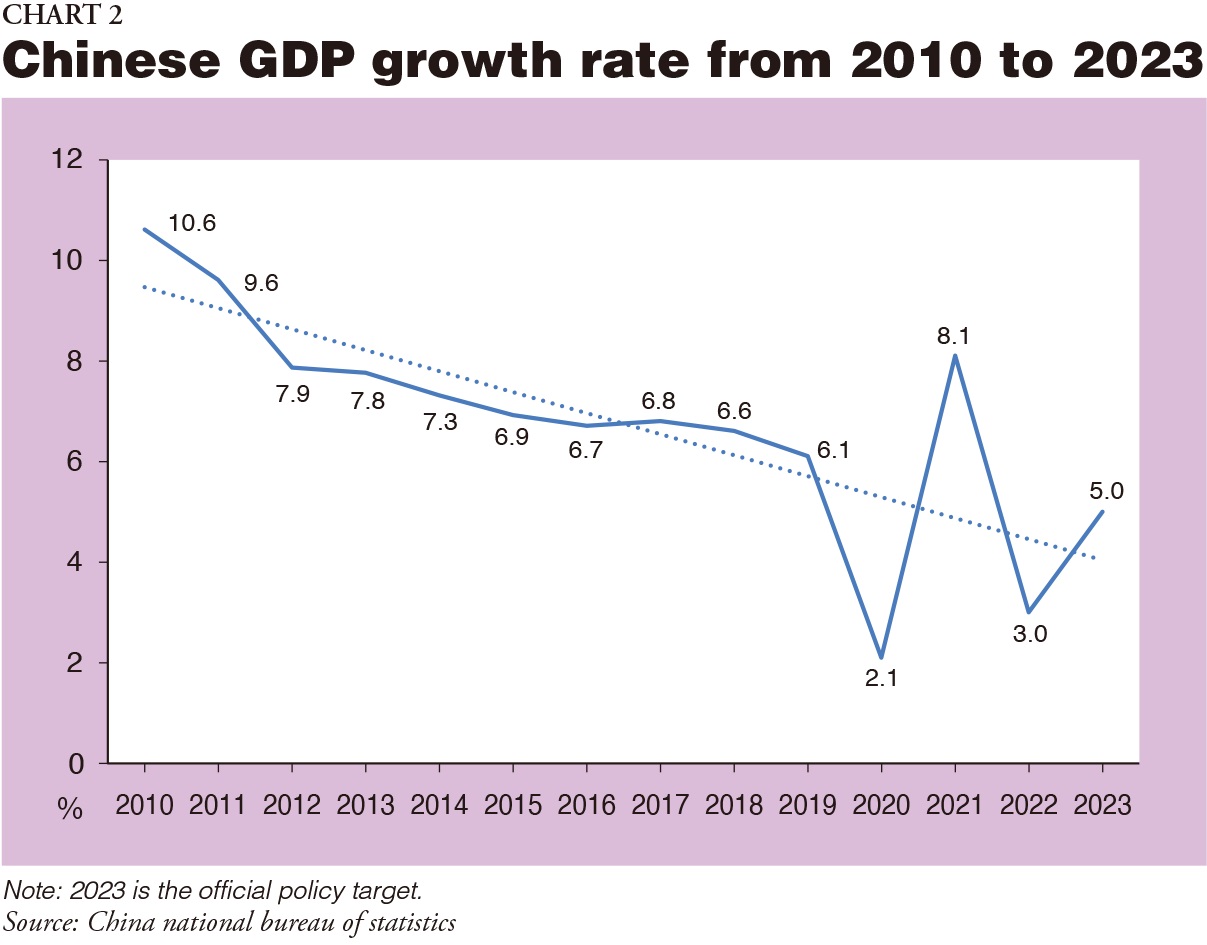

About 10 years ago when Xi Jinping was vice president of China, he promised to rebuild the country's market-oriented economic system and improve the open-door policy to contribute more to globalization. Most people expected he could lead reforms of the political and economic system to drive Chinese development. Under the presidency of Hu Jintao almost all reforms were postponed, although the economy still developed rapidly. That was mainly due to infrastructure investment related to the Olympic Games in 2008 in Beijing and Exposition 2010 in Shanghai. Another engine that drove Chinese economic development was the real estate bubble. Obviously, such kinds of economic development are not sustainable.

For Xi, it has not been easy to lead continuous economic development in such a big country. As a member of the "red second generation" (the children of the founders of the Chinese Communist Party), Xi must maintain the authority of the CCP, and this is much more important than other policy targets. To realize this goal, Xi must first of all exclude his political opponents. As a leader of an authoritarian polity, Xi needs to strengthen his personality cult; otherwise he may not be able to stabilize the country's politics and society. So far, his administration has been successful in improving the CCP's anti-corruption campaign, though this is an endless game.

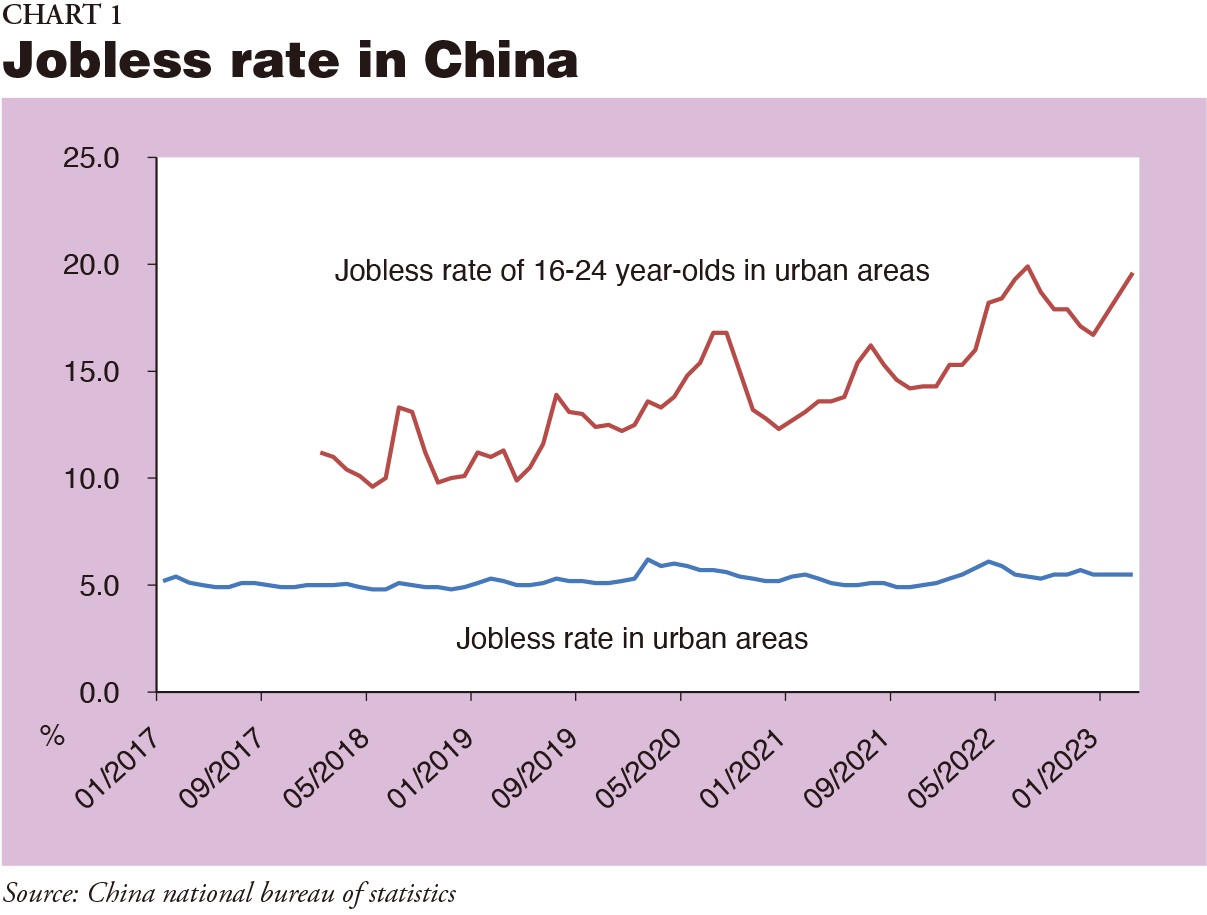

Xi's administration started its third term in March 2023. But there seems to be no specialist in economic policy operations in his team, and Premier Li Qiang does not have any experience of working in central government. The Chinese central government is like a large and complicated machine, and as the captain of this machine Li will need a long period of working experience in examining whether the machine works or not. Li is going to face the difficulty that few of his colleagues care for him--most of them only care about what Xi is thinking. Li does not know whether his colleagues will enforce his policies effectively. Another important point is that Li needs a team to help him to create a policy mix. For example, the Chinese unemployment rate among 16 to 24 year-olds reached about 20% in April 2023 (Chart1). How to lower this rate is an emergent issue that could threaten social stability and will be a serious test for Li.

GDP Growth Rate Target Post-Covid

The Chinese economy realized miraculous development under President Jiang Zemin (1993-2003) and Hu Jintao (2003-2012). But since 2012 under Xi the economy started to slow down, especially declining rapidly due to Covid-19 from 2020 to 2022. Covid not only damaged the growth rate of the economy but also seriously affected the structure of the economy and society. Chart 2 shows that the jobless rate among the young generation in urban areas reached about 20%. One of the reasons is that the Zero Covid-19 policy damaged the private sector and service industries, both of which contribute to creating employment opportunities; but thousands of small and medium-sized private companies went bankrupt.

In addition there were more than 10 million graduates from university every year most of whom cannot get a job. They dream of entering big companies and getting a high salary, but the Chinese economy is clearly under recession and few companies can pay such salaries to graduates. The mismatch of demand and supply in human resources has made the jobless rate increase sharply.

Finally, there are about 300 million farmers working in urban areas. But farmers who have lost their jobs are not included in the official unemployment data. So the real jobless rate in China is higher than the official data.

The problem here is what kind of policy mix to implement in order to create more employment opportunities. Actually, the solution is not so difficult. Fundamentally, China has the economic potential to sustain a 5-6% GDP growth rate through private consumption and investment and external trade. Although China is facing serious difficulties with the G7, the G7 countries have to keep importing most of their consumer goods from China. The problem is how to encourage private consumption and investment domestically. Examining economic development over the past three decades, it is easy to see that the driving force is not state-owned enterprises but the private sector. Private companies create more employment opportunities, contribute more to GDP growth, and pay more tax than the public sector. But Xi's administration changed the policy of giving them more preferential treatment, and most of the private big tech companies have been punished by the government, including Alibaba, Tencent, and Didi Chuxing Technology. Now it is time to change this policy and make the market more open, fair and global; otherwise the Chinese government cannot realize the goal of 5% GDP growth.

Chinese-Style Modernization

Xi's administration wants to realize his Chinese dream. He defined the dream as Chinese-style modernization and promised to create a strong China. Historically, China was invaded because it was too weak. Last October, Xi gave a speech at the CCP Congress in which he emphasized the importance of the party's leadership, effectively claiming that only the CCP can make China strong and the Chinese people happy. This is the legitimacy of the CCP and to prove it Xi's administration must sustain economic development; otherwise any kind of modernization is unthinkable.

So the goal of improving economic development is clear, but the policy mix is completely contrary. Xi has emphasized time and again his aim of making state-owned enterprises bigger and stronger. It is true that the government can make state-owned enterprises bigger by M&A, but it cannot make them stronger. Only market competition can make companies stronger by the invisible hand of price mechanisms. The government's visible hand will only weaken the competitiveness of companies. Forty years ago the Chinese government did not need to open markets and liberalize the economy to strengthen price mechanisms. But it was liberalization and decentralization that realized the miracle of economic development. What Xi's administration is doing is challenging the open-door policy and leading the country back to the era of Mao Zedong. Xi believes that by controlling the country's economy, as in Mao's era, the CCP can maintain its leadership.

Why does Xi persist in this view? To answer this question, we need to examine his background. First, he was born into a red family. His father Xi Zhongxun was a revolutionary who followed Mao in fighting against Chiang Kai-shek's Kuomintang army in Northwest China. The DNA of red families is that they refuse to hand over the country to others. That means they cannot accept democracy. Here we need to make it clear that no democracy means no market-oriented economy and the economy cannot develop sustainably. No matter what the style of modernization, the point is how to realize it. Propaganda alone cannot save the red families, and it cannot save the country.

So what is Chinese-style modernization? Undoubtedly, in Xi's mind Chinese-style modernization is one that is controlled by the CCP; any other style of modernization is not suitable for China. It is easy to understand his thinking, but without economic development, Xi's goal will remain a castle in the air.

Bonds & Bubble

Under the Chinese government's improved Zero Covid-19 policy, PCR tests were provided for almost all people every week during the period from 2020 to 2022. As a result, not only local governments but also the central government fell into a budget deficit in 2022. It is necessary for the government to implement fiscal policies to improve infrastructure investment, but it is now finding it difficult to finance such investment.

Let us take a look first at Chinese local government budgets. Until the Jiang era, the central government prohibited local governments from issuing bonds. Former Premier Zhu Rongji reformed the fiscal system to separate taxes owing to the central government from those owing to local governments, and meanwhile the central government strengthened the reallocation of budgets to low-income provinces.

Traditionally, the central Chinese government was concerned about local governments issuing bonds because of the possibility of their involvement in illegal finances due to the lack of governance by the people. As a result, some of the local governments might have been unable to repay their debts. It was reasonable to restrict local governments from issuing bonds. But the problem then is how can local governments finance infrastructure investment, such as subway projects and water and gas supply facilities. In the Hu era, former Premier Wen Jiabao decided to allow local governments to issue bonds and sell land leasehold rights, with the revenues belonging to the local governments. Wen's original thinking was to strengthen local social security funds, but the result of this decision was to create a property market bubble.

Most developed countries are concerned about inflation, and their central banks often start to raise interest rates too rapidly. But China is more concerned about unemployment. Especially, for local governments it is necessary to generate more liquidity to encourage economic development. Small and middle-sized enterprises and service industries contribute to creating employment opportunities, but over the past three years the Zero Covid-19 policy has damaged SMEs and service industries directly. It will not be easy to recover their losses.

It is difficult for the government to generate more liquidity under a recession. Concerns over the real estate bubble bursting are cooling down private consumption. The unemployment problem is also restraining private consumption. It seems that Premier Li has not found an effective policy mix to encourage economic development.

In most countries, during Covid households hoarded cash, pushing up the personal savings rate. China is no exception. Its personal savings rate (savings/GDP) reached 33% in 2022, three points higher than pre-Covid. But China is a country in which income disparities are very large. Most rich families have increased their savings, but low-income families have to repay mortgage loans and auto loans, while the cost of child education is a burden that is too heavy for them. Furthermore, many young people cannot find jobs, and the unemployment rate has reached 20%, according to official data.

Attracting More Foreign Investment

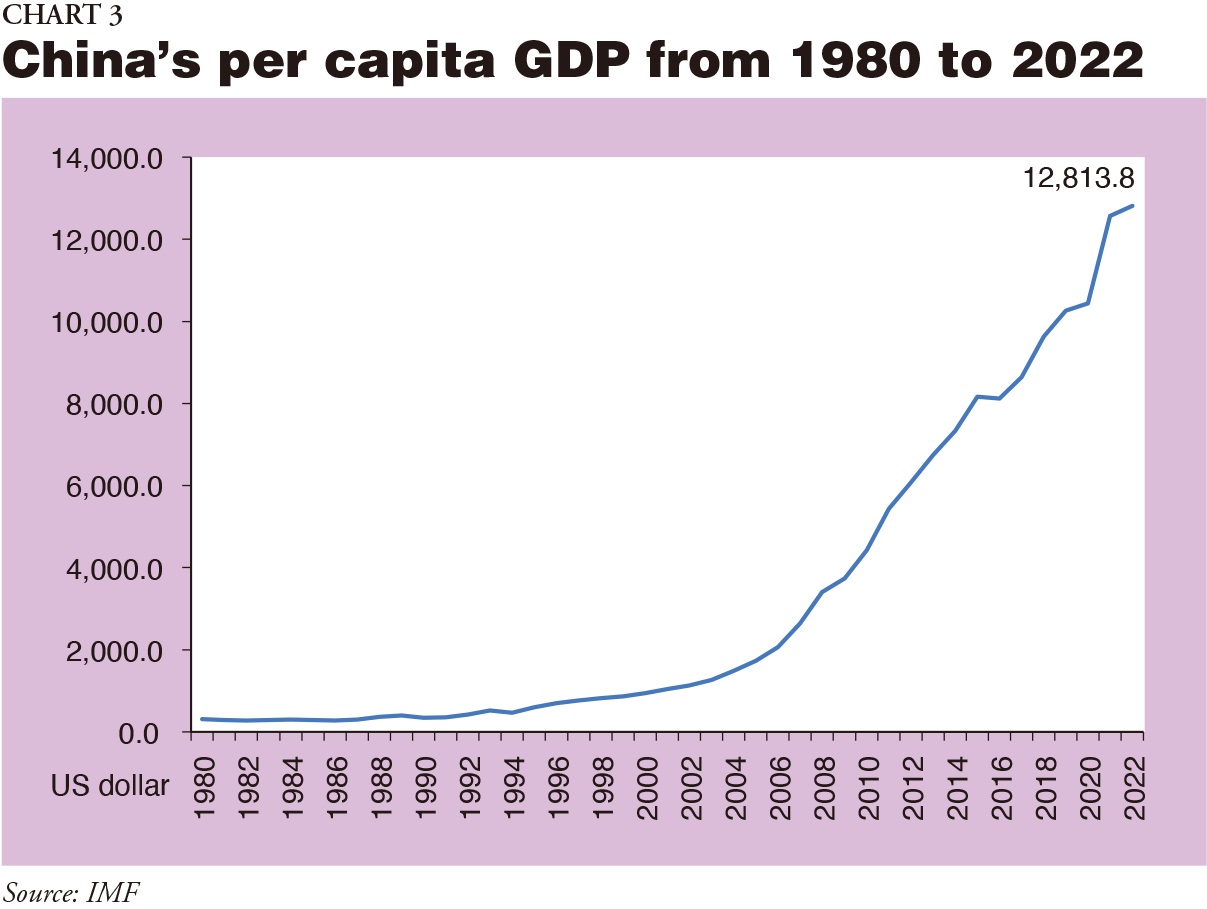

Theoretically, China is still an export-dependent economy. The bad news for Premier Li is that most of the multinational companies are thinking of reallocating their global supply chains and value chains. It is difficult to imagine that multinational companies will decouple from China completely and move most of their factories to other developing countries. Decoupling may be impossible, but reallocation is already underway. In particular, most multinational companies are removing their innovation centers from China to other countries. Before the trade war between China and the United States, many multinationals concentrated their innovation centers in China in order to strengthen their competitiveness there. China was an attractive and hopeful market, and to an extent it still is. China's per capita GDP reached US$12,813.8 in 2022 (Chart 3), and there is no doubt that China is going play a major role as a global market. The problem here is whether China can play a role as a global manufacturing center. Nowadays, more and more foreign companies are strengthening their strategy of "in China for China"--that is, make in China and sell in China. But they are moving their factories for exports from China to Vietnam and India.

Meanwhile,over 20 years ago, former Premier Zhu emphasized the need to encourage domestic demand. In particular, experiencing the Asian currency crisis of 1997, the Chinese government adjusted its policy to rebalance the export dependent policy and domestic demand dependent policy. At first, with the beginning of an open-door policy in the 1980s and 1990s, the Chinese government made great efforts to attract foreign direct investment (FDI) in order to boost the economy. After the Asian Currency Crisis, Premier Zhu recognized the necessity to strengthen domestic demand. But post-Zhu, during Hu Jintao's era, most of the reforms were postponed. The Chinese economy is still dependent on foreign demand. This means that the Chinese government has been trying to keep FDI within China as much as possible.

Since the administration of President Donald Trump, the American government has strengthened its sanctions on China. Then in 2022 discussions began on a new proposal for economic collaboration called the Indo-Pacific Economic Framework among its 14 participants. Their discussions focus on four pillars: (1) trade, (2) supply chains, (3) clean economy, and (4) fair economy. The framework aims at achieving a free and open Indo-Pacific on the economic front, and can be considered as a kind of encirclement to China. It could speed up the reallocation of global supply chains and the removal of factories from China to other developing countries.

In December 2022, the Chinese government stopped the Zero Covid-19 policy and allowed the free movement of its people both domestically and abroad in order to encourage economic activities. Since then, it has sent many delegations to Japan and other developed countries to attract foreign companies to invest in China directly. These measures show that the Chinese government still wants to maintain its economic model based on exports and foreign corporate investment. The problem is that China has lost its attractiveness for foreign companies.

Conclusion: the Lost Decades Under Xi

Actually, it is not so difficult for Premier Li to maintain economic development at a fundamental level of about 5%. First of all, he needs to improve liberalization, deregulation and decentralization. The key point here is to rebuild a market-oriented economy instead of socialist economy. It has been proved that the market mechanism is more effective than the government. Secondly, China should change its wolf warrior diplomacy to regain the confidence of global society. And thirdly, it must promise to follow international rules, especially those relating to intellectual property right protection.

Over the past four decades globalization has helped China realize miraculous economic development. Whether China can become a really strong and responsible country will depend on its acceptance of global rules.

Finally, it is necessary to rethink the relationship between China and Japan. This relationship is special and quite different from that of the US and China, or the European Union and China. Differing perspectives over World War II and bilateral history have made the two nations' cooperation more difficult, but over the past four decades Japanese companies and engineers have sincerely tried to help Chinese industries catch up. Chinese GDP grew to be the second largest in the world in 2010, and since then many Chinese people have thought there is nothing for China to learn from Japan. Meanwhile, not only historical issues but also the sovereignty of the Senkaku Islands have made the bilateral relationship more difficult. Some questionnaire surveys have shown that over 80% of Japanese people do not like China. In such circumstances, it is difficult for the two countries to work together.

In East Asia the biggest concern now is whether China will invade Taiwan or not. Late Japanese Prime Minister Shinzo Abe made his opinion clear in a speech in which he said "a Taiwan emergency means a Japan emergency." This geopolitical risk is damaging regional business. China and Japan need to strengthen their dialogue.

But as for Chinese policy making and economic development, my conclusion is that Xi's administration needs to deepen reforms instead of backtracking to the Mao era. Xi has emphasized his dream of making China a strong country--but before it can be a strong country, China must be a responsible country.

Japan SPOTLIGHT July/August 2023 Issue (Published on July 10, 2023)

(2023/07/10)

Ke Long

Ke Long is a senior fellow at the Tokyo Foundation for Policy Research.

Japan SPOTLIGHT

- Coffee Cultures of Japan & India

- 2025/01/27