Philippine conglomerates increase investments in health care

MANILA, Philippines — For decades, conglomerates have been leaning toward the most profitable businesses, especially retail and infrastructure, to catch up with a rapidly evolving Philippines.

Ayala Corp., for example, did not start out as the business empire that it is today. The founders of the country’s oldest conglomerate opted to invest first in a distillery in 1834.

It eventually ventured into banking (El Banco Español Filipino de Isabel II, now Bank of the Philippine Islands, and the country’s first bank), transportation, insurance, telecommunications, and real estate, among others.

Metro Pacific Investments Corp. (MPIC), on the other hand, was founded in 2006 mainly as an investment holding company. Its core businesses include power (Manila Electric Co., or Meralco) and toll operations (Metro Pacific Tollways Corp., or MPTC).

It also has a significant shareholding in Maynilad Water Services Inc. Utilities, after all, are among the defensive businesses that are not easily impacted by economic downturns.

But as communities evolved, both conglomerates soon found another industry worth investing in, and one that is perhaps considered among the most vital sectors across the globe: health care.

While Ayala was already somewhat present in the health-care scene in 2014 through QualiMed, the chain of hospitals and satellite clinics of subsidiary Ayala Land Inc., it was not until the following year that a new business unit was established.

In 2015, Ayala officially introduced Ayala Healthcare Holdings Inc. (AC Health). This followed its takeover of 50 percent of pharmacy chain Generika Drugstore, which had around 400 stores in its network. This is now at 1,150, including additional branches from recently acquired St. Joseph Drug.

Bridging gaps in affordable retail healthcare

In formally submerging into the waters of healthcare, AC Health chair Fernando Zobel de Ayala said they wanted to “help address the gaps in affordable retail healthcare.”

“We believe this is an excellent platform for Ayala to reinvent the space and serve as the foundation for our emerging healthcare portfolio,” Zobel said of their investment in Generika a decade ago.

AC Health president Paolo Borromeo also told International Finance Corp. in 2022 that they wanted to create “shared value” through “scalable, sustainable businesses with social impact.”

“[In 2015], 70 percent of national healthcare expenditures came out of the pockets of ordinary Filipinos; only 30 percent came from the government or private insurance,” Borromeo pointed out. “Many people went to a doctor only once every few years or didn’t go at all. This problem needed to be solved and we felt we could play a meaningful role in the healthcare sector.”

But perhaps its biggest investment that ultimately paid off was its takeover of Healthway Philippines Inc. in 2019.

Healthway had around seven mall-based multispecialty clinics that year, along with 40 corporate clinics. Healthway Medical Network has since expanded this into 236 corporate and multispecialty clinics and six hospitals.

Five years after taking Healthway under its care, AC Health established the country’s first cancer hospital for P3 billion. Located in Taguig City, Healthway Cancer Care Hospital’s capacity could be extended to treat 10,000 patients, Borromeo previously said.

“[The target] is high but attainable ... we want to encourage treatment and screening, and those are the most important things,” he told reporters in an earlier interview.

Big and bold

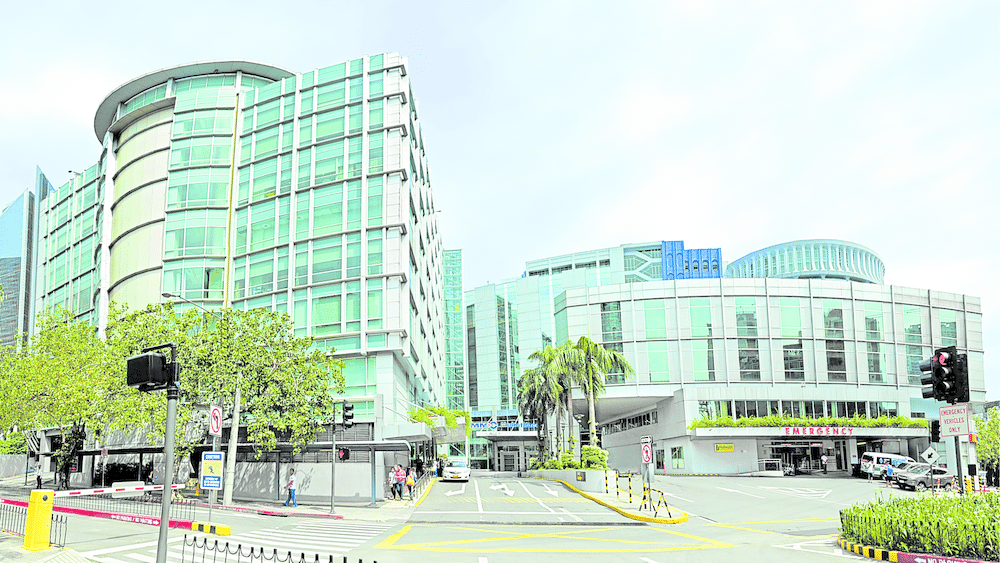

MPIC, for its part, started big and bold with its acquisition of Makati Medical Center (MakatiMed) in 2007. This marked its entry into the healthcare sector.

Four years later, it injected another P300 million into MakatiMed specifically to help the latter upgrade its facilities and medical equipment. It was an effort seen as modernizing and improving the services of the 56-year-old hospital.

READ: Metro Pacific eyeing to acquire 4 more hospitals in 2025

After seeing the success of MakatiMed, MPIC, through Metro Pacific Health (MPH), went out of its way to acquire 26 more hospitals.

Previously called Metro Pacific Hospitals, MPH rebranded in October 2022. It wanted to expand its services to include digitalized healthcare through mobile applications and teleconsultations.

“We will not just provide quality hospital care, we will make our services accessible to a greater number of our people,” MPIC chair and billionaire Manuel Pangilinan said during the relaunch event.

This year, it plans to add four more to its portfolio, making it the largest private hospital network.

In searching for more deals to expand their healthcare portfolio, MPIC chief financial officer Chaye Cabal-Revilla explained they were particularly encouraged by the segment’s performance in 2024.

During the period, MPH contributed P560 million to MPIC’s total earnings last year, representing a 70-percent surge. Its network also includes Asian Hospital and Medical Center, Cardinal Santos Medical Center and Manila Doctors Hospital.

Collaboration of conglomerates

Both companies effectively recognized the need to invest in healthcare. But it is worth noting that they did not completely move independently.

In February, the two prominent conglomerates united their digital healthcare systems. This was done in a bid to boost accessibility and provide a unified ecosystem for Filipinos.

READ: WHO: Basic health services lacking in PH, Western Pacific

Metro Pacific Health Tech Corp. (mWell), the digital health and wellness platform of MPIC, fully acquired KonsultaMD. It was the flagship healthcare unit of Ayala-led Globe Telecom Inc.’s 917Ventures.

“By integrating our resources with KonsultaMD, we are well-positioned to provide expansive and high-quality healthcare to all Filipinos, both locally and globally,” Revilla said.

Founded in 2015 as a health hotline, KonsultaMD currently has 2.7 million users and “a vast network of partner doctors.” This was added to mWell’s network of 3.1 million users. Included are 90,000 users across other countries in Asia, North and South America, Africa, Oceania and Europe.

“By combining our expertise with mWell’s powerful digital health ecosystem, we are set to bring even greater innovations to telehealth,” KonsultaMD CEO Beia Latay also noted.

/rwd

(2025/06/20-04:00)

INQUIRER

- 06/20 14:42 Sara Duterte may be violating obligation with her trips abroad – Palace

- 06/20 12:51 Marcos meets Japanese tourism partners on 2nd day of Japan trip

- 06/20 11:29 Sara Duterte on personal trip to Australia to join rally for her father

- 06/20 08:58 DOTr studying train line upgrades – Dizon

- 06/20 05:32 UN rapporteur urges PH to return as ICC member

- 06/20 04:00 Philippine conglomerates increase investments in health care

- 06/20 02:20 AGI eyes new luxury hotel, malls through P59-B buildout

- 06/20 02:16 Robinsons Land pumps up REIT arm with 9 more malls

- 06/20 02:10 Preparing Philippine businesses for sustainability compliance

- 06/19 17:59 Torre to police commanders: ‘Don’t hide in your offices’

- 06/19 14:22 New COVID-19 'Nimbus' variant not yet detected in PH, says DOH chief

- 06/19 12:07 Killing of P200 pay hike bill also kills bid for living wage

- 06/19 11:40 7 Filipinos hurt in Iran missile strikes on Israel – PH embassy

- 06/19 11:08 Meralco unit PacificLight switches on 100-MW plant in Singapore

- 06/19 09:56 PH peso sinks back to 57:$1 as US Fed hold boosts dollar

- 06/19 05:12 Barbers pushes for AI-regulating gov’t agency

- 06/19 02:22 DTI launches supply chain, logistics center to support MSMEs

- 06/19 02:18 Firms in Spain earn nod to send meat to the Philippines

- 06/18 16:51 PSEi retreats as Israel-Iran conflict rises

- 06/18 12:25 Motorists will get fuel subsidies due to Mideast tension – Marcos

- 06/18 09:15 Zero dengue deaths by 2030 possible – scientific working group

- 06/18 08:54 Experts urge PH gov't to expedite approval of new dengue vaccine

- 06/18 02:16 Gov’t orders DOE to ensure sufficient oil supply

- 06/18 02:13 Philippines to adopt OECD cryptocurrency tax framework

- 06/18 02:10 New incentives program for electric vehicles seen ‘more inclusive’

- 06/18 02:09 San Miguel leads Philippine firms in ‘Southeast Asia 500’ list

- 06/18 02:04 Philippine exit from list of ‘risky’ markets seen raising investor interest

- 06/17 13:12 MMDA: Driver caught 309 times for same traffic violation in 10 months

- 06/17 12:00 DOTr chief commits privatization of 10 airports by 2028

- 06/17 10:49 House refusal to accept Duterte lawyers’ entry may delay trial – Senate

- 06/17 07:01 Philippines climbs to 51st in global competitiveness report

- 06/17 05:45 Filipina worker wounded in airstrikes vs Israel ‘critical’

- 06/17 02:14 Israel-Iran conflict seen unlikely to derail BSP rate cut

- 06/16 19:07 Senate, House tell agencies: Monitor, help Filipinos caught in war

- 06/16 13:58 Marcos on Filipinos in Israel: Make sure ‘no one is left behind’

- 06/16 11:27 Marcos orders agencies: Prioritize power, internet access in schools

- 06/16 05:40 4 Filipinos in Israel injured amid air strikes

- 06/16 05:36 PH, Japan hold joint drills after RAA

- 06/16 05:32 Problems of past class opening persist in current school year

- 06/16 02:32 Stage set for fresh BSP rate cut to 5.25%

- 06/16 02:26 Final price caps set for clean energy auction

- 06/16 02:20 NEA tasked to help co-ops secure green energy requirements

- 06/15 14:49 DA estimates over 200,000 metric tons of tuna catch in 2024

- 06/13 18:24 AboitizPower P100-B bond program gets SEC approval

- 06/13 17:01 DA lifts ban on beef, poultry products from Germany, Belgium

- 06/13 17:01 DA lifts ban on beef, poultry products from Germany, Belgium

- 06/13 14:55 Edsa 2’s lessons for Sara Duterte trial from Joseph Estrada’s fall

- 06/13 11:55 Sotto: Sen. Miriam taught me that senator-judges can’t make motions

- 06/13 02:30 BSP orders banks to go beyond OTPs

- 06/13 02:24 Filinvest hosts Qatar Airways’ first Philippine office

- 06/13 00:50 Rodrigo Duterte appeals for an interim release from ICC detention

- 06/12 21:56 Marcos offers condolences to India over deadly plane crash

- 06/12 15:34 Chief justice on Independence day: Combat corruption, apathy

- 06/12 14:49 Christian Monsod: Senate decision to remand ‘railroading a wrong power’

- 06/12 13:36 Taiwan’s TPEx tapped to help Philippine SMEs, bond market grow

- 06/12 13:08 Strong, credible voices reverberate vs ‘delay’ in Sara Duterte trial

- 06/12 10:33 Pulong Duterte celebrates independence but dad's detention leaves pain

- 06/12 07:30 Agriculture group urges Marcos to block P200 daily wage hike

- 06/12 06:00 Marcos: Value the nation’s heritage by protecting rights, freedoms

- 06/12 05:44 House, Senate in stalemate over proposed pay hike

- 06/12 05:42 PH removed from EU’s ‘high risk’ dirty money list

- 06/12 02:32 Legislated wage hikes to harm economy, hurt poor Filipinos - economic team

- 06/11 16:29 Solon raises alarm over ASF vaccines for alleged mutation risks

- 06/11 16:24 House to seek clarity on Senate’s remand before receiving case

- 06/11 15:37 No court jurisdiction lost in Sara Duterte impeachment case - Escudero

- 06/11 15:05 Protesters rally in numbers at Senate over Duterte trial delay

- 06/11 13:29 Big business group 'deeply concerned' over stalled Sara Duterte impeachment trial

- 06/11 13:02 Economic team warns of ‘dangerous repercussions’ of P200 wage hike

- 06/11 11:07 Philippines exits EU ‘high-risk’ dirty money list

- 06/11 09:05 Philippine agricultural trade deficit narrows in April

- 06/11 02:28 BSP: FDIs extended slump in March

- 06/10 13:01 41 Chinese vessels seen in various parts of West Philippine Sea in May

- 06/09 14:57 PCG to assess damage caused by grounded Chinese ship off Pag-asa island

- 06/09 12:19 Impeachment process has ‘constitutional infirmities’ – Sara Duterte team

- 06/09 11:36 Senate minority to initiate Sara Duterte impeachment trial this Monday

- 06/09 09:51 F-16 maker sees US making formal offer to PH for fighter jets

- 06/09 05:30 FDA adds 10 more drugs to VAT-free medications

- 06/09 02:09 Philippine market tagged best in SE Asia on slowing inflation

- 06/09 02:07 US agri exports seen growing as Philippines' middle class expands

- 06/09 00:11 South Korea seen to seek deeper security cooperation with PH

- 06/08 02:12 AI is unlocking human potential in new ways

- 06/06 15:23 PH-Japan reciprocal access agreement gets House of Councillors' OK

- 06/06 14:11 ICC prosecutors submit 7th batch of evidence vs Rodrigo Duterte

- 06/06 13:31 Prosecution to present impeachment articles no matter what – Zamora

- 06/06 09:43 Joblessness in the Philippines worsens in April

- 06/06 02:28 Japan debt watcher keeps Philippines' ‘A’ rating

- 06/05 09:16 Inflation cools to 1.3% in May, slowest pace in nearly 6 years

- 06/05 04:36 Reusing plastic ‘a win for everyone’

- 06/05 04:34 Wind power drives Camarines Sur’s energy shift

- 06/05 04:32 In Palawan, a resilient system of seaweed farming

- 06/05 02:28 Philippines may miss growth goal this 2025 – OECD

- 06/04 14:14 Torre pushes for continuing education for police officers

- 06/04 13:25 DA extends issuance of fish import permit till June

- 06/04 12:19 PNP sets 5-minute police response time in a pilot test for Metro Manila

- 06/04 05:55 Senate pressed to fulfill mandate, hold Sara Duterte trial

- 06/04 05:00 DOH seeks emergency declaration on HIV surge

- 06/04 04:55 Marcos lauds upgrades at Naia Terminal 3

- 06/04 02:08 Gov’t debt hit fresh high of P16.75T in April

- 06/04 02:05 BSP enables banks to freeze funds

- 06/04 00:03 DMW to help OFW who had in-flight miscarriage aboard S. Korean plane

- 06/03 16:30 Castro on delayed impeachment trial: Is Senate taking revenge on House?

- 06/03 11:59 Teodoro calls Chinese officer’s proxy war question ‘propaganda’

- 06/03 09:13 HIV cases in PH surge 500%, prompting DOH call for health emergency

- 06/03 05:50 Escudero: Sara Duterte trial delay not tied to Senate power play

- 06/03 05:00 PH, EU to begin dialogue on defense, security issues

- 06/03 02:15 DA okays meat exports from Taiwan, Thailand

- 06/03 02:14 Philippine factory activity cooled in May as US trade war bit

- 06/03 02:10 DTI revisits P1.75-T investment target for 2025

- 06/03 02:09 BSP rate cuts in June and August likely on the table, says Deutsche Bank

- 06/03 02:08 Foreign airlines mull over ‘terminal enhancement’ fee

- 06/02 14:05 Escudero: No Marcos order to delay Sara Duterte impeachment trial

- 06/02 05:42 DOH laments increase in vaping among youth

- 06/02 05:15 AFP: China paper twisting narratives

- 06/02 05:15 South Korea eyes expanded arms deals with PH

- 06/02 05:05 UP study finds method that can detect breast cancer early

- 06/02 02:10 Gov’t raised P390B in borrowings in April

- 06/02 02:09 Poll: Inflation slowed in May

- 06/02 02:04 Razon challenges tycoons’ energy play

- 06/01 23:02 Macalintal: ‘Can impeachment case be carried over to next Congress?’

- 06/01 16:57 Russian vlogger to serve possible 18 months in PH jail – Remulla

- 05/30 13:56 Timor-Leste set conditions before deporting Teves, says Santiago

- 05/30 12:43 China Coast Guard stops shadowing PH civilian ship in West PH Sea

- 05/30 11:52 Teves now at NBI detention facility in New Bilibid Prison

- 05/30 08:00 First Gen calls for price cap review to attract green energy investors

- 05/30 05:44 Surnames of ‘senators’ also crop up in probe of Sara Duterte funds

- 05/30 02:30 Marcos admin drops plan to sell defense bonds

- 05/30 02:22 Filipino firms spending more on cybersecurity

- 05/29 23:41 PH maintains activities in Pag-asa Island, Pag-asa Cays lawful

- 05/29 16:21 Marcos to meet EU executive during visit to PH on June 2

- 05/29 15:42 West Philippine Sea Atin Ito mission: Crewman recalls first sight of Chinese threat

- 05/29 15:35 Philippines plans to improve livestock, poultry import rules

- 05/29 13:54 Teves turned over to PH authorities, departs Timor Leste for Manila

- 05/29 11:23 China assault on Malaysia sovereignty draws parallels to PH ordeal

- 05/29 02:28 Bangko Sentral orders stricter client due diligence

- 05/29 02:16 Philippine insurance sector to outpace global growth

- 05/26 11:20 Marcos calls for legally binding South China Sea Code of Conduct